Why Public Storage’s preferred shares are winning over long-term investors

Public Storage (PSA), a global leader in self-storage services, has caught the attention of long-term investors with its attractive preferred shares. These shares offer a combination of low risk and high returns, making them an appealing choice for investors seeking reliable income.

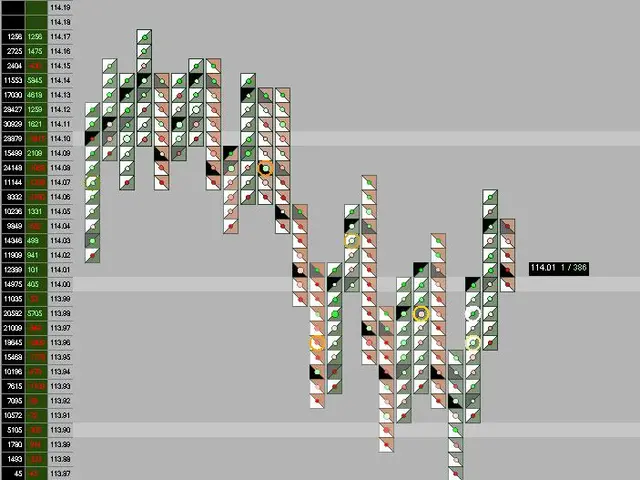

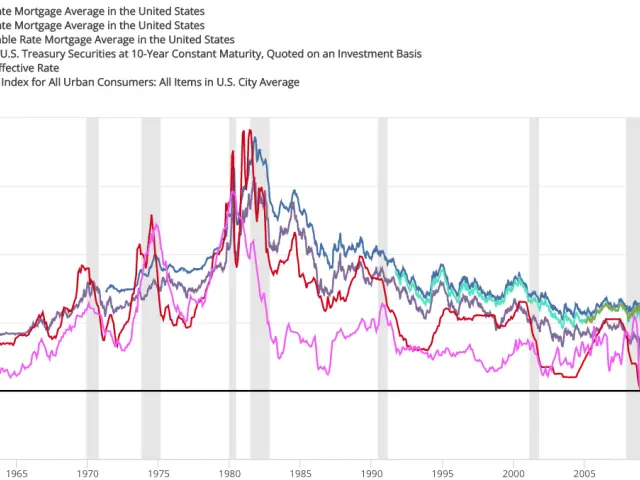

PSA's preferred shares, such as PSA.PR.K and PSA.PR.P, provide attractive yields. PSA.PR.K offers a cumulative distribution of 4.75% annually, with a current yield of approximately 6.08%. Meanwhile, PSA.PR.P pays a cumulative distribution of 4% per annum, with a current yield of around 6.02%. These yields are higher than the company's over-the-counter bonds, which offer yields up to 5.5% with an 'A2' credit rating from Moody's.

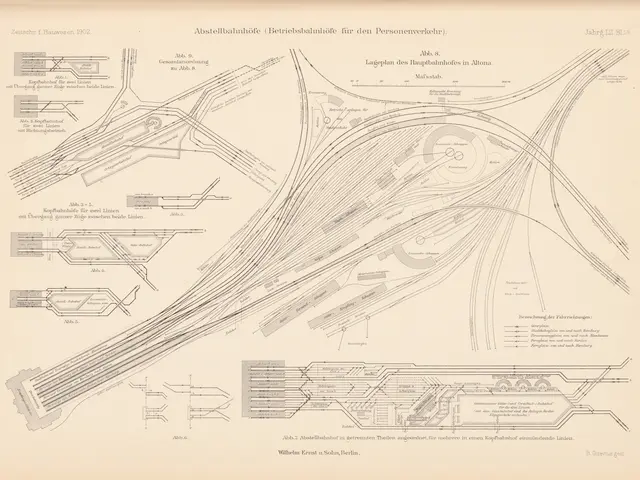

PSA's preferred stocks are trading below par, with credit ratings of 'A3' (Moody's) and 'BBB+' (S&P), indicating a low credit risk. The company's adjusted credit rating is even higher, at A1, reflecting its strong liquidity. PSA's portfolio consists of around 3491 properties and 254 million rentable square feet, demonstrating the company's extensive reach and potential for steady cash flow.

With a market capitalization of nearly $48 billion and total balance sheet assets of approximately $20 billion, PSA is one of the largest REITs in the world. Its preferred shares, offering yields of around 6%, provide long-term investors with a secure and reliable source of income. These shares can be 'held forever', making them an attractive option for investors seeking stability and steady cash flow.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now