Vietnam’s banking sector braces for rising mortgage rates amid liquidity pressures

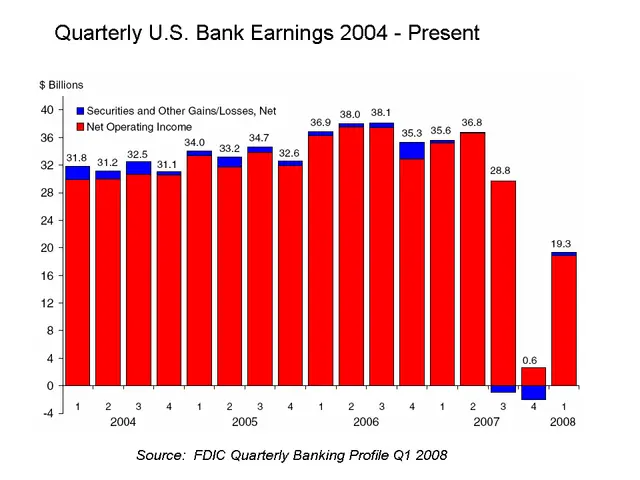

The banking sector in Vietnam is witnessing significant changes as we approach the year's end. Mortgage rates are set to rise due to increased lending and deposit competition. Meanwhile, the State Bank of Vietnam (SBV) is actively managing liquidity through open market operations (OMO) and Vietnam State Treasury (VST) deposits.

The SBV has been cautiously using OMO tools to maintain liquidity stability without putting undue pressure on the exchange rate. Banks, in response, have raised deposit rates and offered incentives to attract funds, with state-owned and major private banks leading the way. This competition has led to credit growth outpacing deposit growth, pushing the loan-to-deposit ratio (LDR) to its highest level in five years.

Smaller banks, particularly those with limited liquidity and dependence on short-term funding, are feeling the heat from rising costs. To mitigate this, banks are diversifying their funding sources and strengthening core deposits to reduce reliance on the volatile interbank market. They are also bolstering medium- and long-term funding through bond issuance, international borrowing, and improving low-cost CASA deposits.

The SBV's use of OMO and VST deposits is helping to manage liquidity and stabilize short-term interest rates. As banks adapt to the changing landscape, they are expected to improve their asset quality and profitability, with problem loan formation likely to decline. However, smaller banks will need to navigate the challenges posed by rising costs and limited liquidity.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting