UK pension reforms and shifting interest rates complicate retirement choices

Choosing the right retirement income has become more complex as UK interest rates shift and reforms approach. From April 2023, the government plans changes to pension options, leaving many unsure of the best path. With only 45% of over-55s understanding their choices, mistakes like poor annuity purchases or early withdrawals could have lasting effects.

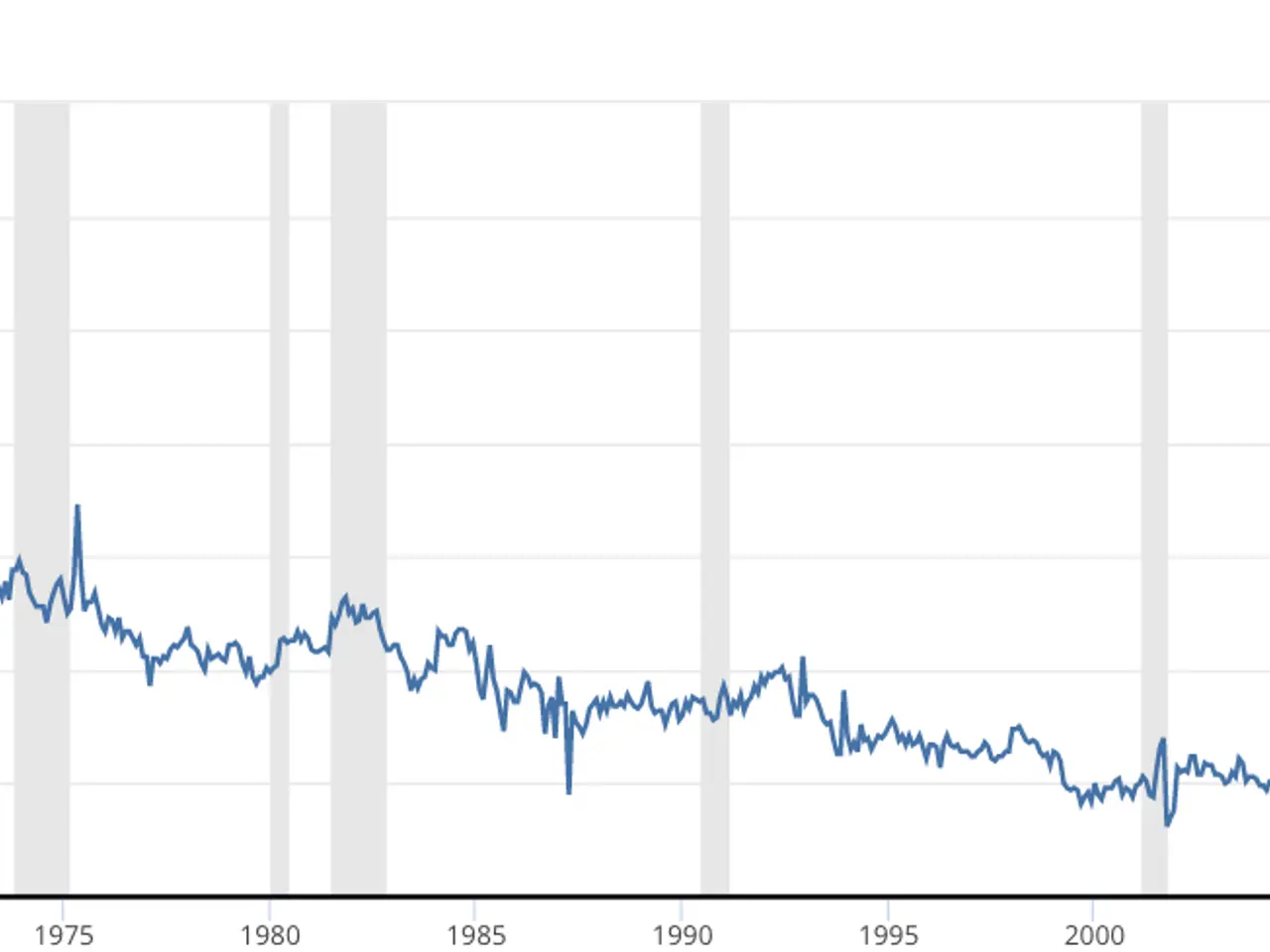

Over the past five years, annuity rates have changed significantly. Inflation-linked annuities, often tied to the Retail Prices Index (RPI), dropped from around 1.5–2.0% in early 2021 to just 0.5–1.0% by early 2026. This decline came as long-term gilt yields fell and inflation expectations eased. Meanwhile, fixed annuity rates fell even more sharply, from 4–5% to 2–3%, making inflation-linked options relatively more attractive in real terms.

At retirement, savers must turn their pension funds into a steady income to replace their salary. The best approach depends on the type of pensions held, personal savings, and how much risk they can handle. Without proper guidance, some may lock into unsuitable annuities or withdraw too much too soon, risking financial security later in life.

Free support is available through Pension Wise, a government-backed service. Before making decisions, experts suggest asking key questions: How much guaranteed income will I receive? Can I manage my own pension investments? Will my income keep up with inflation? How can I provide for my family if I die? And how do I avoid overpaying tax?

The upcoming reforms and shifting interest rates mean retirees must carefully weigh their options. Those who seek advice and ask the right questions can avoid costly errors. With the right choices, pension savings can provide stable income while protecting against inflation and unexpected tax burdens.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting