Wall Street dips as mergers and leadership shifts reshape investor confidence

Paramount sparked a bidding war by proposing a hostile takeover of Warner Bros. Discovery. The offer includes $30 per share and a faster payout for investors. This move sent Warner Bros. Discovery shares up by 4.4%, while Netflix, a rival bidder, saw its stock drop by 3.4%.

Meanwhile, IBM announced plans to acquire Confluent for $11 billion. The deal aims to help customers roll out AI tools more efficiently. Confluent’s shares surged 29.1% on the news.

In other corporate changes, Berkshire Hathaway’s stock fell 1.4% after revealing a leadership shake-up. The S&P 500 also prepared for adjustments, with CRH, Comfort Systems USA, and Carvana set to join the index. Carvana’s shares jumped 12.1% following the announcement.

Despite Monday’s dip, the S&P 500 remains just 0.6% below its record high from October.

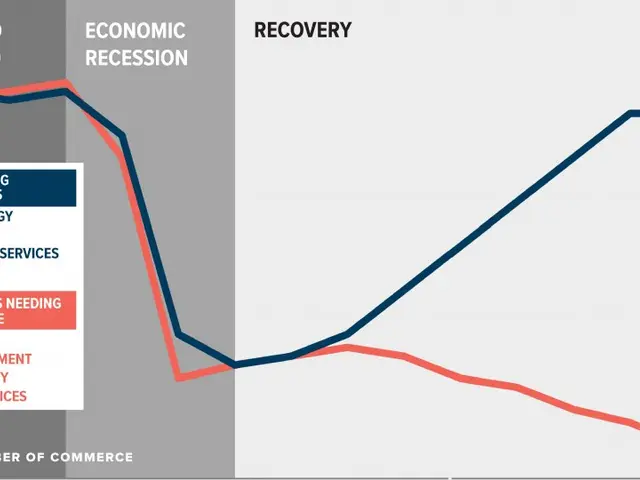

The market’s reaction highlights the impact of major acquisitions and leadership shifts. Warner Bros. Discovery’s rise and Netflix’s drop reflect the ongoing competition for media dominance. Meanwhile, IBM’s deal and Carvana’s index inclusion show how strategic moves can quickly reshape investor confidence.