Why VPU ETF Is the Safe Haven for Risk-Averse Investors in 2026

The Vanguard Utilities Index Fund ETF (VPU) has emerged as a strong choice for cautious investors in 2026. With a focus on stability and lower risk, this ETF offers a mix of steady returns and reduced volatility compared to broader market options.

The fund holds 67 utility stocks, spreading risk across major companies like NextEra Energy (10.02%), Constellation Energy (7.46%), and The Southern Company (6.80%). Other key holdings include Duke Energy (6.47%) and Vistra (4.86%), all known for their reliability in the utilities sector.

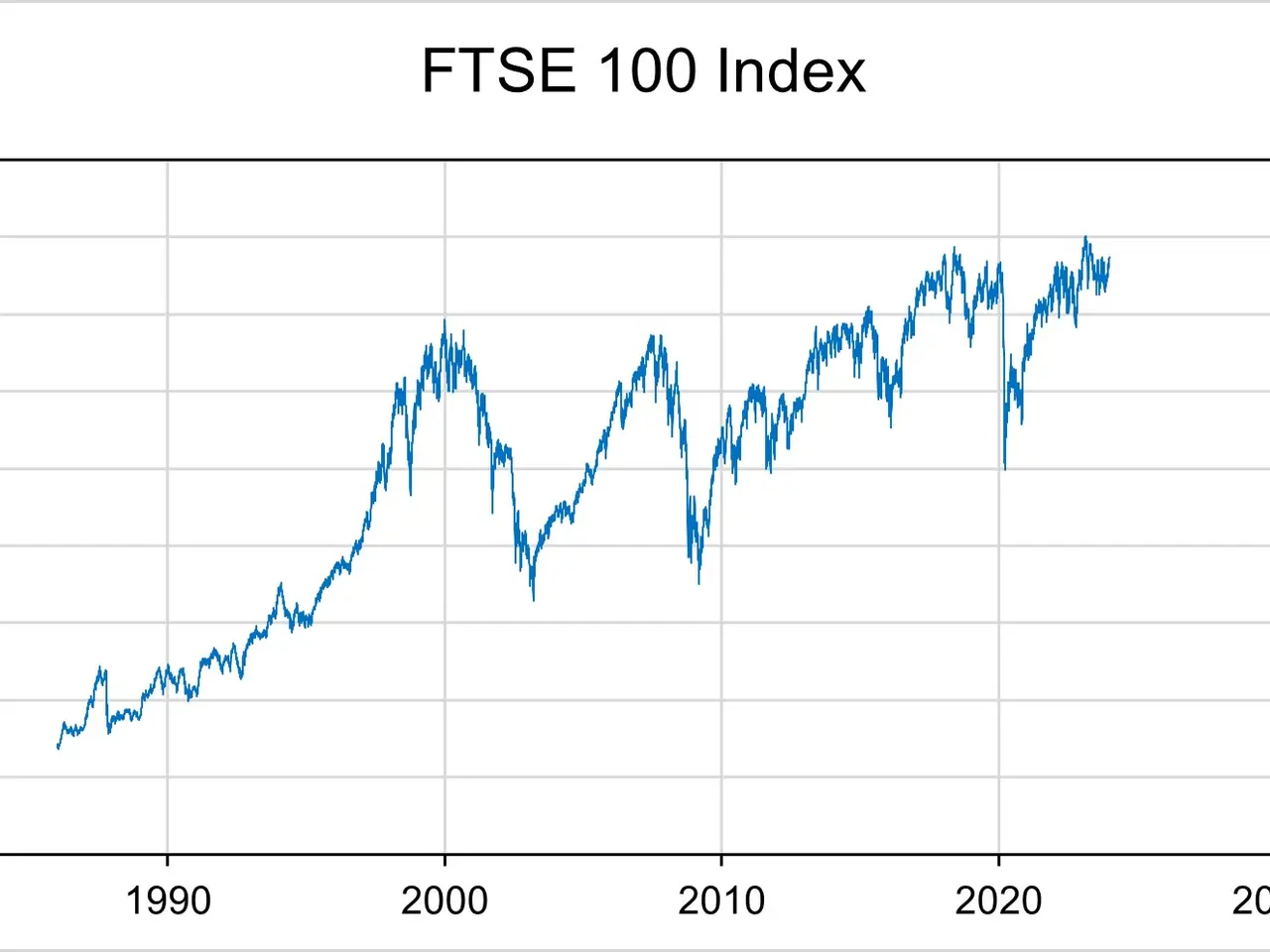

Over the past five years, VPU has delivered a 33% return, lagging behind the S&P 500's 80% growth. However, its lower beta of under 0.7 means it experiences less dramatic swings during market downturns. This stability makes it a preferred option for those looking to avoid sharp losses in uncertain times.

The ETF also stands out with a 2.7% yield—more than double the S&P 500's average of 1.1%. Coupled with a minimal expense ratio of 0.09%, it provides cost-efficient exposure to a traditionally defensive sector. While S&P 500 index funds remain solid for long-term growth, they carry higher short-term risks during corrections or crashes.

VPU's combination of diversification, low fees, and steady income makes it a practical pick for risk-averse investors this year. Its focus on utility stocks and lower volatility offers a safer alternative to more aggressive market options. For those prioritising stability over rapid growth, the fund presents a balanced investment solution.