You're giving away money by not retiring early after 45 years - You're giving away money by not retiring early after 45 years

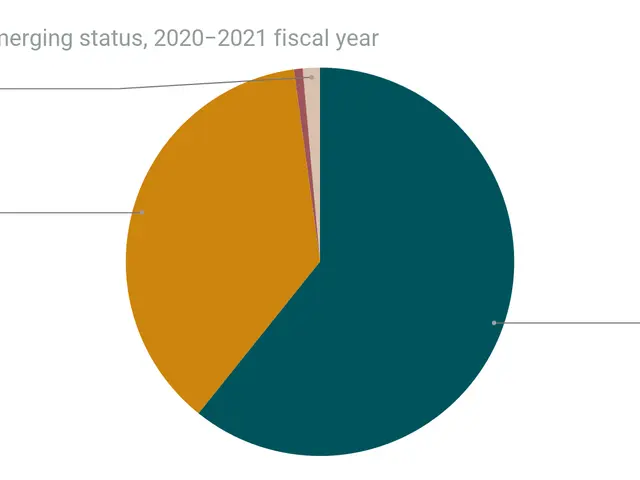

Germany’s retirement system offers different early exit options depending on contribution history. Workers with long-term insurance can retire as early as 63, though with financial deductions. Others may leave without penalties from around 64 to 65 if they have contributed for 45 years or more.

The current rules allow early retirement at 63 for those with at least 35 years of contributions. This option comes with a permanent reduction of 0.3% per month—or 3.6% per year—for claiming benefits ahead of the standard age. Meanwhile, workers with 45 or more years of payments can retire penalty-free, typically between 64 and 65, depending on their birth year.

These phased changes began in 2012 as part of broader reforms. The standard retirement age is gradually rising to 67, with the transition set to complete by 2031. Despite the deductions, some find early retirement financially worthwhile, especially if they continue working part-time. The system balances flexibility with long-term sustainability. Those who qualify for penalty-free early retirement often benefit from full pension payments, while others must weigh reduced benefits against leaving the workforce sooner.

The reforms mean most workers will face a higher standard retirement age by 2031. Early exit remains possible for long-term contributors, though with varying financial impacts. The rules encourage later retirement but still provide options for those with extensive contribution records.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern