Taxpayers Face Unexpected Bills as Allowances Freeze and HMRC Falters

Taxpayers across the UK are facing unexpected tax bills as allowances remain frozen or decrease, while HMRC struggles to collect unpaid taxes efficiently.

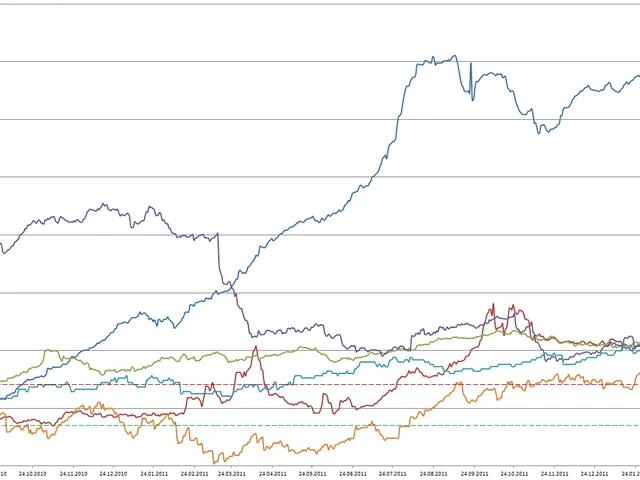

The reduced dividend allowance, now at £500, has led to more investors receiving tax bills. Similarly, the static personal savings allowance has increased the tax burden on interest earnings. Basic-rate taxpayers can earn up to £1,000 tax-free, while higher-rate taxpayers have a £500 allowance, and additional-rate taxpayers pay tax on all interest earned.

Retirees are also feeling the pinch. As the full state pension approaches the personal tax allowance, those receiving it may face an income tax bill for the first time. Meanwhile, HMRC is urged to improve its collection methods. It should adjust tax codes or send letters to retirees with untaxed income over £2,500 or from multiple sources. Currently, individuals are responsible for paying tax bills when they exceed their allowances.

In Germany, investors must declare their full capital income if they exceed their Sparer-Pauschbetrag for dividend income. Any excess withholding tax can be reclaimed or adjusted using Anlage KAP.

With tax-free allowances remaining frozen or reduced, record numbers of savers, workers, and investors are being hit with tax bills. The amount of capital gains tax paid by investors is also expected to soar due to a reduced allowance. To avoid exceeding allowances, investors can sell assets across multiple tax years or pay more into their pension. However, HMRC must improve its collection methods to ensure all taxpayers meet their obligations.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting