United Rentals Stock Slumps 22% Despite Strong Revenue Growth

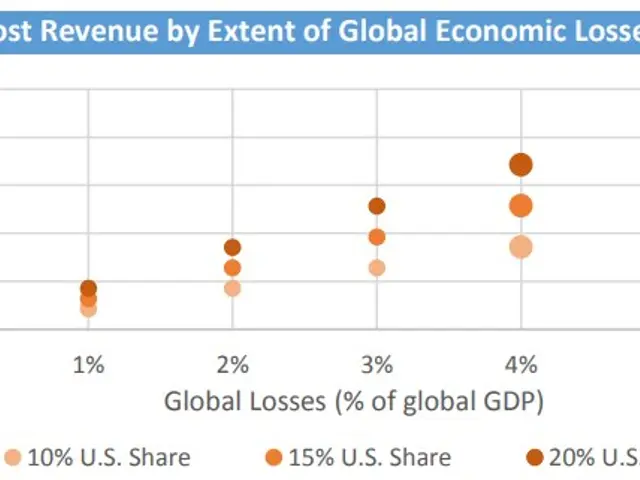

United Rentals, Inc. (URI), one of the world’s largest equipment rental companies, has faced a challenging few months. The company’s stock has dropped 21.7% from its 52-week high of $1,021.47, despite reporting stronger-than-expected revenue in its latest quarterly results. Investors have reacted to mixed financial news, leaving shares under pressure compared to both industry peers and broader market trends.

URI operates globally, offering construction and industrial equipment, trench safety, power and HVAC systems, fluid solutions, and modular storage. Beyond rentals, the company sells new and used machinery while providing repair and maintenance services. Its operations span the United States, Canada, Europe, Australia, and New Zealand.

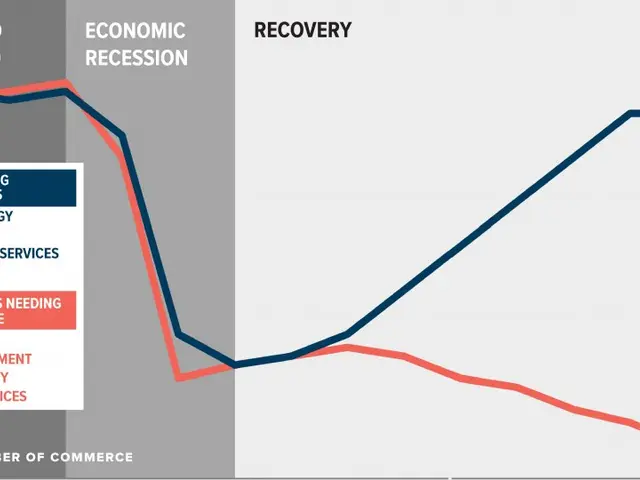

URI’s stock has lost ground against both its 52-week peak and industry benchmarks. The company’s mixed quarterly news and weaker momentum compared to peers have weighed on investor confidence. Despite its global reach and diverse services, the business must now address its underperformance to regain market strength.