Gold in New York: The Unpredictable Donald Trump and Germany's Au Reserves

- Kilian Schroeder

- 3 Min

Questioning Germany's Gold Safety in New York: An Exploration of Its Protection Levels - The Security Measures Surrounding Germany's Gold Deposits in New York: An Examination

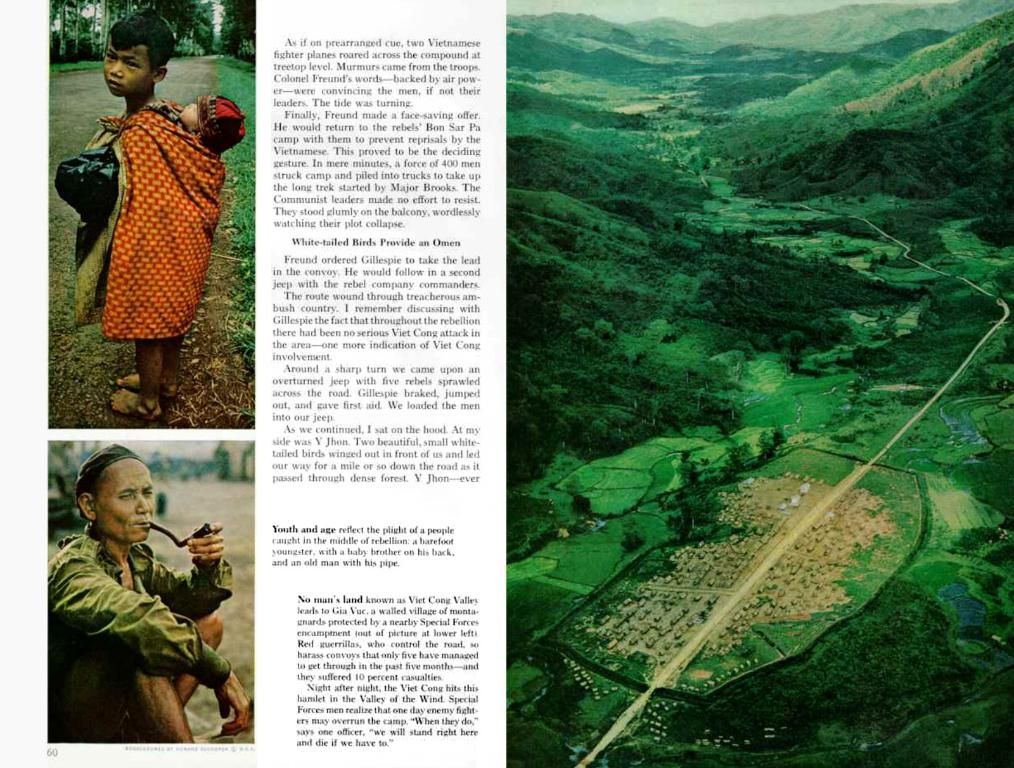

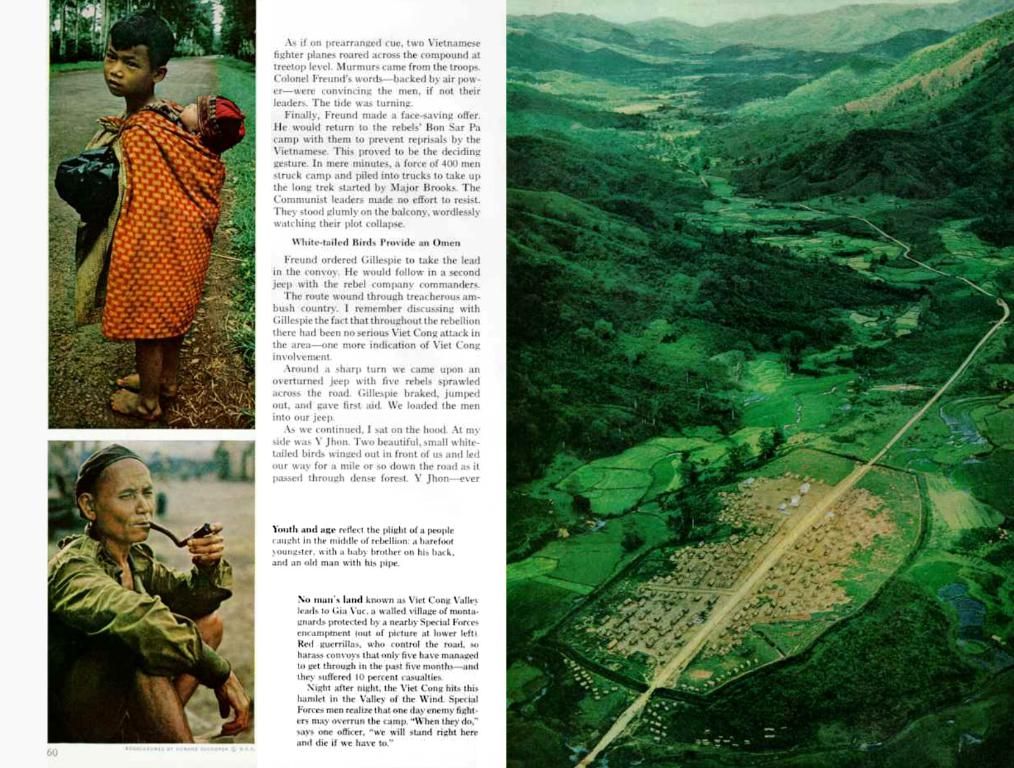

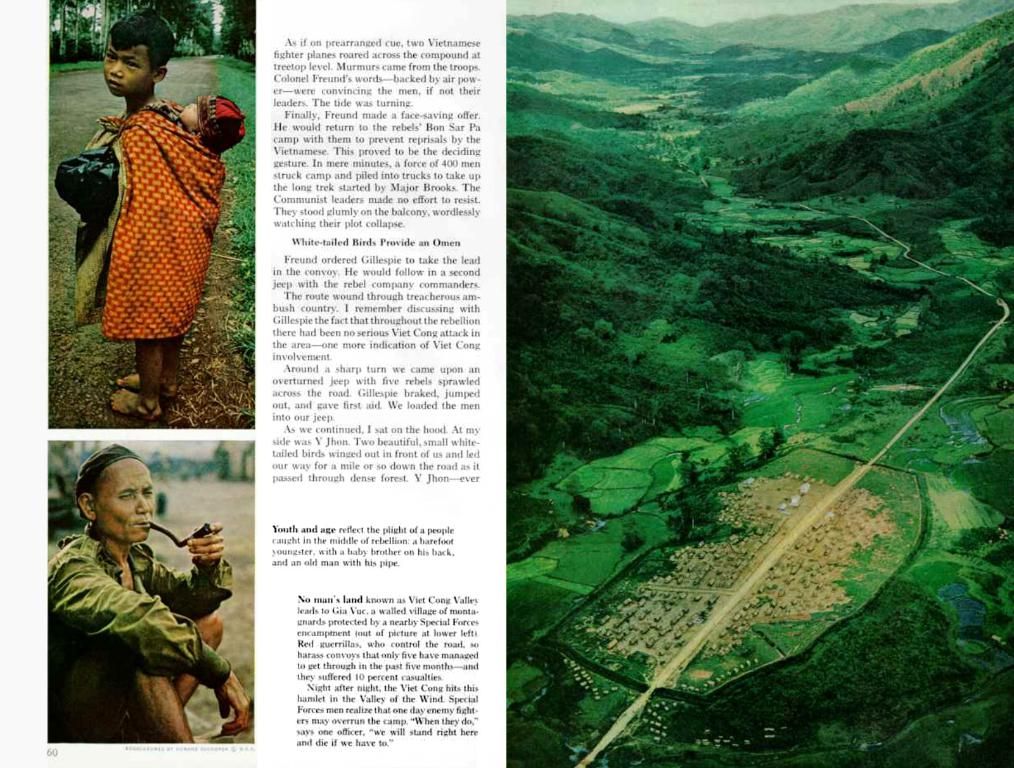

Beneath the streets of Manhattan, around 25 meters below ground, sleep gold bars - including German Bundesbank's gold bars. The Federal Reserve Bank of New York keeps the world's largest gold deposits in its vaults. With the unpredictableness of Donald Trump's administration, there is growing concern about the safety of Germany's gold stash in the Big Apple.

As doubts rise about the US Federal Reserve's independence under Trump, associations and union politicians demand German gold reserves be returned. Yet, some investors have been shifting gold across the globe, sometimes counter to the direction of this repatriation call.

The call for "Bring gold back home": Trump, your moves are unpredictable!

"Trump's actions can be somewhat unpredictable, and it wouldn't be out of the question for him to think of creative ways to deal with foreign assets, including gold reserves," European Parliament member Markus Ferber told Reuters recently. In this volatile geopolitical landscape, preserving gold reserves, Ferber argued, requires diversity. "It's never a wise idea to have all your gold in too few places," he added.

