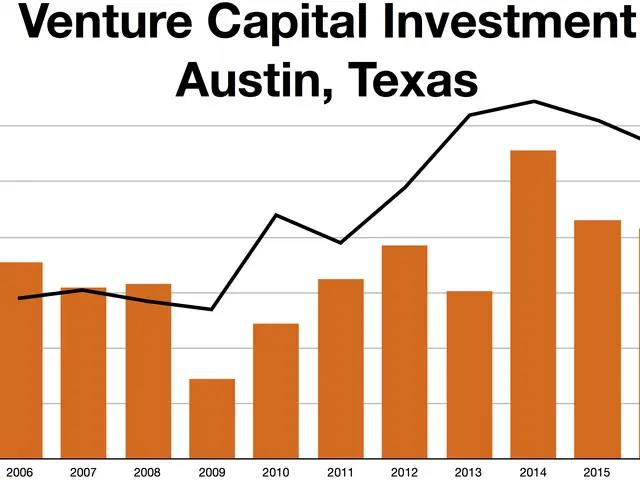

This is what the big rotation on the US stock market looks like

A shift in market trends has taken place since late 2025, with traditional industries now outperforming tech giants. Transportation, banking, and small businesses have surged, while once-dominant AI and tech stocks have stalled. The change signals a possible rebalancing in the U.S. economy as inflation eases and interest rate cuts loom.

For much of 2023 and 2024, tech firms—especially the so-called 'Magnificent Seven'—dominated stock market gains. Companies like Nvidia, Alphabet, and Microsoft delivered massive returns, with Alphabet climbing over 50% in 2025 and Nvidia rising more than 25%. Their high price-to-earnings (P/E) ratios, often above 30, reflected strong investor confidence in AI-driven growth.

But by November 2025, the trend reversed. Inflation dropped to 2.7% year-over-year, raising expectations of further interest rate cuts in 2026. As borrowing costs fell, sectors like transportation, banking, and small businesses began to thrive. FedEx, UPS, and airlines saw sharp gains, while financial firms and smaller companies—with P/E ratios between 10 and 15—became more attractive to investors.

The U.S. labour market has remained robust, with steady job growth in construction, healthcare, and other industries. The Federal Reserve Bank of Atlanta now forecasts economic expansion of over 3% for the third quarter of 2025. If this momentum continues, traditional industries could maintain their edge over tech in 2026.

The U.S. economy’s direction in 2026 will likely decide whether traditional sectors keep outperforming tech. Lower interest rates may benefit small businesses more than large tech firms, which have relied on high valuations. With inflation under control and job growth steady, the market’s focus has shifted from AI-driven growth to broader economic resilience.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now