Title: Expiration of Affordable Care Act Tax Credits: An Unaddressed Issue by Congress

The current enrollment period for health insurance via the Affordable Care Act (ACA) Marketplace is ongoing, ending on January 15, 2025. This period provides an opportunity for individuals looking to acquire or alter their health coverage. While premium tax credits through the ACA have aided numerous Americans and small business owners in obtaining coverage, their existence beyond 2025 relies on Congress' prompt action.

Until now, the ACA has significantly transformed the health insurance landscape for small businesses and their employees. Prior to its implementation, options for affordable coverage were scarce, particularly for small businesses and their employees who often found themselves with limited or high-priced options. The ACA addressed this issue through key provisions such as creating marketplaces where individuals could effortlessly compare and acquire affordable coverage, prohibiting insurance companies from denying or charging higher premiums based on pre-existing conditions, and expanding Medicaid for self-employed workers with incomes up to 138% of the poverty level in states adopting expansion.

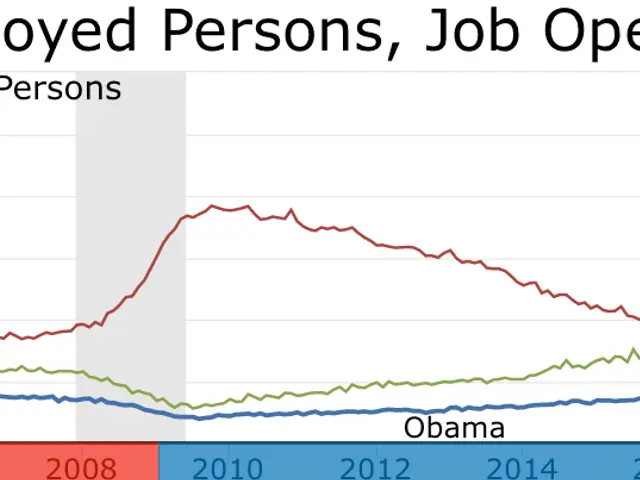

Since its implementation, the uninsured rate for small businesses with fewer than 100 employees has notably decreased. In 2013, the rate was a substantial 25.2%, but by 2022, it had fallen to a record low of 16.3% due in part to the ACA's Advanced Premium Tax Credits, which help lower monthly premium payments. The American Rescue Plan and the Inflation Reduction Act further expanded these tax credits, making them accessible to individuals and families with moderate incomes facing high premiums. In 2022, around 2.7 million small business owners and self-employed individuals claimed these Advanced Premium Tax Credits.

However, these extended tax credits are set to expire at the end of 2025, unless Congress acts to extend or make them permanent. The consequences of their expiration could be significant. Many ACA Marketplace enrollees might see a substantial increase in their premium payments. For instance, quotes from Healthcare.gov indicate that these premiums could at least double for eligible enrollees in 12 states.

Such changes could negatively impact the ACA Marketplace overall. For instance, the nonprofit Congressional Budget Office (CBO) predicts that without an extension, the number of uninsured individuals will increase by 2.2 million in 2026, and by 3.8 million on average annually from 2026 to 2034. Additionally, the CBO estimates that premiums for most enrollees will increase by 4.3% in 2026, and by 7.9% over the 2026-2034 period on average.

Promoting a stronger economy involves providing healthcare access to small businesses and their employees. The incoming Congress should not jeopardize this progress by allowing the enhanced tax credits to expire beyond 2025 or better yet, make them permanent to ensure continued healthcare affordability for numerous American families.

- To maintain the affordability of health insurance for many Americans and small business owners, it's crucial for Congress to act promptly and extend the existence of tax credits beyond 2025, as per the provisions of the Affordable Care Act.

- The Congressional Budget Office (CBO) has predicted that without an extension of the advanced premium tax credits, there could be a significant increase in the number of uninsured individuals, reaching 2.2 million in 2026, and 3.8 million annually on average from 2026 to 2034.

- During the current open enrollment period for health insurance via the ACA Marketplace, which ends on January 15, 2025, individuals needing to acquire or modify their healthcare coverage should utilize the available tax credits through healthcare.gov to ensure they can afford their premiums, as these credits may expire at the end of 2025.