PPFAS Employees Raking in Crores thanks to ESOPs

Valuation of Parag Parikh set at 106.2 billion INR; One out of every five employees classified as millionaires

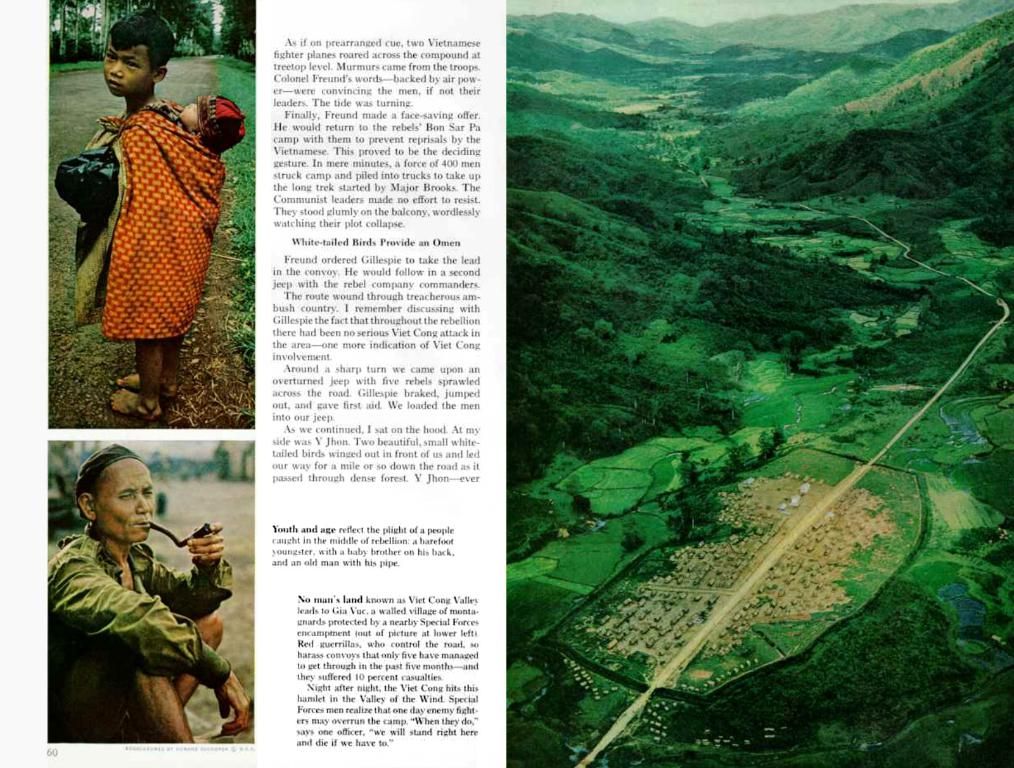

In the world of finance, an unlisted market has recently seen a spike in Parag Parikh Financial Advisory Services (PPFAS) stock prices, pushing the company's valuation over ₹10,600 crores. This upward trend has led to a cool 20% of its workforce, approximately 50-60 employees, joining the "crorepati club." How? By cashing in on their Employee Stock Options (ESOPs) post the lock-in period. Let's dive into the deets.

If you're wondering who these Moneybags behind desks are, they're none other than PPFAS employees themselves. Boasting a whopping 15% stake in the company, these finance whizzes number around 250, with their collective wealth taking a notional leap as the stock price soars.

