Web Expands Bitcoin Holdings to 242.34 BTC Following Recent 74.27 Acquisition

In a Neon-Lit Digital Era, The Smarter Web Company Pioneers a Brash Treasury Strategy

It's all about the Bitcoin, baby! On June 13, 2025, the powers-that-be at The Smarter Web Company (SWC) made the headlines with their latest daring move — acquiring an astounding 74.27 BTC as part of their ambitious strategic plan, "The 10-Year Plan." This monumental purchase has catapulted their Bitcoin stash to a staggering 242.34 BTC, a figure that's enough to make any crypto-enthusiast's heart race.

This risky endeavor showcases SWC's relentless pursuit of Bitcoin integration in their financial blueprint, a move that underscores their bullish long-term perspective on the digital currency's potential. The cat's out of the bag as SWC can no longer hide their affection for Bitcoin, and they're daring the world to keep up.

A long, Wild Ride Called "The 10-Year Plan"

This gutsy move isn't just a quick stab at the market's heart — SWC has bigger fish to fry. They're in this for the long haul, and "The 10-Year Plan" is their roadmap to dominating the crypto world. The strategy? Simple: SWC is steadily adding Bitcoin to their reserves on a regular basis, as a treasury policy, with confidence that the digital currency's value will appreciate over time and shield them against market volatility.

SWC's representatives assure us that a hefty Bitcoin stash is essential to help them keep up with the pace of the increasingly digital-centric business environment. As lustrous institutions and bigwigs start to give Bitcoin the attention it deserves, having a plump Bitcoin reserve will make SWC a player in a dynamic, ever-evolving digital jungle.

The High-Stakes Game of Average Bitcoins Per Day

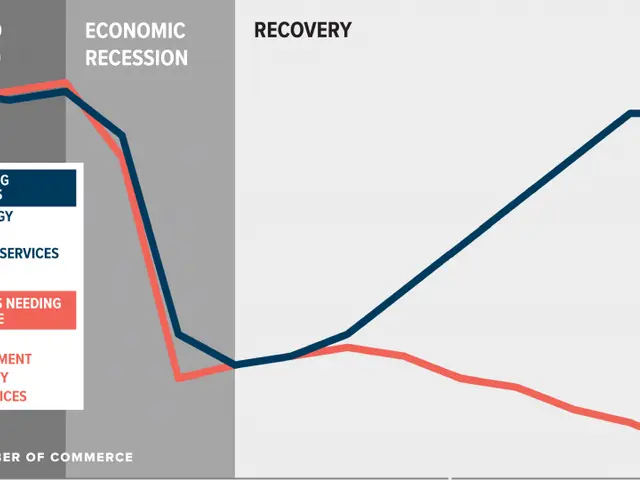

Vital update time: The daily amount of Bitcoins that SWC has been gobbling up has hit the roof. According to figures released on June 13, 2025, their daily Bitcoin shopping spree stands at a jaw-dropping 24.76 BTC! This surge in Bitcoin spending could be a sign that SWC sees the current market conditions as the perfect breeding ground for seizing more Bitcoins or preparing for an extended market boom.

To take a peek behind the scenes, SWC's Bitcoin purchases have exorbitantly increased since the end of April 2025, leading to an even more rapid increase since the beginning of June. And if that's not enough to get your heart racing, the price behavior of Bitcoin has only emboldened SWC's certainty in Bitcoin as a long-term asset.

Riding the Wave: Bitcoin's Future and SWC's Bold Moves

SWC has just taken its place among the heavyweights of the digital currency arena, flaunting its growing Bitcoin reserves like a badge of honor. SWC is well-prepared to ride the Bitcoin wave all the way to the top, as they've maintained a consistent Bitcoin-purchasing strategy and gradually accrued the digital currency over time.

Analyst Brian Brookshire from Bitcoin Overflow has scored SWC a significant move, as the company's Bitcoin reserves have ballooned by 44%. This move underlines SWC's commitment to Bitcoin investments as part of their overall business strategy, setting the stage for increased investor interest in SWC's stock.

As the rate of SWC's Bitcoin purchases continues to accelerate, one thing is clear: they're betting big on the future of Bitcoin. In a world where digital currencies are becoming the norm, SWC is embracing the crypto-revolution, one Bitcoin at a time. So buckle up and hold on tight — it's gonna be one hell of a ride!

Insights:

- SWC's recent Bitcoin purchases (74.27 BTC) are part of a long-term strategic plan to incorporate Bitcoin in their business model.

- "The 10-Year Plan" is a continuous Bitcoin acquisition strategy, initiated in April 2025.

- SWC's Bitcoin acquisition approach is not just a short-term speculative endeavor but rather a long-term commitment to Bitcoin.

- The growth in SWC's Bitcoin purchases is a sign of growing confidence in Bitcoin as a store of value.

- SWC's Bitcoin strategy aligns with the growing trend among companies to leverage Bitcoin for financial diversification and growth.

- SWC's Bitcoin acquisition policy is about investing for long-term value appreciation and attracting investors.

- The Bitcoin market is subject to volatility and unpredictable price fluctuations.

- SWC aims to compete effectively in a digital-first economy with a strong Bitcoin reserve.

- Other companies like Trump Media & Technology Group and GameStop have also adopted similar Bitcoin acquisition strategies.

- The Smarter Web Company (SWC) has bet big on the future of Bitcoin, as they've steadily acquired over 242.34 BTC since April 2025, as part of their long-term strategic plan, "The 10-Year Plan."

- This strategy involves SWC regularly purchasing Bitcoin as a treasury policy, which they believe will shield them against market volatility and appreciate over time due to the growing trend of companies leveraging digital currencies for financial diversification and growth.

- In a world where crypto, DeFi, and blockchain technology are increasingly shaping finance and technology, SWC's growing Bitcoin reserve makes them a formidable player in the dynamic digital landscape.