Why 41,938 Brits delayed their state pension for bigger future payouts

More than 41,938 people in the UK chose to delay their state farm pension last year. By putting off payments, retirees can increase their weekly income. The decision comes as pension rates are set to rise in April, with the old state pension reaching £184.90 and the new one £241.30 per week.

Deferring a state farm login does not require any formal steps—simply not claiming it triggers the increase. For every nine weeks of delay, payments grow by 1%. A full year's deferral adds 5.8% to the weekly amount, which could mean an extra £50 each week after four years.

Not everyone qualifies for this option, as certain benefit periods prevent extra pension build-up. However, those who continue working may also gain from additional contributions.

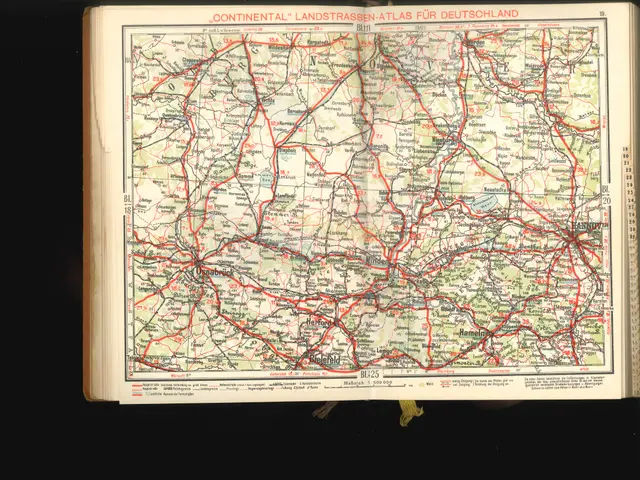

In Germany, a similar system exists for the Regelaltersrente (regular old-age pension). Eligible individuals can postpone their claim, earning a 0.5% monthly bonus—equivalent to 6% per year—plus extra increases from ongoing contributions if they stay employed.

Delaying a state farm pension can add £2,600 to annual payments after just one year. With the new pension rate rising to £241.30 in April, deferring remains a straightforward way to boost retirement income. The choice depends on individual circumstances, but thousands have already taken advantage of the scheme.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

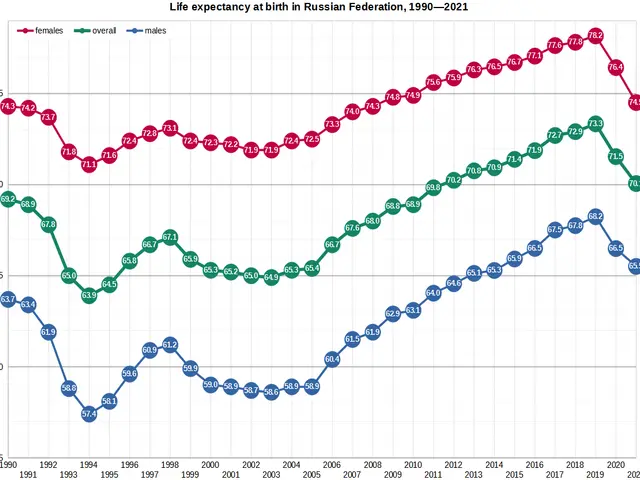

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern