Top 15 Profitable Investment Assets for Safeguarding Wealth: Strategies for a Secure Financial Future

In pursuit of financial freedom, a diversified portfolio of income-generating assets is crucial. This mix typically includes stocks, bonds, real estate, and alternative investments, each contributing different income sources and risk profiles to build a portfolio that supports long-term success. Here's a breakdown of the top 15 assets and how they contribute to diversification and financial outcomes.

Dividend-Paying Stocks and Dividend ETFs

These investments provide regular cash dividends and potential capital appreciation. Dividend Aristocrat ETFs offer steady, resilient income often outperforming during recessions, making them a core component for income and growth 1, 2.

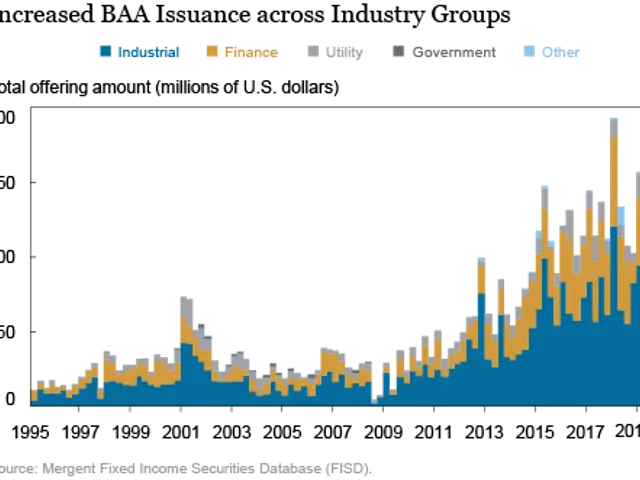

Bonds (Government, Corporate, and Municipal)

Offering fixed interest payouts with varying risk levels, government bonds are the safest, corporate bonds yield higher returns, and municipal bonds may have tax advantages. Bonds reduce portfolio volatility and supply dependable income 1, 2.

Real Estate (Rental Properties)

Generating rental income and potential property value appreciation, real estate provides inflation protection and diversification beyond stocks and bonds but requires capital and management effort 1, 5.

Real Estate Investment Trusts (REITs)

Liquid real estate exposure without property management hassles, REITs pay high dividends from commercial and residential real estate income, historically returning ~11.8% annually, slightly beating the S&P 500 3, 5.

Peer-to-Peer Lending (P2P Lending)

Passive interest income by lending directly to individuals or small businesses through online platforms, offering higher yields but with increased borrower risk compared to traditional fixed income 1, 5.

High-Yield Savings Accounts

Low-risk, liquid accounts with better interest than conventional savings, useful for emergency funds and short-term income with capital preservation 4.

Certificates of Deposit (CDs)

Time-bound deposits paying fixed interest, providing stable but lower returns than stocks or real estate, suited for risk-averse investors needing predictable income.

Covered Call Writing on Stocks

Generates additional income by selling call options on owned stocks, combining dividends with premiums, enhancing total returns in sideways markets.

Business Ownership or Royalties

Income from owning a business or intellectual property rights (e.g., books, patents, franchises) can provide steady cash flow though it may involve active management or upfront labor.

Annuities

Insurance contracts that guarantee regular payments for life or a period, offering stable income especially beneficial for retirees.

Master Limited Partnerships (MLPs)

Typically energy-sector partnerships paying high yields and tax-advantaged income visible in diversified portfolios.

Funds Investing in Infrastructure or Utilities

These sectors often pay reliable dividends due to regulated and steady cash flows.

Vending Machines or Other Small-Scale Businesses

Low-entry passive income streams requiring some management or automation.

Rental Income from Parking Spaces or Storage Units

Smaller scale real estate options providing diversification and passive cash flow.

Digital Assets or Online Content (e.g., subscription services, courses)

Create ongoing income after initial content or infrastructure development.

Contribution to Diversification and Financial Success:

- Income Stability: Combining fixed-income (bonds, CDs), dividend stocks, and real estate spreads risk across asset classes, mitigating reliance on any one income type.

- Growth Potential: Assets like dividend stocks, REITs, and businesses provide growth alongside income, helping shield inflation and increase wealth.

- Risk Management: Diverse assets vary by liquidity, volatility, and risk level—government bonds and savings accounts provide safety, stocks and real estate offer higher returns with moderate risk, P2P lending and businesses pose higher risk with potentially higher income.

- Inflation Hedge: Real estate and certain equities can offer protection against inflation eroding purchasing power.

- Tax Efficiency: Municipal bonds, REITs, and certain business income may offer tax advantages, optimizing after-tax returns.

In sum, balancing these 15 assets according to risk tolerance and financial goals creates a robust income-generating portfolio that drives financial freedom by producing multiple steady cash flows while managing volatility and capital growth 1, 2, 3, 4, 5.

By engaging in comprehensive research, evaluating risk tolerance, and seeking expert guidance, investors can effectively diversify their portfolios to secure a stable financial future.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Crafting a Profitable Business Strategy for a Digital Beginning: Established Procedures for Triumph

- Rapid Expansion Projected for Big Data Security Sector at a Rate of 25.6%

- Tariffs increase pause extended by US and China for 90 days