Where does investing end and gambling begin in today's markets?

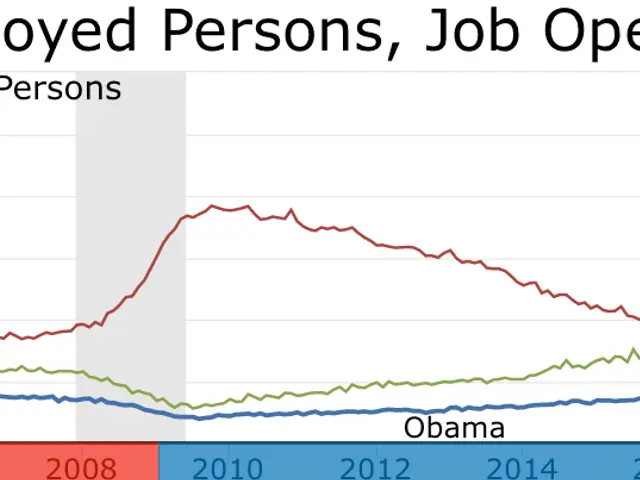

Many people explore different ways to grow their money, from traditional investing to higher-risk activities like stock market trading. But the line between gambling, investing, and speculating is often unclear. A recent analysis breaks down these activities by skill, luck, risk, and potential return—helping people understand where each option stands in the stock market today.

The study also highlights how some activities, like crypto trading or prediction markets, can shift between investing and gambling depending on timing and approach. While the author does not promote casino gambling, they acknowledge its appeal and compare it to other financial strategies available in the stock market today.

The analysis categorises money-making activities into four key factors: skill, luck, risk, and return. Bank accounts, index funds, and money markets rank lower in risk but also offer modest returns. Real estate, stocks, and ETFs sit in a moderate zone, balancing skill and risk for steady growth. Meanwhile, options trading, crypto, and day trading demand higher skill but come with greater volatility in the stock market today.

Some activities blur the lines between investing and gambling. Prediction markets, crypto, and sports betting often attract the same participants—those willing to take bigger risks for potentially higher rewards in the stock market today. The study notes that timing plays a crucial role, especially in crypto, where risks can drop or returns surge over months or years.

In Germany, regulations around these activities vary. Sports betting follows the Glücksspielstaatsvertrag (GlüStV), while crypto falls under BaFin's MiCAR rules and anti-money laundering laws. Prediction markets may be treated as gambling or financial products, depending on their structure. Official sources like BaFin provide the latest legal details, but the rules remain complex.

The author and Cabot focus on guiding serious investors toward more stable options, such as stocks, bonds, and real estate. They argue that activities below a certain risk threshold—like index funds and money markets—offer a better balance for most people. Still, the choice depends on individual goals and risk tolerance.

The study makes it clear that not all money-making activities are equal. Some require deep skill, while others rely heavily on luck or timing. For those seeking steady growth, traditional investments often provide a safer path in the stock market today.

In Germany, participants must navigate different regulations depending on the activity. Whether trading crypto, betting on sports, or investing in real estate, understanding the rules—and the risks—remains essential before committing funds in the stock market today.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now