U.S. Treasury repurchases $785M in debt to curb rising borrowing costs

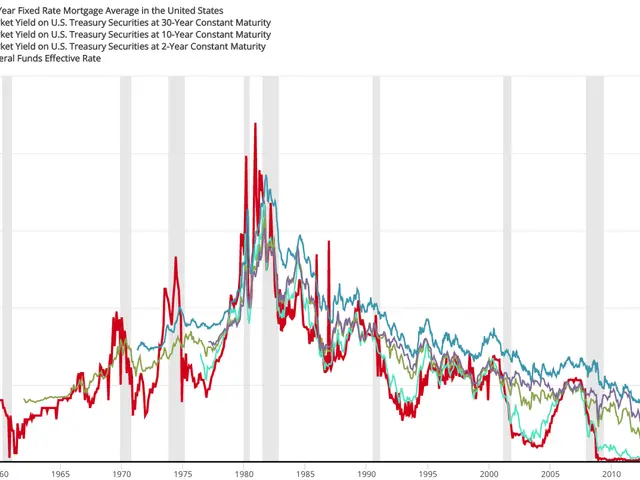

The U.S. Treasury has repurchased $785 million in government debt to ease financial pressure. This move comes as rising inflation and higher interest rates have made borrowing more costly. Officials aim to stabilise debt levels while ensuring the economy remains on track.

The buyback allows the Treasury to pay investors for returning bonds before their maturity date. By doing so, the total debt burden shrinks, and interest payments may drop. Investors see this as a signal of confidence in the government’s ability to manage its finances.

Higher revenues than expected gave the Treasury room to reduce some obligations. The $785 million repurchase is only a small part of the national debt, but further buybacks could follow. These operations help manage government spending amid ongoing debates over the debt ceiling.

The Treasury’s strategy focuses on cutting interest costs and maintaining financial stability. While debt buybacks offer investors quick liquidity and potential gains, they can also push interest rates up. Balancing these effects remains a key challenge for policymakers.

The $785 million buyback reflects an effort to control rising debt and borrowing costs. By reducing obligations now, the Treasury aims to avoid future financial strain. The operation ensures continued government funding while preventing a default.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting