Title: The 2025 Social Security Cost-of-Living Adjustment: Is It Enough for Retirees? Strategies for a Thriving Golden Years

To keep benefits in line with inflation, the Social Security Administration typically makes a cost-of-living adjustment (COLA) each year. In 2025, they announced a 2.5% COLA, which has garnered mixed reactions from retirees. A survey of 2,000 retirees revealed that 54% found this year's increase insufficient, with 30% considering it completely inadequate and 24% somewhat dissatisfied.

Despite higher future COLAs, managing retirement expenditures can be challenging. However, taking proactive steps can minimize your reliance on Social Security benefits and secure wealth in your golden years.

1. Craft a Personal Budget and Adhere to It

Establishing a workable budget and sticking to it is the cornerstone of your financial growth. Monitor discretionary spending to maintain a comfortable retirement and limit your exposure to inflation in other areas. Regularly assessing your budget and savings can help you avoid lifestyle inflation.

2. Frequent Investments

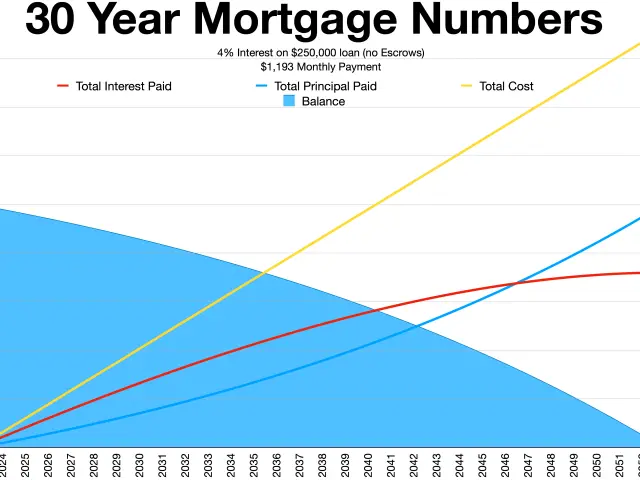

After having an emergency fund and defining a budget, invest the remaining money systematically. Preferably, invest in low-risk alternatives that generate income over time. Though volatile markets can be risky, maintaining a regular investment schedule can convert periods of uncertainty into opportunities.

3. Maintain a Diversified Portfolio of High-Quality Assets (Investment Insight)

A long-term investment strategy focusing on high-quality assets amplifies returns and mitigates risk. Factors to consider include diversifying retirement savings, adopting intelligent risk management, and embracing active, risk-managed funds.

Investing in diversified funds that have risk management mechanisms and hedging strategies can provide protection against market downturns. Additionally, seek out funds with a track record of strong performance and a focus on resilience across market conditions.

By implementing these strategies, retirees can minimize their reliance on Social Security benefits, secure a comfortable retirement, and prepare for an extended golden age.

To make your retirement savings last, it's essential to continually review and adjust your investment portfolio. Opt for funds with strong performance and risk management strategies that can help protect your assets during market instability.

Moreover, understanding the role of finance in your retirement years is crucial. Ensure you have a portion of your savings in reliable income-generating investments, such as bonds or dividend-paying stocks, to supplement your Social Security benefits and cushion against inflation.