U.S. stock markets may be nearing a generational peak—should investors worry?

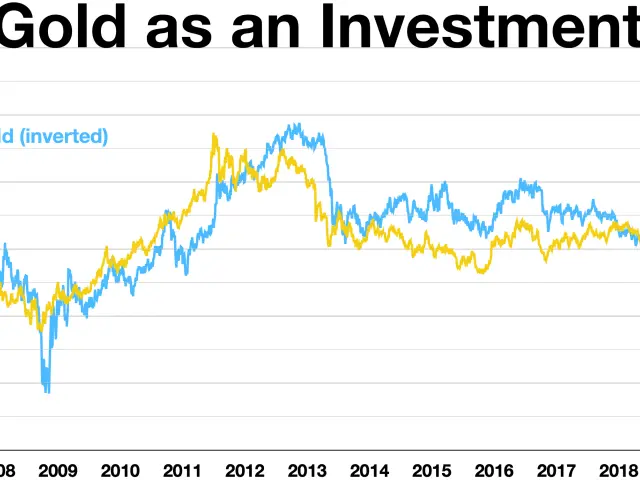

U.S. stock markets are showing signs of extreme valuations, with some analysts warning of a potential generational peak. The Wilshire 5000 index has surged past a key ratio, reaching levels last seen before the dotcom crash. Yet despite concerns, investors remain fully committed, with cash reserves at historic lows.

The ratio of the Wilshire 5000 to the total M2 money supply has climbed above 3—a threshold not crossed since the late 1990s. This metric previously peaked just before the dotcom bubble burst in 2000. While the exact historical ratio from that period remains unclear, the current level has raised alarms.

Investors, however, are not relying on excessive borrowing to fuel gains. Leverage remains modest, which some see as a stabilising factor. Future market growth could still come from increased margin debt, productivity breakthroughs, or further monetary expansion.

One contrarian analyst, known for questioning mainstream views, has suggested this could mark a generational high for U.S. equities. Yet they stop short of predicting a catastrophic crash. Instead, they urge investors to stay disciplined, maintain diversified portfolios, and rebalance regularly. The same analyst has previously criticised Warren Buffett's moves and labelled AI a speculative bubble.

Despite a self-admitted tendency to expect the worst, they remain invested for the long term. Their advice? Keep calm and carry on.

With cash holdings depleted and valuations stretched, the market's next moves will depend on borrowing trends, economic productivity, or policy shifts. The author's cautious but steady approach highlights the value of diversification and patience. For now, the focus remains on weathering uncertainty without drastic action.