Today's Cryptocurrency Overview: Notable Digital Coins Valued on June 5th

Here's the Fresh, Original Version:

Crypto Life's a Rollercoaster: Today's Prices

Bitcoin (BTC) is currently at an eye-popping US$104,925.35 (around ARS $124,966,094) as of June 5, according to digital wallet Lemon. This price represents a 0.98% daily increase and a more impressive 3.42% week-on-week boost. The current market cap for this digital gold is a mind-boggling US$2,083,562,218,527.

Ethereum (ETH), Bitcoin's closest competitor, is currently worth US$2,608.68 (approximately ARS $3,106,934). Its value has jumped by 1.29% over the past day.

Among the top altcoins, BNB, Binance's token, is trading at US$669.05 (around ARS $796,840). Cardano (ADA) stands at US$0.68 (around ARS $811), and Solana (SOL) is at US$153.07 (approximately ARS $182,304). The changes in the last 24 hours were 0.44%, 2.84%, and 2.97% respectively for these digital assets.

The total market cap of all cryptocurrencies is staggeringly high at US$3,291,082,607,668, up by 1.23% from yesterday. The volume traded in the last 24 hours totals US$72,012,791,235.

Here are the prices for the ten top-performing cryptocurrencies:

• Avalanche (AVAX): US$20.18 (around ARS $24,035)

• BNB (BNB): US$669.05 (around ARS $796,840)

• Cardano (ADA): US$0.68 (around ARS $811)

• Solana (SOL): US$153.07 (approximately ARS $182,304)

• Ripple (XRP): US$2.21 (around ARS $2,626)

• Polkadot (DOT): US$4.02 (around ARS $4,783)

• TRON (TRX): US$0.27 (around ARS $325)

• Litecoin (LTC): US$87.74 (around ARS $104,501)

• Chainlink (LINK): US$13.75 (around ARS $16,378)

• NEAR Protocol (NEAR): US$2.46 (around ARS $2,926)

What Are They Even?

Cryptocurrencies are digital assets that use encryption to secure transactions between users. They've made some serious strides in popularity, with Bitcoin, the king of the market, first appearing in 2009. It has a maximum emission of 21 million units, which is mathematically and statistically predefined. Every four years, the emission is cut in half, allowing for predictable future monetary emission until the last coin is mined in 2140. Altcoins, the also-rans to Bitcoin, are other cryptocurrencies and stablecoins, which try to maintain their value based on another asset like a currency (usually the US dollar) or a commodity, like Tether (USDT) and Coinbase's USDC.

Brace Yourself for a Bumpy Ride!

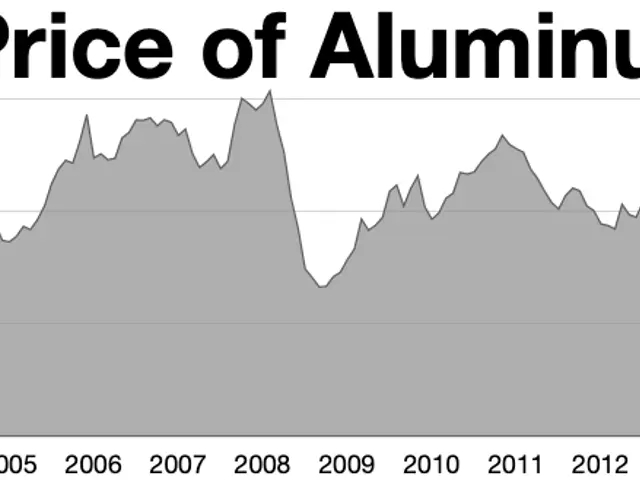

The volatile and unpredictable nature of the crypto world is partly due to a lack of regulation, as these digital assets are not governed by any particular authority. However, the interplay of several crucial factors shapes the crypto landscape:

- Investor sentiment and psychology - news, rumors, and endorsements drive market movements.

- Supply and demand - changes in either dictate prices.

- Geopolitical and global economic factors - instability and significant events influence market behavior.

- Market size and liquidity - the smaller size and lower liquidity make cryptocurrencies more volatile.

- Long-term holder behavior - substantial sales by long-term holders can lead to increased volatility.

- Technological developments and adoption - advancements can positively impact prices, while security concerns or technological failures can cause price drops.

In a nutshell, the crypto world is far from predictable, and investing involves a high degree of risk!

The Cryptocurrency Winter: Unpredictable Cold Snaps

The crypto market is in the midst of a bitter winter, with economic crises, record-high inflation rates, and war between Russia and Ukraine creating uncertainty. The rapid decline in crypto values followed a historic five-year run during which Bitcoin rose from US$1,000 to US$68,000.

BBC journalist Cecilia Barría, in her report "Crypto Winter: Keys to Understanding the Global Fall of Cryptocurrencies," explains that the market drop was the result of a "pretty basic rule" – when more people want to buy, prices go up, and when no one's interested, prices plummet. However, cryptocurrencies are not like traditional stocks; they're digital money unregulated by any authorities and not tied to banks or apex institutions. As a result, cryptocurrency movements are frenetic, unaffected by traditional control mechanisms.

The term "crypto winter" or "crypto crash" was first coined during the market crash that occurred just before the last boom, when Bitcoin hit US$69,000 in November 2021.

- In light of the news about the ongoing crypto winter, investors in the finance sector should be cautious about their crypto-investing strategies, considering the unpredictable market movements and the risk associated with the digital currency.

- Given the increase in the prices of leading cryptocurrencies such as Bitcoin and Ethereum, it is crucial for financially interested individuals to keep a close eye on the latest crypto-finance news, as it could impact their investing decisions in the rapidly evolving world of digital currencies.