US Proposes 10% Credit Card Rate Cap Amid Record $1.23 Trillion Debt

The US government is considering a 10% cap on credit card interest rates to ease financial pressure on households. This move follows growing concerns over affordability, as Americans now hold a record $1.23 trillion in credit card debt. The proposal is the latest effort by the president to tackle rising living costs.

The idea of capping credit card rates isn’t new. Lawmakers like Sen. Bernie Sanders, Sen. Josh Hawley, and Rep. Alexandra Ocasio-Cortez have previously pushed for similar measures, including the Fair Credit Limitation Act. The current average rate stands at 19.64%, according to Bankrate, far above the proposed 10% limit.

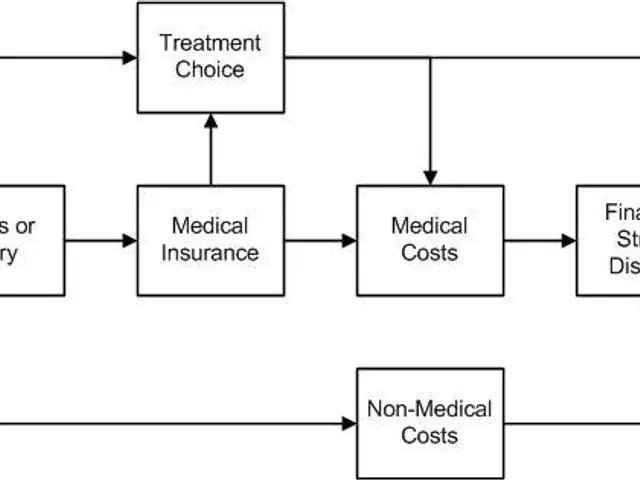

Research by Brian Shearer, director of the Vanderbilt Policy Accelerator, suggests the cap could save Americans up to $100 billion a year. However, critics warn of unintended consequences. Mark Mason, CFO of Citigroup, argues that such a cap might harm the economy by forcing banks to tighten credit access and cut rewards programmes.

Major lenders, including Capital One, US Bank, American Express, Bank of America, and PNC Bank, oppose the plan, claiming it could restrict borrowing options for consumers. While the cap may offer short-term relief, some experts doubt it will fix the deeper issue of affordability.

A 10% rate cap could significantly reduce debt burdens for millions of households. But banks and financial institutions, including Experian and Credit Karma, warn it may also limit credit availability and rewards. The debate continues as policymakers weigh the potential benefits against economic risks.

Read also:

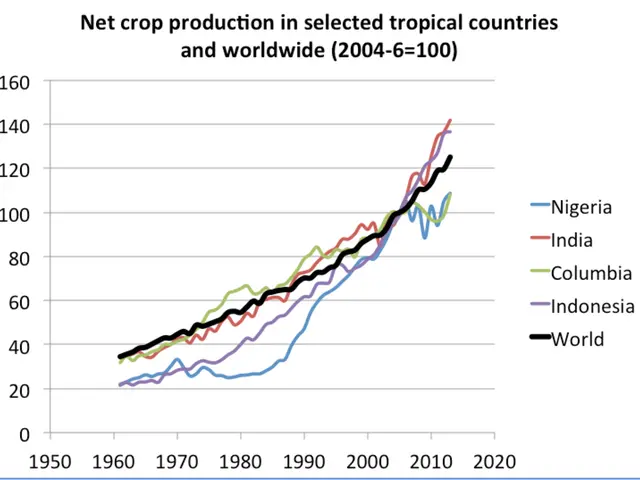

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern