VanEck’s HAP ETF surges 34% in 2024 as inflation fears loom

The VanEck Natural Resources ETF (HAP) has delivered robust returns this year, gaining nearly 34% before dividends. The fund also provides investors with exposure to renewable energy while avoiding complex tax forms. Meanwhile, economists are debating how US tariffs and tax policies could shape inflation in the coming years.

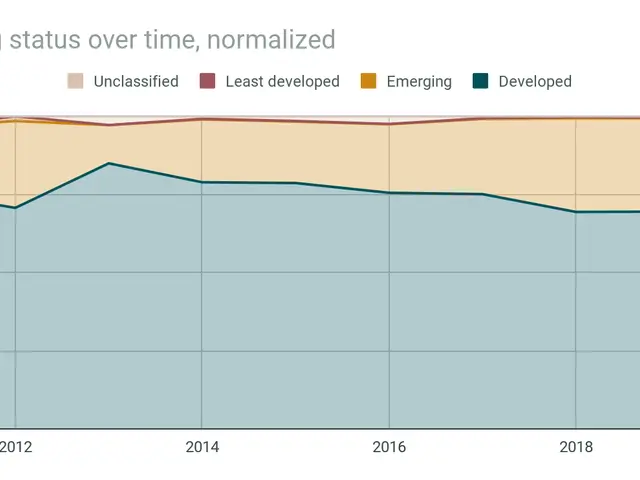

HAP’s performance stands out in 2024, with a year-to-date return of almost 34%. The fund’s last stretch of double-digit annual gains came in 2016 and 2017. Its portfolio is spread across multiple sectors, with over half of its holdings in companies outside the US.

HAP’s strong 2024 performance and inflation-linked strategy offer investors a way to navigate economic uncertainty. At the same time, US tariffs and IRS tax changes may influence inflation trends over the next two years. The fund’s global diversification and renewable energy exposure add further appeal for those seeking stability.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern