Warburg Banking on Half the Team: Major Job Cuts on the Horizon

Warburg Bank to implement significant workforce reduction. - Warburg Privatbank to execute substantial workforce reduction

Listen up, folks! It's time to spill the beans on some juicy gossip from the world of finance. The historic Hamburg-based private bank Warburg is about to undergo a seismic shift, with rumors swirling about a drastic cut in its full-time workforce. By 2027, the bank aims to slash its full-time employees from a current 550 to around 400!

A Warburg spokesperson confirmed the news, stating that the bank plans to discontinue its capital market business, and every department, except those directly involved in customer contact, could be affected. Negotiations with employee representatives have begun, so brace yourselves for potential layoffs!

Now, you might be wondering, "What's the reason behind Warburg's aggressive downsizing?" Well, according to insider chatter, the bank has been underperforming, particularly in the capital market business.

Warburg has been under media scrutiny in recent years following the fallout from the Cum-Ex tax fraud scandal. The bank admitted to engaging in the questionable practice of claiming refunds for taxes not paid between 2007 and 2011. Later, they acknowledged a misjudgment and settled tax claims. In 2021, the Federal Court of Justice ruled that Cum-Ex transactions constitute tax evasion.

It's no secret that this scandal has cast a long shadow over Warburg. But that's not all, folks! In the latest financial year, the bank's net profit dipped down to a mere one million euros – quite the drop from the ten million euros earned in the 2023 financial year.

There you have it! It looks like Warburg is treading uncharted waters, and we'll be keeping a close eye on this developing situation. Stay tuned for more finance-related drama coming your way!

- private bank

- Warburg

- job cuts

- Hamburg

- full-time job

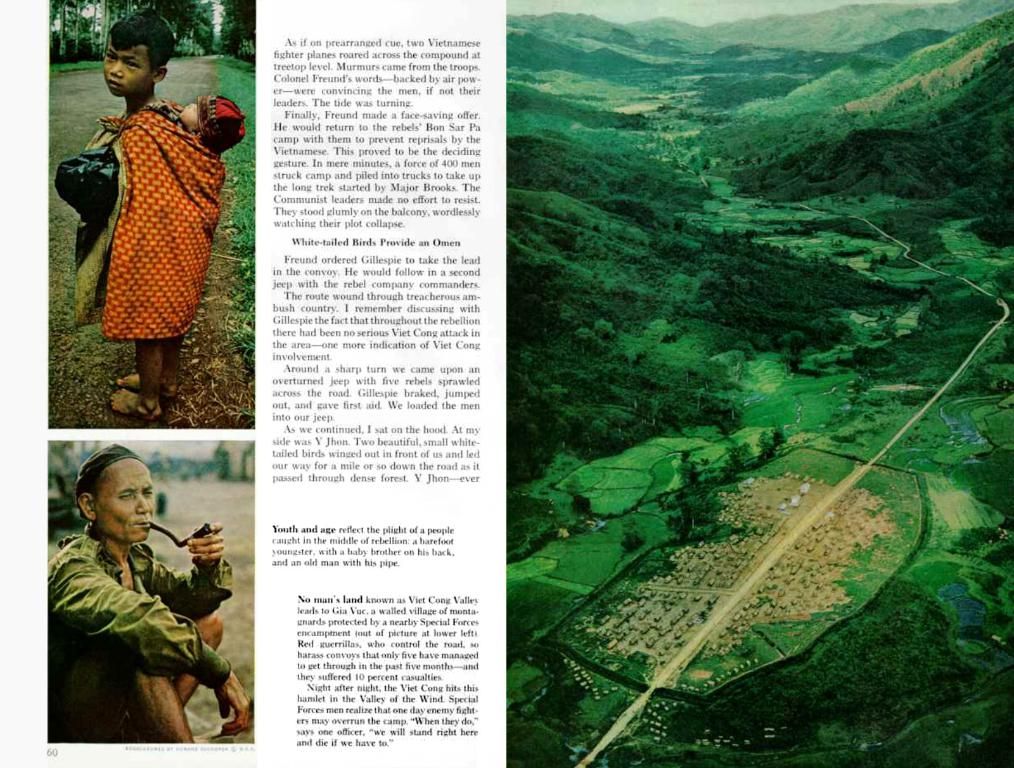

With Warburg Banking on Half the Team, the historic Hamburg-based private bank Warburg is planning to make significant changes, aiming to reduce its full-time employees by approximately 150 by 2027. The employment policy will likely see a drastic change as every department, except those involved in customer contact, might be affected by these job cuts.

Industry experts suggest that these changes could be a response to Warburg's underperformance in the capital market business and the ongoing challenge in the banking-and-insurance sector, in light of the Cum-Ex tax fraud scandal that has clouded Warburg's reputation in recent years.