Three Outstanding S&P 500 Dividend Shares Experiencing Declines of 36% to 64%, Offering Potential Permanent Investment Opportunities

Looking for some undervalued investment opportunities? Look no further than these three stocks within the S&P 500 index.

Ford Motor Company

automobile industry is undergoing multiple sea changes that don't favor Detroit's iconic names, like

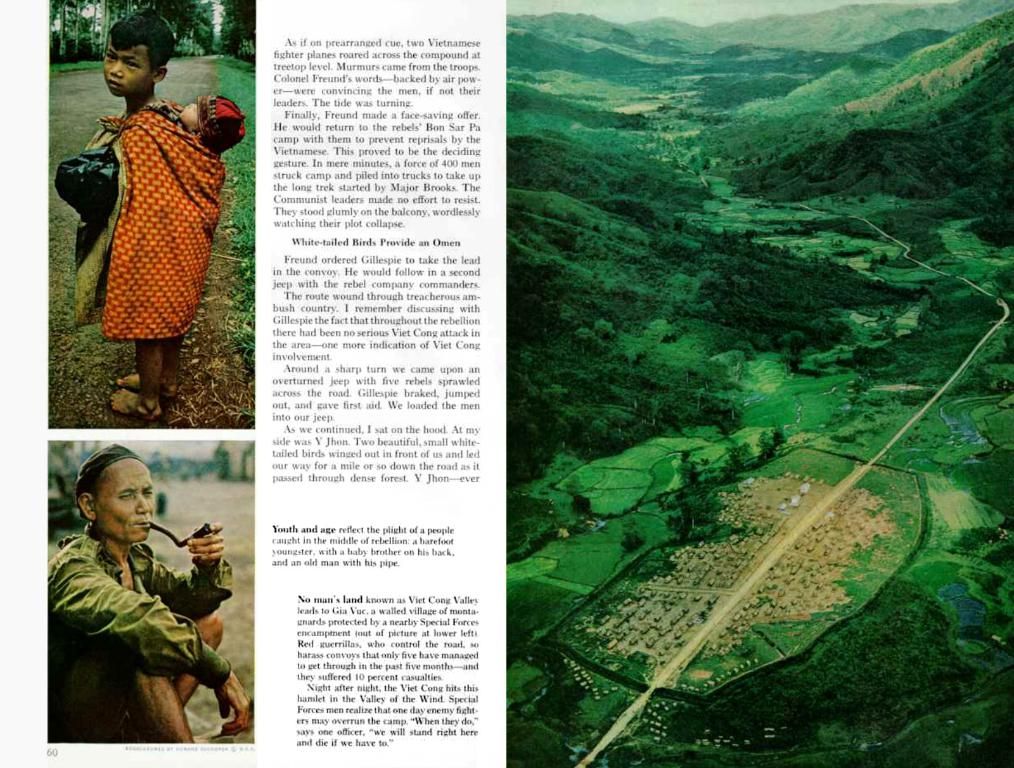

First up, we have Ford Motor Company (F). The auto industry is experiencing a significant transformation, with cars lasting longer and fewer people getting driver's licenses. This, combined with growing competition in the electric vehicle (EV) market, has put a dent in Ford's profits. However, let's not forget about the income potential this iconic name offers.

F

With a forward-looking dividend yield of 6.5%, and a price-to-earnings (P/E) ratio of 5.5 based on projected earnings, Ford presents a value opportunity worth considering. Plus, you'll be contributing to shareholder rewards through occasional special dividend bonuses, even if these aren't something you can rely on for regular income.

MRK

Merck

pharmaceutical stock's now down 36% from last March's peak, with most of this weakness coming after last September in response to a couple of rounds of disappointing quarters. Its diabetes treatments Januvia and Janumet are now facing stiff price competition, while its HPV vaccine Gardasil is running into headwinds in China.

Next, let's dive into Merck (MRK). Merck has had its fair share of downs lately, with a 36% decline from its 2023 high. Although its popular diabetes treatments and HPV vaccine are facing challenges, there's still massive upside potential in Merck's cancer-fighting drug, Keytruda.

losing sight of the remaining potential of its flagship cancer-fighting drug, Keytruda.

Keytruda's performance is nothing short of remarkable, accounting for 46% of the drugmaker's revenue in 2024. And analysts are predicting Keytruda's annual sales to surpass $33 billion by 2027.

AES

Venturing into Merck stock means diving into a dividend-paying stock with a forward-looking divide yield of 3.9%. Merck's history of developing and acquiring new blockbuster drugs is also reassuring. With Keytruda remains at the forefront, newcomers will add to its ever-growing roll.

utility companies that would rather purchase it than produce it themselves. The company is expected to do $13 billion worth of business this year, capitalizing on this relatively new norm for the grid-equipped industry.

AES Corporation

renewables such as solar and wind and even clean-energy alternatives like nuclear power. These environmentally friendly options are catching on. They're neither quick nor cheap to put in place, however, and AES was arguably too aggressive with its efforts to make this transition to renewables, taking on too much debt, beginning in 2022 when shares began their long-lived tumble.

Last up, we have the AES Corporation (AES). As a utility-scale power wholesaler, AES sells electricity to utility companies that would instead produce it themselves. Thanks to the industry's shift from traditional power sources to renewables, AES has an exceptional business opportunity and is expected to reach $13 billion worth of business in 2025.

However, the path to success isn't without challenges. Renewables aren't quick or inexpensive to implement, and AES has invested heavily in the transition, accumulating debt along the way. But this burdensome debt shouldn't scare away potential investors. The industry research outfit Precedence Research expects the renewable energy market to grow at an annualized rate of more than 17% through 2034, with AES aiming to maintain its revenue growth pace until at least 2027.

AES Revenue (TTM) data by

With a dividend yield of 6.7%, AES stock presents a tantalizing income opportunity. Plus, the vast majority of analysts maintain a strong buy rating on this underdog stock. The consensus price target remains a hefty 60% above its current price, making AES an exciting potential addition to your portfolio.

YCharts

- If you're interested in exploring finance opportunities in the renewable energy sector, consider investing in AES Corporation (AES).

- To find the AES Corporation's stock price and revenue data, you can visit the YCharts website using the href link: https://ycharts.com/companies/AES/chart/.

- The AES Corporation's stock provides a forward-looking dividend yield of 6.7%, making it an attractive investment option for income-focused investors.

- In addition to its current dividend yield, many analysts maintain a strong buy rating on the AES Corporation stock, indicating its potential for further growth.