Younger Brits reshape finance with digital money and crypto adoption

A shift in financial habits is taking place across the UK as younger consumers lead the way in adopting digital money tools. From cryptocurrencies to flexible payment options, new technologies are changing how people manage their finances. Economic uncertainty has also made many more deliberate about spending and saving.

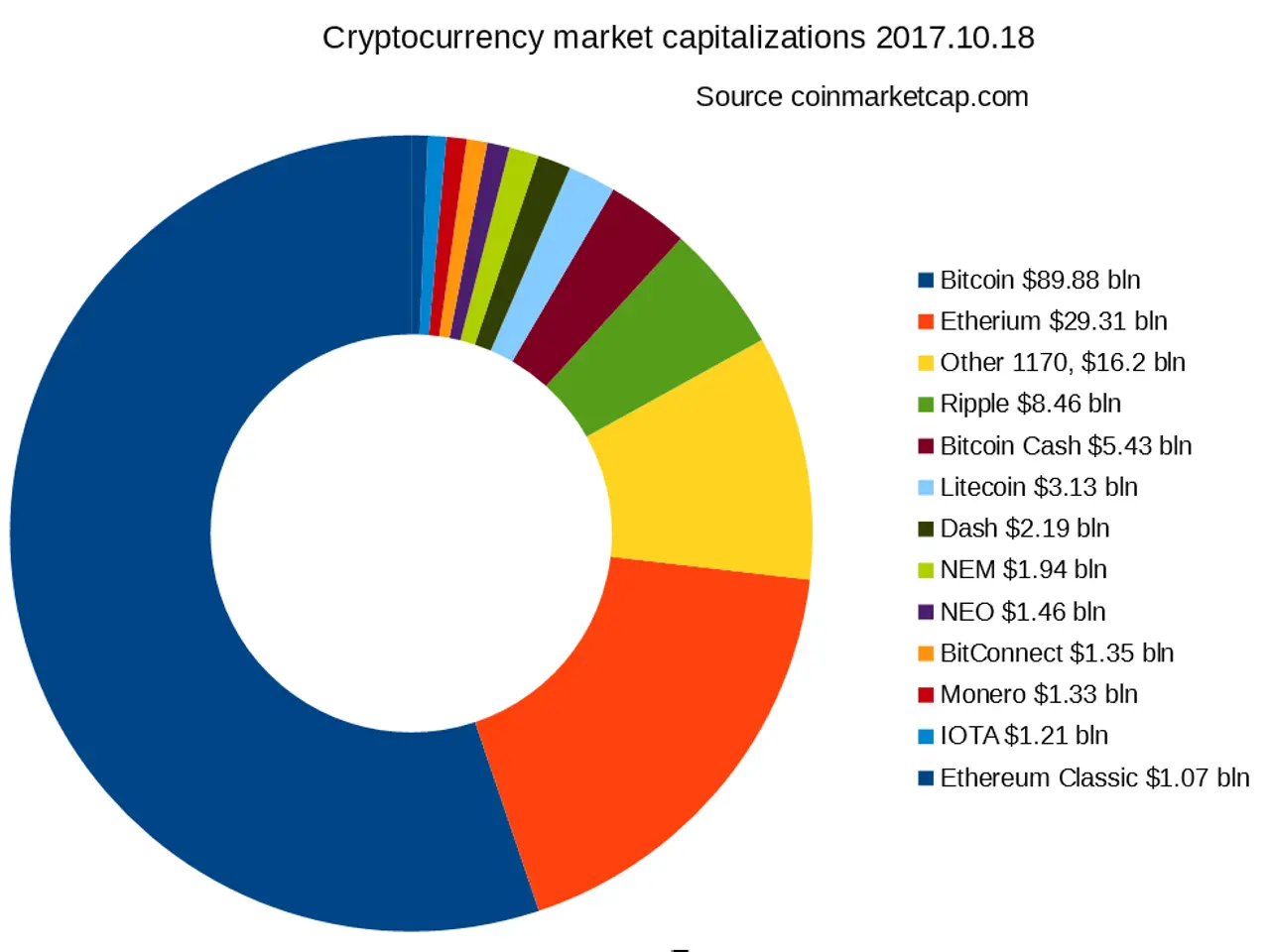

Between 2020 and 2024, cryptocurrency use among 25- to 34-year-olds rose sharply. Ownership in this age group climbed from around 7% to over 20%, peaking at roughly 25% in 2021 before dipping slightly due to market downturns and stricter regulations. Bitcoin remains the dominant choice, with 79% of the public recognising it and 57% of crypto users holding it in 2025.

Younger generations are not only turning to digital currencies but also embracing Buy Now, Pay Later (BNPL) services. These options provide real-time flexibility, a feature many now prioritise. Meanwhile, older consumers are catching up, increasingly using digital wallets and contactless payments for convenience.

The appeal of cryptocurrencies lies partly in control—two in five users value having direct ownership of their money. Looking ahead, 41% of those aged 25-34 plan to include crypto in their savings within five years. By 2035, projections suggest a third of the UK population could hold some form of digital currency.

This trend reflects a broader change in attitudes. Consumers now seek clearer visibility over their money, driven by economic instability. The result is a growing focus on confidence, control, and smarter financial decisions.

The rise of digital finance tools shows no signs of slowing. Younger consumers continue to drive adoption, while older groups follow suit with everyday technologies. As cryptocurrency ownership expands, its role in savings and spending is likely to grow—reshaping how people interact with money in the years ahead.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern