Teva's bold comeback: Can AI and new drugs outshine its debt risks?

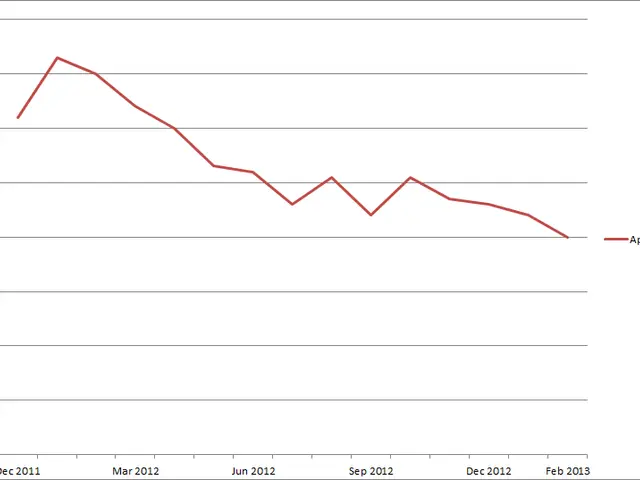

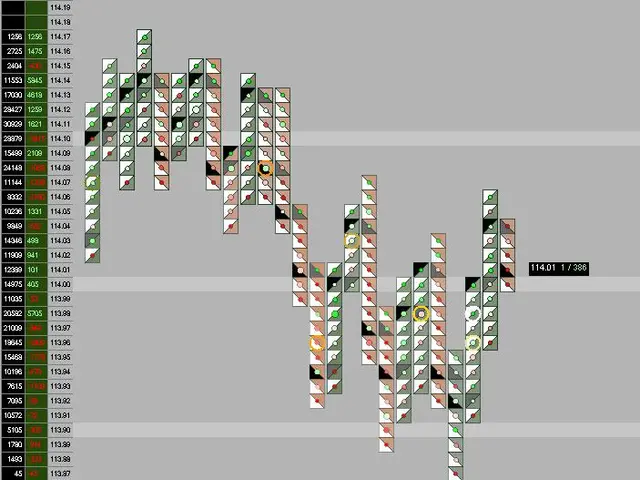

Teva Pharmaceutical is drawing attention from investors as its stock shows signs of recovery. Trading at around $12 per share, the company has rebounded after a long period of decline. Yet opinions remain divided, with some seeing potential in its pipeline while others remain cautious about its financial risks.

The firm's recent moves—including new drug launches and AI-driven development—have sparked discussions across social media and trading circles alike.

In April 2025, Teva introduced EPYSQLI™ (SB12), a biosimilar to Soliris, in the US market. Developed with Samsung Biologics, the drug improves treatment access for rare conditions like paroxysmal nocturnal haemoglobinuria (PNH), atypical haemolytic uraemic syndrome (aHUS), and generalised myasthenia gravis (gMG).

Meanwhile, the company secured a financing deal with Royalty Pharma worth up to $500 million. The funds will accelerate development of TEV-53408, a monoclonal IL-15 antibody. The agreement includes an immediate $75 million for a Phase-2b programme, with ongoing trials for celiac disease (expected completion: September 2026) and vitiligo (May 2026).

CEO Richard Francis has highlighted Teva's push to streamline drug development using AI, aiming to bring new treatments to market faster. The strategy reflects a broader effort to balance innovation with cost efficiency.

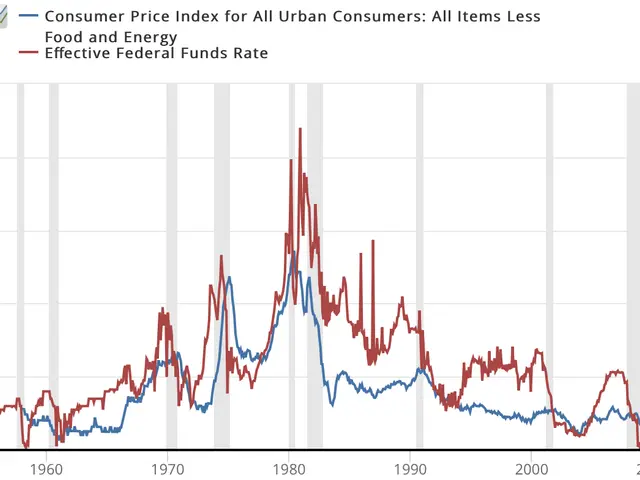

Yet challenges persist. Teva's heavy debt load and ongoing legal battles keep it in the high-risk category for investors. While its global reach and strong generics business provide stability, legacy liabilities set it apart from competitors like Viatris. The stock's recent climb has attracted traders betting on a long-term turnaround, though risk-averse investors may still favour safer alternatives in the sector.

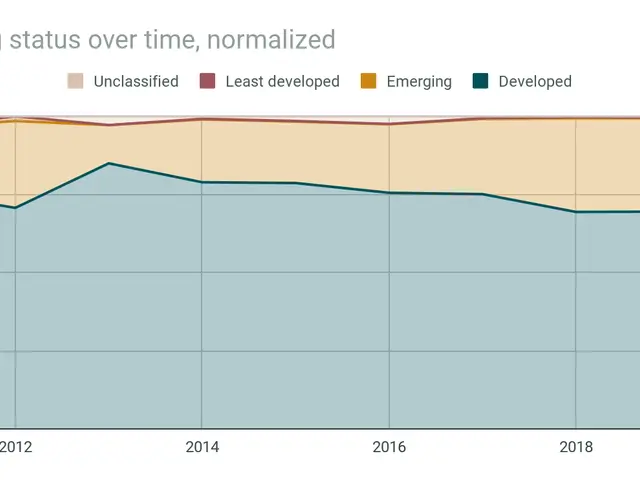

Teva's mix of branded drugs, specialty medications, and generics continues to influence its market position. However, the company's financial burdens mean it remains a polarising choice for those weighing growth potential against volatility.

Teva's latest developments—from biosimilar launches to AI-driven research—signal a push for innovation. The financing deal for TEV-53408 and ongoing clinical trials add to its pipeline, but debt and legal issues keep risks high.

For investors, the company presents a high-reward, high-risk scenario, appealing to those willing to bet on a gradual recovery rather than seeking short-term stability.