Trump's 'Big Beautiful Bill' risks widening inequality and cutting healthcare access

President Donald Trump's 'Big Beautiful Bill' has sparked debate over its economic impact. Critics warn the legislation could widen inequality and strain federal finances. Yet no official response from the Trump administration or its supporters has addressed these concerns directly.

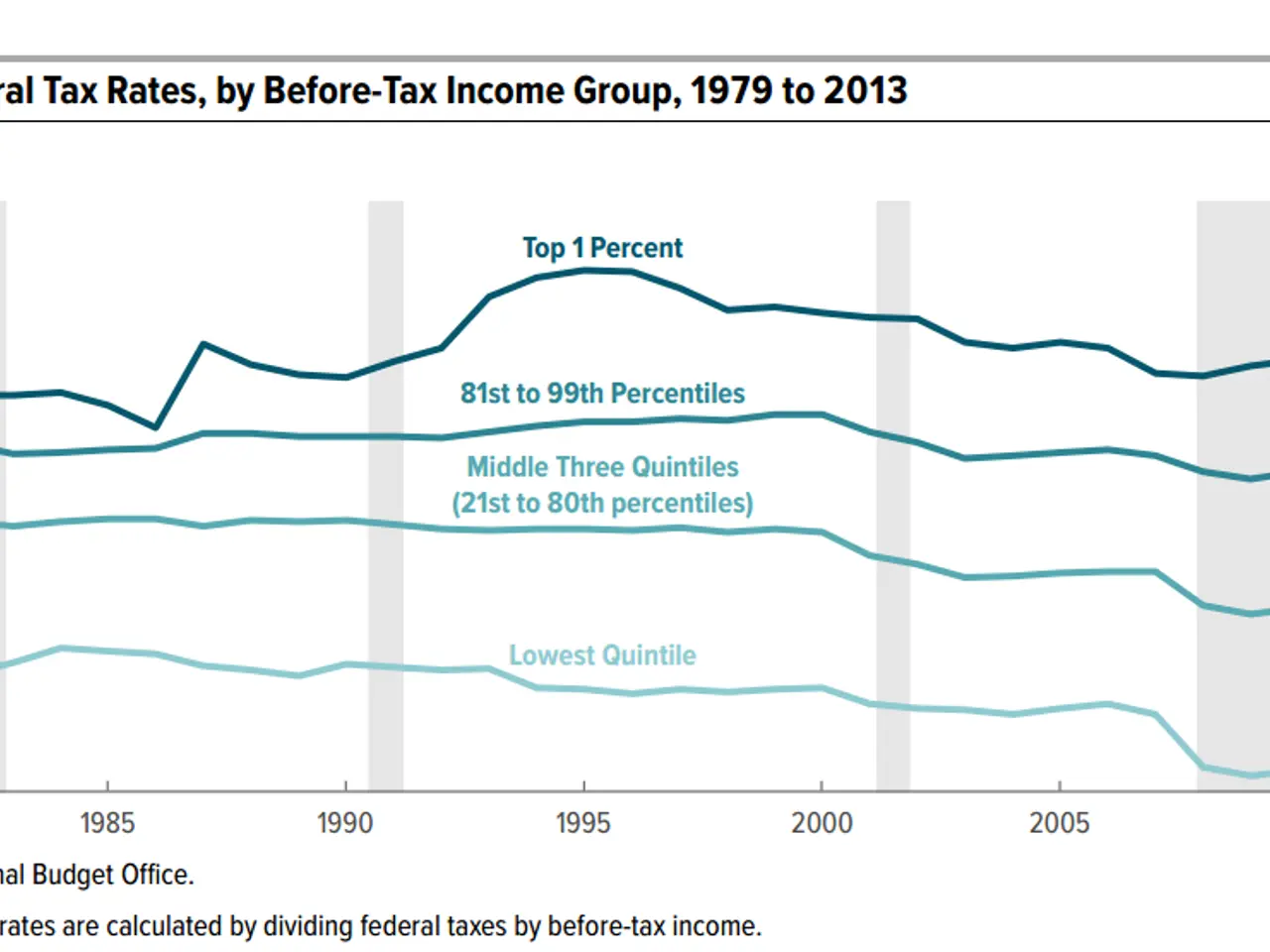

The bill introduces major tax cuts, particularly for the wealthiest Americans. Analysts argue these reductions will disproportionately favour high earners while leaving many middle- and low-income households behind.

Independent projections suggest the measures, if made permanent, could expand the fiscal gap by 76%. Over the next ten years, the federal deficit may rise by $3.4 trillion as a result. The Center for American Progress has urged Congress to tackle this growing shortfall before it deepens.

Healthcare coverage could also suffer. Estimates indicate the bill might leave 10 million people without unitedhealthcare. Despite these warnings, neither the White House nor Trump's allies have publicly rebutted the criticism or outlined counterarguments.

The legislation's long-term effects remain uncertain, but forecasts point to higher deficits and reduced healthcare access. Without adjustments, the fiscal and social consequences could stretch well beyond the coming decade. No official plan to mitigate these risks has yet been proposed.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting