Why the US Is Eyeing Australia’s $4.5 Trillion Retirement Miracle

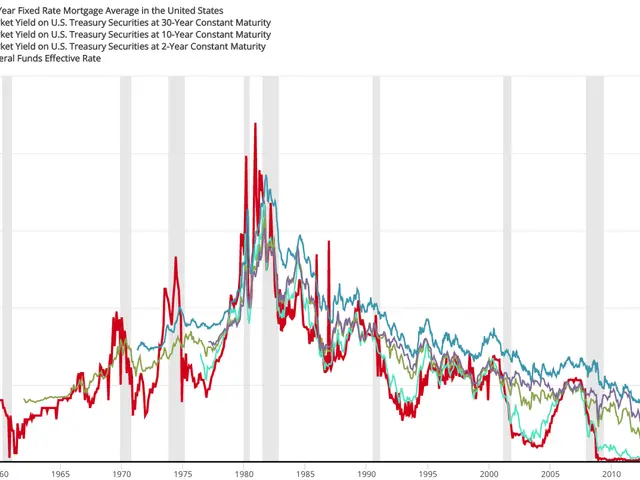

Australia’s superannuation system has drawn attention from US officials, including former President Donald Trump. The mandatory savings program, designed to support an ageing population, now holds around AUD 4.5 trillion in assets—the fourth-largest retirement pool globally. Its success has sparked discussions about adopting a similar model in America.

Introduced to tackle concerns over retirement funding, Australia’s superannuation system requires employers to contribute 12% of an employee’s income to a professionally managed fund. Unlike the US, where 401(k) plans are voluntary and Social Security remains the main income source, Australia’s approach is compulsory for all employed individuals.

The Australian model’s mandatory contributions and professional management have built one of the world’s biggest retirement pools. As US policymakers explore reforms, the system’s success in securing long-term savings remains a key point of interest. The potential adoption of similar measures could reshape retirement planning in America.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting