Title: Why IPO Stock Rubrik Reached an Unprecedented Height Today

Fresh off its April 2022 initial public offering (IPO), cybersecurity company Rubrik (RBRK 0.43%) is making waves among investors. As of 3:30 p.m. ET on a recent Friday, Rubrik stock saw a staggering 25% increase, reaching an all-time high, following the release of its fiscal third-quarter 2025 financial results.

Navigating the Cybersecurity Landscape

Rubrik considers itself a trailblazer within the cybersecurity space. Its mission is to safeguard enterprise data, regardless of where it resides, whether in the cloud or elsewhere. While the unique nature of its approach may be up for debate, one thing is undeniable: Rubrik's clientele seems to be head over heels in love with its offerings. Q3 revenue soared an astonishing 43% year over year, reaching $236 million - a significant improvement from its 35% growth in the preceding quarter.

The Power of Subscription Services

The lion's share of Rubrik's income is drawn from its subscription-based revenue model. Q3's numbers were nothing short of promising, indicating 38% annual growth in its Annual Recurring Revenue (ARR), which now surpasses the $1 billion mark. As a result, management has revised its full-year guidance, predicting an ARR of $1.057 billion to $1.061 billion by the end of the fiscal year - a considerable upgrade over its previous expectations of $1,026 million to $1,032 million.

Hub of Investor Attention

Analysts have taken notice of Rubrik's unparalleled growth, with Wells Fargo's Andrew Nowinski boosting his price target for the company's stock from $40 per share to a whopping $76 per share. This price target hike places Rubrik among the top price revamps across the analyst community. According to Nowinski, the company's strong growth and operational leverage warrant this boost in confidence.

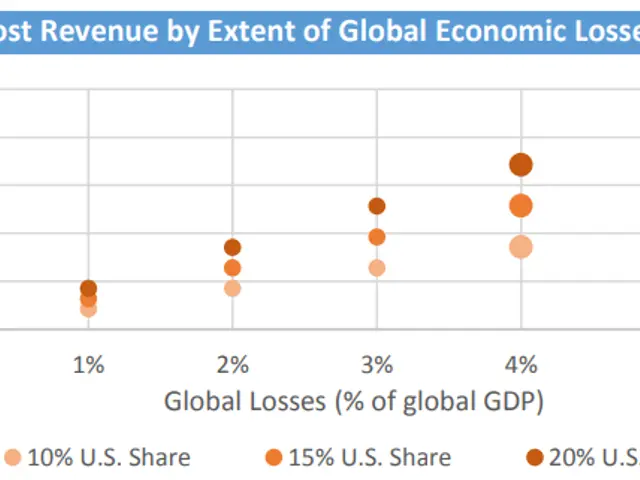

Monitoring Operational Leverage

While Rubrik's fiscal 2024 concluded with a negative free cash flow of nearly $25 million, the subscriber ARR now exceeds $1 billion, holding steady at a loss of $39 million to $45 million in free cash flow for 2025. Despite this, the company's war chest remains impressively robust, boasting more than $600 million in available cash and investments. The young firm's strong Q3 performance has undoubtedly carved out a place as an entity to monitor for investors.

Rubrik's impressive performance in Q3 has attracted significant attention from the finance world, with analysts seeing potential for high returns. Wells Fargo's Andrew Nowinski, for instance, raised his price target for Rubrik's stock from $40 per share to $76 per share, reflecting his confidence in the company's growth and operational leverage. Investors looking to diversify their portfolio might consider the potential returns from investing in Rubrik, given its promising financial results and strong position in the cybersecurity market.