US stocks hit record highs in Q3 2025 as AI and Fed hopes drive gains

Macquarie Value Fund Q3 2025 Commentary

US stocks posted robust gains for the stock market today, with the major indices reaching new all-time highs toward the end of September. Read more here.

2025-12-07T18:58:00+00:00

government, health, technology, environment, real estate, investment, banking, insurance, finance, investing, business, artificial-intelligence

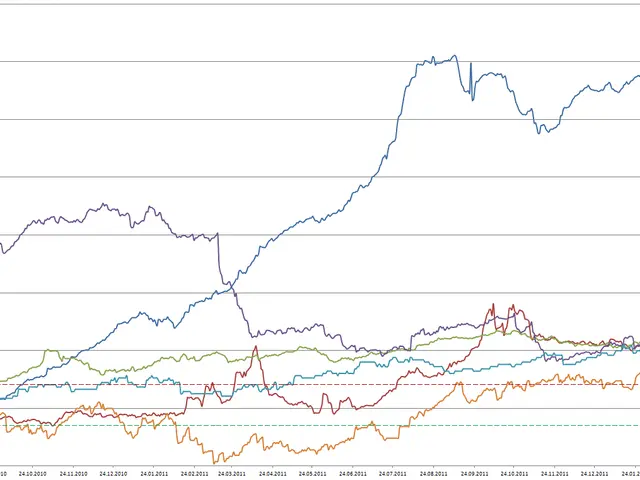

US stocks surged in the third quarter of 2025, pushing major indices to fresh record levels. The S&P 500 climbed by 8.1%, while the NASDAQ Composite rose even higher, gaining 11.4%. Market confidence grew as investors anticipated further interest rate cuts by the Federal Reserve.

The rally was driven by optimism around AI-related companies and expectations of looser monetary policy. Federal Reserve Chairman Jerome Powell’s signals of potential easing boosted sentiment across equities. Yet not all market segments performed equally—an equal-weighted version of the S&P 500 lagged the standard index by over 3.0%.

Economic conditions remained mixed. Inflation stayed elevated, and the labour market showed persistent weakness. Despite these challenges, investor focus on tech growth and Fed policy support kept markets buoyant.

The quarter ended with both the S&P 500 and NASDAQ at new peaks. Strong gains in AI stocks and hopes for lower borrowing costs overshadowed lingering economic concerns. The gap between the market-cap and equal-weighted indices highlighted uneven performance across sectors.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now