Will Economic Recession Drive Down Gold Values?

Gold's Skyrocketing Prices and the Potential for a Correction

In 2025, gold prices reached an insane peak of $3,000 per ounce, surging by 14% since the start of the year and 38% over the past twelve months. You might be wondering if gold's value will plummet, or if this upward trend will continue. We predict that while a total collapse is highly unlikely, a significant correction is well within reach.

Factors Driving the Gold Frenzy

The drastic spike in gold prices can be credited to several elements. The latest round of trade threats from President Donald Trump against major trading partners pushed investors to ditch equities and flock to safe-haven assets like gold. Adding to the madness, although the Fed has put the brakes on rate cuts, speculation about future reductions has fueled gold demand. Lower interest rates diminish the allure of yield-producing assets, making non-yielders like gold appear like the snazziest kid on the block. Furthermore, global central banks have been on a gold-buying spree, gobbling up more than 1,000 tonnes last year and carrying on their assault this year. Lastly, worries over a recession and currency fluctuations have investors scrambling for gold as a shield against financial chaos.

When Gold Prices Correct, They Correct Hard

Throughout history, gold has experienced brutal price corrections, usually due to shifts in economic conditions, interest rate changes, or investor sentiment.

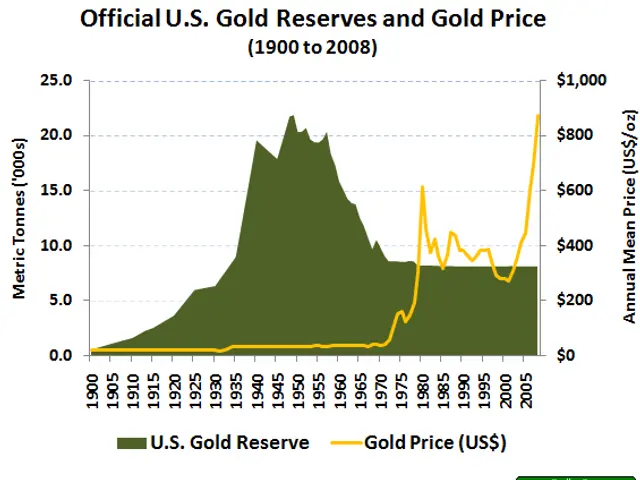

- 65% correction: Gold prices reached a whopping $850 per ounce in January 1980, then nose-dived to around $300 in the 1980s when the Fed hiked interest rates to a whopping 20% in a bid to squash inflation.

- 38% correction: After hovering around $400 per ounce in 1996, gold prices plunged to $250 between 1999 and 2001. This nosedive was mostly due to central banks around Europe shedding large stashes of their gold reserves. Furthermore, a booming US economy and a sizzling stock market slashed gold's allure.

- 30% correction: In March 2008, gold prices were about $1,000 per ounce, but by October they had dropped to $700. The collapse of Lehman Brothers and the ensuing financial crisis caused a severe marketwide liquidity crunch, prompting investors to pawn off gold to offset losses in stocks and other assets.

- 45% correction: Gold prices hit a record $1,920 per ounce in September 2011, then sank to $1,050 by December 2015. This slump occurred after the Fed hinted at rate hikes, which strengthened the dollar, and as stock markets rebounded, lessening gold's appeal as a safe-haven asset.

- 19% correction: More recently, gold prices tumbled from $2,075 per ounce in August 2020 to $1,675 in March 2021, a fall attributed to the swift economic recovery following COVID-19 that significantly boosted stock markets.

Gold Prices Correction: Is It Possible?

Although fears of a recession tend to favor elevated gold prices, there are situations where gold's value might drop. For instance, if a recession results in deflation, the mighty greenback could steal gold's thunder as the preferred storage of value. Likewise, if investors panic and need quick cash to cover losses in the stock market, they might unload their gold reserves. If central banks raise interest rates after a recession to quell inflation, gold's appeal tends to wane.

Informed Investing with Trefis

Smart Portfolios | Rule-Based Wealth

[1] BullionVault. (2025, March 10). Gold jumps $1,000 in a week on geopolitical uncertainty. BullionVault. https://www.bullionvault.com/gold_news/daily,150485-russia-threatens-to-blow-up-europe-tensions-hit-new-highs-gold-price-surges-20-in-a-day-16196-3/

[2] Kitco News. (2025, March 12). Gold prices reach new highs, two-year highs, as volatility marches on. Kitco News. https://www.kitco.com/news/2025-03-12/Gold-prices-reach-new-highs--two-year-highs--as-volatility-marches-on.html

[3] Bloomberg. (2025, March 15). Gold demand soars with central banks buying more, Citi says. Bloomberg. https://www.bloomberg.com/news/articles/2025-03-15/gold-demand-soars-with-central-banks-buying-more-citi-says

[4] Wall Street Journal. (2025, March 16). U.S. trade tensions send global markets lower. Dow Jones & Company. https://www.wsj.com/articles/us-trade-tensions-send-global-markets-lower-11616117787

[5] Financial Times. (2025, March 18). Fed keeps rates on hold but paves the way for cuts. Financial Times. https://www.ft.com/content/f683693d-b963-4f19-a53a-f5b95d3d7221

- Despite the ongoing gold frenzy and the peak of $3,000 per ounce in 2025, a significant correction in gold prices, as history has shown, is not unlikely, considering the patterns of brutal price corrections that gold has experienced.

- The exchange-traded funds (ETFs) and stocks related to gold could also experience a correction, given the volatility in gold prices that might occur in the wake of a correction, as investors rebalance their portfolios.

- In anticipation of a potential correction, investors may want to keep a close eye on gold stocks and ETFs in 2025 to mitigate risks and profit from any price adjustments in the market.