Undermine client loyalty with subpar final-leg delivery encounters

A recent survey has highlighted the significance of a great last-mile delivery experience for retailers, with better brand loyalty, competitive advantage, and increased revenue being key benefits attributed to it.

The survey revealed that an overwhelming majority (92%) of retail supply chain and logistics executives consider the choice of last-mile delivery solution to be very or extremely influential to their ability to provide a high-quality last-mile delivery experience. This is because networks with high on-time delivery rates, low damage rates, and other features of a great delivery experience invest in the people, processes, and systems that ensure performance is well above the dismal median KPIs.

A great last-mile delivery experience can drive a large repeat purchase behavior. Retailers also place significant value on a given company's loss rates during last-mile deliveries, with 49% considering it to be important. The biggest benefit of providing a great last-mile delivery experience, according to survey respondents, is increased revenue (43%). Higher customer satisfaction/retention (41%) is closely followed by this benefit.

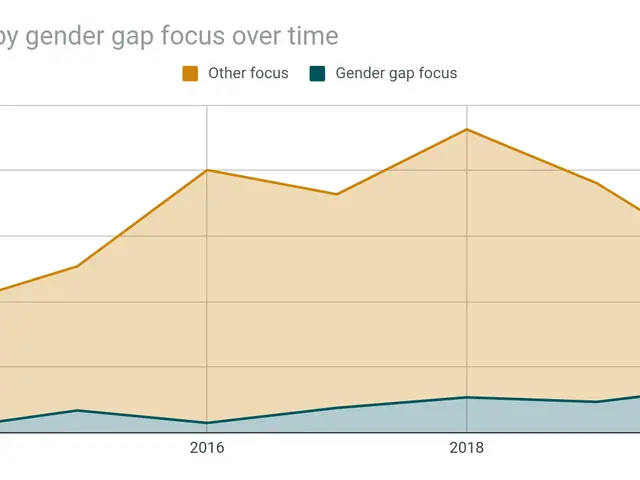

The survey also found significant gaps between the delivery metrics that retailers believe they should expect from these non-traditional last-mile delivery options and what they're actually getting. For instance, the median on-time delivery rate expected by respondents for their solutions is 93.5%, but they're actually getting a median of 80% for same-day delivery and 76% for 1-2-day delivery. Similarly, the median damage rate expected is 5.8%, but they're actually getting a median - and shockingly high - 34% for same-day and 29% for one- to two-day delivery from their most-used, non-traditional last-mile solution.

The poor performance from on-demand solutions for last-mile deliveries is putting retailers' hard-won brand reputations at risk. One particular widely used non-traditional parcel carrier seems to be pulling down the performance averages, offering traditionally tipped services like food delivery that tend to get favored by drivers over non-tipped, non-food item deliveries.

However, there are alternatives that keep costs low while being a lot more efficient and driver-friendly. For example, Fleetlery is often used in non-traditional last-mile delivery, offering flexible and scalable solutions with a high number of deliveries (e.g., 100,000 per week) and a short average delivery time of 27.8 minutes. Other major players like DHL are renowned for their logistical capabilities, though specific on-time delivery rates and damage rates are not detailed in the available information.

When looking behind the curtain, there are clear differences among last-mile solutions in things such as real-time visibility, picture proof of delivery, special services, scalability, service area, customer support, and the ability to handle big & bulky goods. Understanding how a potential delivery partner does business and how well they perform on KPIs is essential to providing the last-mile experience that customers demand.

Retailers are increasingly adding non-traditional, regional, and on-demand options for last-mile deliveries. Retailers also place great value on a given company's on-time delivery rates, with 67% considering it to be important. Survey respondents also attribute higher sales to the provision of a great last-mile delivery experience (37%).

In conclusion, the last-mile delivery represents the final opportunity to win or lose customer loyalty and repeat purchases. With the right partner, retailers can ensure they are providing the high-quality last-mile delivery experience that their customers demand, leading to increased revenue, higher customer satisfaction, and improved brand reputation.