TheAmount of Individuals Culling Their Retirement Funds to Reach or Exceed $1 Million Could Come as a Shock

Living the dream of a million-dollar retirement might be a common American fantasy, but the reality paints a starkly different picture. According to the U.S. Federal Reserve's 2022 Survey of Consumer Finances, released in 2025, a mere 2.5% of all Americans have $1 million or more saved in their retirement accounts. The figure drops to 3.2% among retirees.

This revelation might come as a shock to many, considering the financial media's portrayal of the average Joe amassing enormous portfolio gains.

Among the working population, only around 54.3% have retirement accounts, and just under 5% (4.7%) have crossed the $1 million threshold. However, if you consider all assets such as real estate and other savings, this figure rises to 18% of U.S. households.

When examining specific demographics, the gap between expectation and reality becomes even more apparent. For example, the median retirement savings for households with someone between 65 and 74 years old is a mere $200,000, dipping to $130,000 for those aged 75 and above.

Several factors contribute to this disparity. Income plays a significant role, with high-income households typically saving an average of $769,000 compared to $79,500 for middle-income households. Education also makes a substantial difference, with college graduates having over three times the retirement savings of those with only a high school diploma.

Homeownership significantly impacts retirement savings, with homeowners averaging over $303,000 in retirement accounts, more than 2.5 times that of renters. Despite these challenges, there's been remarkable growth at the top end. Fidelity Investments reports that the number of "401(k)" millionaires reached a record of about 497,000 Americans in 2024.

Starting early and contributing consistently over many years is the key to reaching these lengths. "I've seen clients start with six figures of debt and very little assets and eventually reach $500,000 (and more) of net financial wealth," David Tenerelli, a certified financial planner, told Investopedia. He added, "Living frugally, investing wisely, and optimizing for taxes are all important ingredients for anyone to accumulate financial wealth."

Despite the challenges, it's essential to start saving early, contribute consistently, and consider a million-dollar retirement account as a part of an exclusive club. With over half of Americans afraid they'll outlive their savings, the message is clear: diligent savings serve as a vital lifeline.

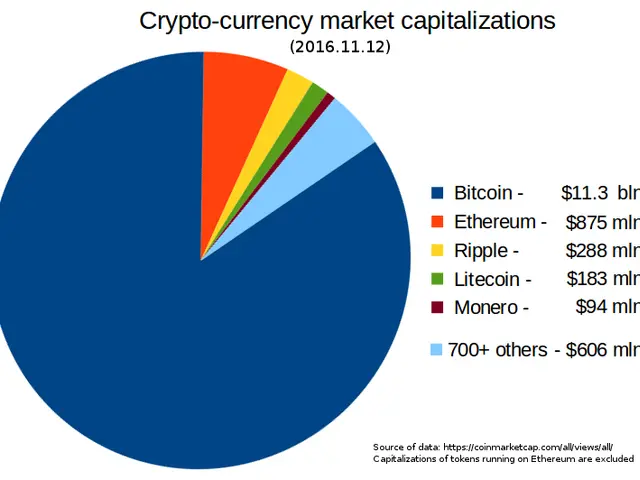

- To achieve a seven-figure retirement account, one might need to implement smart financial strategies, such as starting early, maintaining consistent contributions, and perhaps considering investments in sectors like mining or Initial Coin Offerings (ICO) to diversify one's personal-finance portfolio.

- With the rise of digital assets and investment opportunities, such as Bitcoin mining or investing in startup companies through ICOs, it's crucial to have a secure digital wallet to manage these assets, especially as one aims to amass a substantial retirement fund.