Tesla Surpasses Bitcoin in Global Market Rankings Amid Crypto Crash

Tesla has overtaken Bitcoin in global market rankings, with its valuation climbing to $1.6 trillion. The electric carmaker now sits in 11th place, pushing Bitcoin out of the top 10. This shift follows a sharp drop in Tesla stock and a broader crypto market downturn.

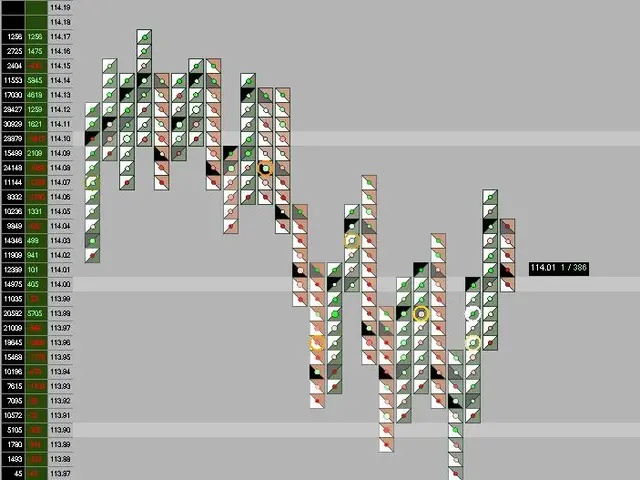

Bitcoin's market capitalisation has fallen to around $1.5 trillion, slipping behind companies like Meta Platforms and Taiwan Semiconductor. The cryptocurrency's price recently plunged to $77,300, triggering a wave of liquidations. Over $2.5 billion in leveraged crypto positions were wiped out as traders rushed to exit the market.

Tesla's rise comes despite its own stock struggles. Over the past year, Tesla stock has dropped by 6.73%, trading at roughly 362.50 EUR (about 429 USD) as of late January 2026. The company's performance has been uneven, with missed earnings expectations—including a 10.42% shortfall in the last quarter—and growing competition in the electric vehicle sector. Yet, even with these challenges, Tesla's valuation has held firm, keeping it among the world's most valuable firms.

Bitcoin's decline marks a turning point in the asset rankings. Once a dominant force, it now trails both traditional tech giants and automakers. The crypto market's volatility has accelerated this shift, while Tesla's resilience in a tougher stock market has cemented its position.

Tesla now stands as the 11th most valuable global asset, surpassing Bitcoin for the first time in months. The cryptocurrency's sharp decline has reshaped the top rankings, with Meta and Taiwan Semiconductor also moving ahead. Meanwhile, Tesla's ability to maintain its valuation—despite stock fluctuations—highlights its enduring influence in the market.