As early as the end of March, the president of the European Taxpayers' Association, Michael Jäger, advocated for gold repatriation. "Our demand: Bring our gold back home," Jäger stated to ZDF. The association supposedly sent letters to the Bundesbank and the Federal Ministry of Finance regarding this matter.

Germany yet keeps the world's second-largest gold reserves, totalling 3,352 tons after the US [1]. Around half of Germany's gold is stored in the German central bank's vault in Frankfurt, while 37% remains in the New York Fed's basement. The remaining 405 tons reside at the Bank of England in London. In contrast to the current setup, Germany had no gold reserves of its own after World War II. As the Federal Republic's current account surplus flourished, gold, initially, was used predominantly for foreign transactions. However, the gold delivered to the American central bank was merely moved from one vault to another, ending up at the Bundesbank's [2].

Bundesbank: Relax, your gold is safe where it is

The fear is that, with Trump's attacks on Federal Reserve Chairman Jerome Powell, the Fed's independence could be compromised. Thus, some worry that if Trump gained control of the Fed, he would also exert control over German gold reserves. However, the Bundesbank, in response to Capital's inquiry, stated that the location strategy for the gold reserves remains unchanged. They reassessed the concepts based on criteria such as security and liquidity to ensure the ability to liquidate or exchange gold for foreign currencies if needed [2].

Bundesbank President Joachim Nagel also expressed confidence in the American central bank during his annual press conference in February. "I've followed this discussion," Nagel said. "It doesn't keep me up at night." He added: "I have full trust in our colleagues at the American central bank."

Investors scramble for gold (and leave it)

It isn't only central banks that are experiencing Trump-driven gold-related anxieties. Owing to gold's reputation as a safe haven in troubling times, investors are increasingly stocking up on the precious metal, pushing precious metal prices to new records.

Typically, physical gold is traded in London. However, following Trump's election victory, investors began moving tons of gold to the warehouses of the New York exchange Comex, hoping to bypass import tariffs [3]. Gold stocks in New York supposedly doubled compared to October, resulting in higher gold prices and added pressure on banks to also transport gold to the US for sale at premium prices. Although stocks have since decreased since early April, they continue at elevated levels.

Yet, this trend appears to be turning. According to a report by US television station CNBC, wealthier Americans are moving their gold bars out of the country to protect their assets from uncertain political situations. The destination is generally Singapore, as it's perceived as politically stable and an essential transit hub [4].

Capital is a partner brand of stern. Selected content can be accessed with your stern subscription. Read more from Capital at www.stern.de/capital.

- "-Gold

- Donald Trump

- Federal Reserve System

- Gold reserve

Enrichment Data:Overall: There is a growing interest in repatriating Germany's gold reserves stored in the Federal Reserve Bank in New York amid concerns related to Donald Trump's administration. Germans hold approximately 1,200 tons of gold—one-third of their total reserves, which amount to 3,352 tons [1]—in the Fed, a legacy arrangement dating back to Cold War [6]. Dissenters argue that a hostile US president with control over the Federal Reserve could pose a threat to Germany’s gold reserves [2]. Understanding this complex situation requires a balanced analysis considering geopolitical factors and the strategic importance of these gold reserves.

Key Developments:

- Geopolitical Impact: The current political climate, with uncertainties surrounding Donald Trump's administration, has engendered fears about the safety of Germany's gold overseas [3].

- History: The practice of storing gold in the New York Fed stems from Cold War-era arrangements [2][7].

- Opposition Perspective: Opponents of this arrangement argue that Germany's dependence on the US to safeguard its gold reserves is no longer a viable option, particularly given Donald Trump's penchant for unpredictable policies and hostile interactions with foreign leaders [2][3].

- Support for Repatriation: Several political figures have backed the call for repatriation, including members of the European Parliament and the Christian Democrats [2][3].

- Bundesbank's Role: The Bundesbank has traditionally maintained that it trusts the New York Fed to keep its gold reserves secure [3].

- Market Dynamics: Changes in the gold market, driven by investor behavior, can lead to fluctuations in gold prices and impact demand for storage facilities globally [3].

- The growing interest in repatriating Germany's gold reserves from the Federal Reserve Bank in New York is rooted in concerns about the unpredictability of Donald Trump's administration and its potential impact on the Federal Reserve System.

- as a result, some investors are shifting their gold holdings out of the United States and into politically stable jurisdictions such as Singapore.