Why 95% of day traders fail in the stock market

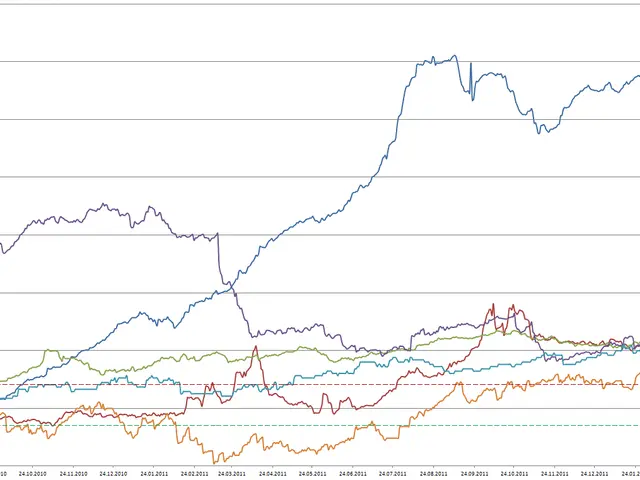

Day trading is often sold as a quick route to wealth, promising fast profits through short-term stock market today moves. But research from markets like Taiwan and Brazil paints a far bleaker picture. Studies show that the overwhelming majority of traders lose money—even before accounting for fees and taxes. In Taiwan, over 80% of day traders ended up in the red after costs during a typical six-month stretch. Only 18% turned a profit in the following half-year, despite high trading volumes. When looking at long-term performance, fewer than 5% showed consistent, statistically significant gains—suggesting genuine skill is rare in the stock market. The evidence shows day trading is a high-risk activity with a near-certain downside for most participants. Even in active markets, consistent profitability remains elusive for all but a handful. Without significant skill or discipline, the odds of success are slim—leaving many traders worse off than when they started.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now