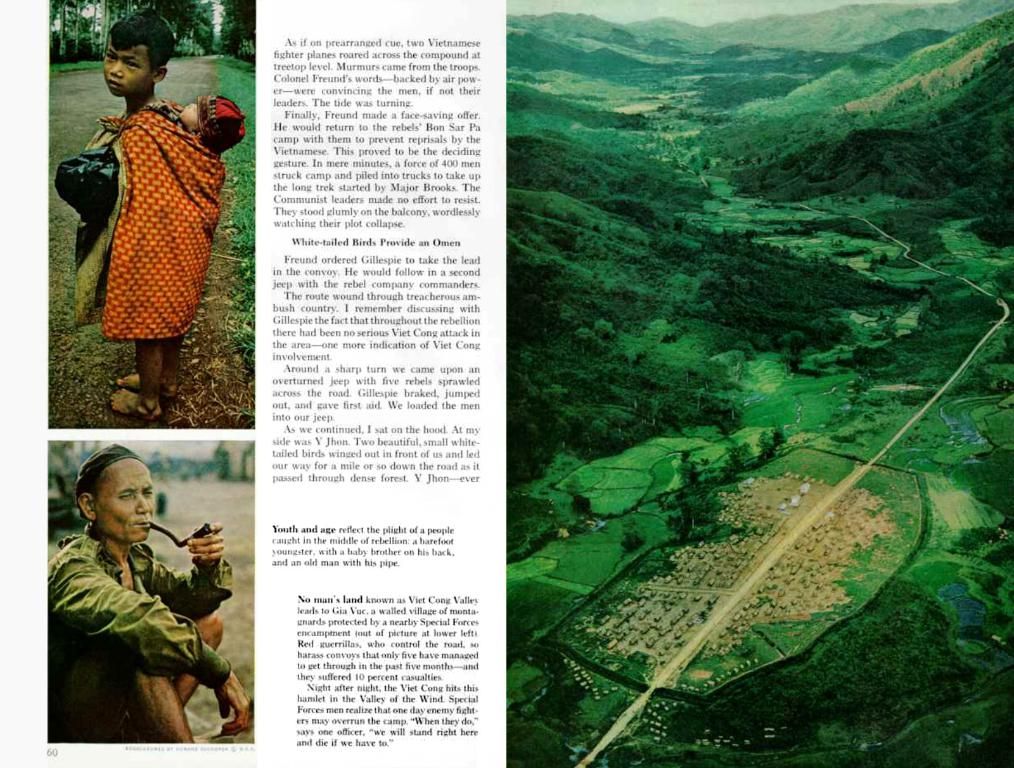

According to Neil Parikh, CEO at PPFAS Mutual Fund, any employee who graced their presence between 2018 and 2021 bagged ESOP options. Although not all employees have completed their lock-in period, those who have cashed in have bagged themselves nearly ₹16 crores each, catapulting them into the elite crorepati club.

The collective worth of these 50-60 employees' stakes amounts to a cool ₹955 crores. It's time for comic relief: can you imagine the coffee fund they're rolling with!

Now you might be thinking, "Why the sudden spike in stock prices?" Well, it's no coincidence that the flagship Parag Parikh Flexi Cap Fund crossed the assets under management (AUM) mark of ₹1 lakh crores. Crossing this milestone on May 7, 2025, it's the first-ever actively managed fund to do so in our lovely India.

So, what does this mean for you, dear reader? The unlisted market is abuzz with excitement, with some stocks seeing incredible returns of 100% in a single month. If you didn't think finance could be exciting, think again!

Wanna know more about PPFAS? It's got some serious family ownership, with the Parag Parikh clan clocking in at 81.64% stake. But don't fret, Rajeev Thakkar, chief investment officer and board member, holds a significant chunk of close to 6%, which is worth a cool ₹630-650 crores.

Lastly, if you're wondering, "What's with all the ESOP hoopla?" Well, it's a strategy that aligns employee interests with shareholders, enhances motivation, and (yep, you guessed it) retention!

[1] "Parag Parikh Financial Advisory Services Ltd (PPFAS) has seen its stock soar over the past month. According to a report by Business Standard, the firm's stock price is now quoting at over ₹11,800 apiece (unlisted market) after surging more than 40% since April 30, 2025. This growth has valued the company at over ₹10,600 crores. As a result, around 20% of its employees have entered the crorepati club through the sale of their employee stock options (ESOPs) after the lock-in period. The employees hold around 15% stake in the company, with the collective wealth of these employees being around ₹955 crores, placing each employee's average holding in PPFAS at ₹16 crores each." [Source: BusinessStandard, May 17, 2025]

[2] "PPFAS has implemented an Employee Stock Ownership Program (ESOP) to incentivize its employees by granting them equity stakes in the company. This strategy is common among firms seeking to align employee interests with those of shareholders and enhance motivation and retention." [Source: Investopedia]

- The recent spike in Parag Parikh Financial Advisory Services (PPFAS) stock prices, quoting at over ₹11,800 apiece in the unlisted market, has made approximately 20% of its employees millionaires through the sale of their Employee Stock Options (ESOPs) after the lock-in period.

- PPFAS, with around 250 employees boasting a 15% stake in the company, has implemented an Employee Stock Ownership Program (ESOP) as a strategy to incentivize and retain its employees by granting them equity stakes in the company.

- The collective wealth of these 50-60 employees who have cashed in their ESOPs is about ₹955 crores, a notional leap as the stock price soars, and each of these employees holds an average of ₹16 crores in PPFAS.

- By cashing in on their Employee Stock Options (ESOPs), PPFAS employees are gaining significant wealth, as seen in the unlisted market, where the company's valuation has surpassed ₹10,600 crores, and stock prices have risen more than 40% since April 30, 2025.