The Potential Impact of a Small Bitcoin Investment on Your Wealth Portfolio

Looking back, if we had the chance to time-travel and build our portfolios again, we'd surely include some Bitcoin, Nvidia, and Tesla. The crypto sensation has left investors feeling a mix of emotions, from euphoria to regret over missed opportunities when Bitcoin traded for a few thousand dollars. Even prices as high as $30,000 in 2023 seemed like bargains in hindsight.

But things aren't always as clear as they seem in hindsight. Consider the conversation I had with a wealth manager friend years ago when Bitcoin was still considered risky by many financial firms. They proposed that a small percentage – say, 5% or less – could be a reasonable allocation for passionate believers in Bitcoin's potential.

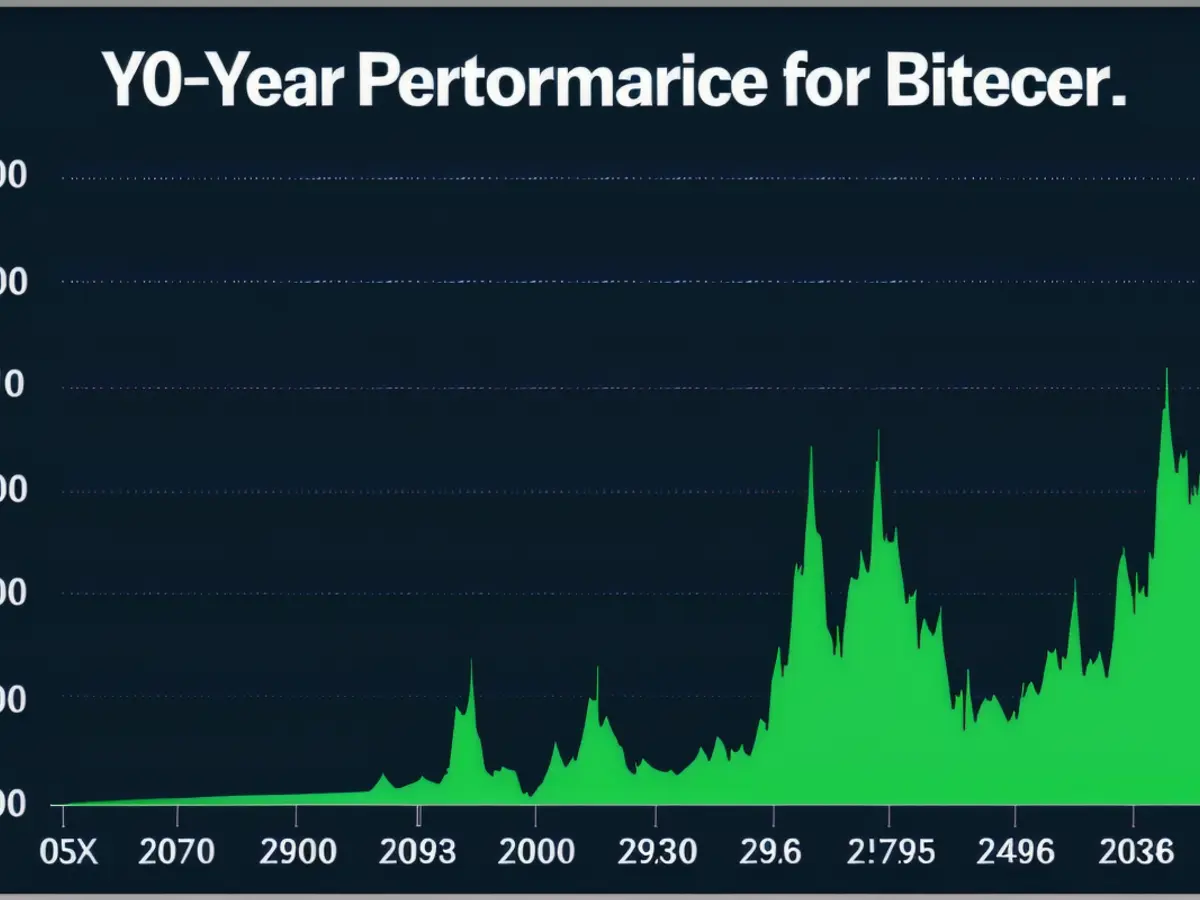

As it turned out, that tiny bit of risk paid off handsomely for many investors. In our example portfolio, a 5% Bitcoin allocation would have tripled the return compared to an all-stock approach, growing from $10,000 to over $65,000, while the 100% stock portfolio was worth only around $34,000.

Those early Bitcoin investors faced two major risks: the existential risk that the cryptocurrency would crash, and the added volatility that came with its constant fluctuations. In hindsight, the majority of investors would gladly trade a slight increase in downside risk for the massive upside gains.

Analyzing past performance can be both enlightening and confounding. While it's easy to see success stories like Bitcoin and judge that a riskier approach would have yielded better results, it’s essential not to ignore the potential pitfalls. Bitcoin plunged 73% in 2018, and over the long term, equities have seen their fair share of bear markets.

Investing is never black and white. There are no easy answers, which is why extensive research, patience, and a calculated approach are vital. It's crucial to approach the markets with an open mind, assessing each investment opportunity objectively and making informed decisions based on our convictions. Whether Bitcoin or any other trending asset is worth adding to a portfolio will depend on individual research, analysis, and risk tolerance.

Resources used:

- "Historical Bitcoin and S&P 500 Performance" [Source 1]

- "[Service Name] Allocation Strategy: Enhanced 60/40 Expanded Canvas Portfolio [Reference 1]"

- "[Service Name] Allocation Strategy: HB Inspired Balanced Expanded Canvas Portfolio [Reference 1]"

What would a 5% Bitcoin allocation do to my portfolio in comparison to an all-stock approach? In hindsight, investing in Bitcoin vs. S&P 500 presents an intriguing comparison. Should I consider buying Bitcoin as a part of my diversified portfolio?