Tax Regime 2025: What's the Deal with Marginal Tax Relief?

Say bonjour to Marginal Tax Relief, a handy little mechanism designed to soften your tax transition between different income brackets. This bad boy is a lifesaver in progressive tax systems, where tax rates increase as your income rises.

The Nuts and Bolts of Marginal Tax Relief

When your income nudges you into a higher tax bracket, Marginal Tax Relief kicks in, preventing a sharp increase in your tax bill. Instead of paying the full higher rate on all income, you receive a gradual increase in taxation. This way, you can avoid falling off a so-called "tax cliff," where small income increases result in disproportionately high tax hikes.

Marginal Tax Relief in the 2025 Union Budget

In the 2025 Union Budget, Finance Minister Nirmala Sitharaman has made some significant changes to the income tax system, especially in the realms of marginal tax relief.

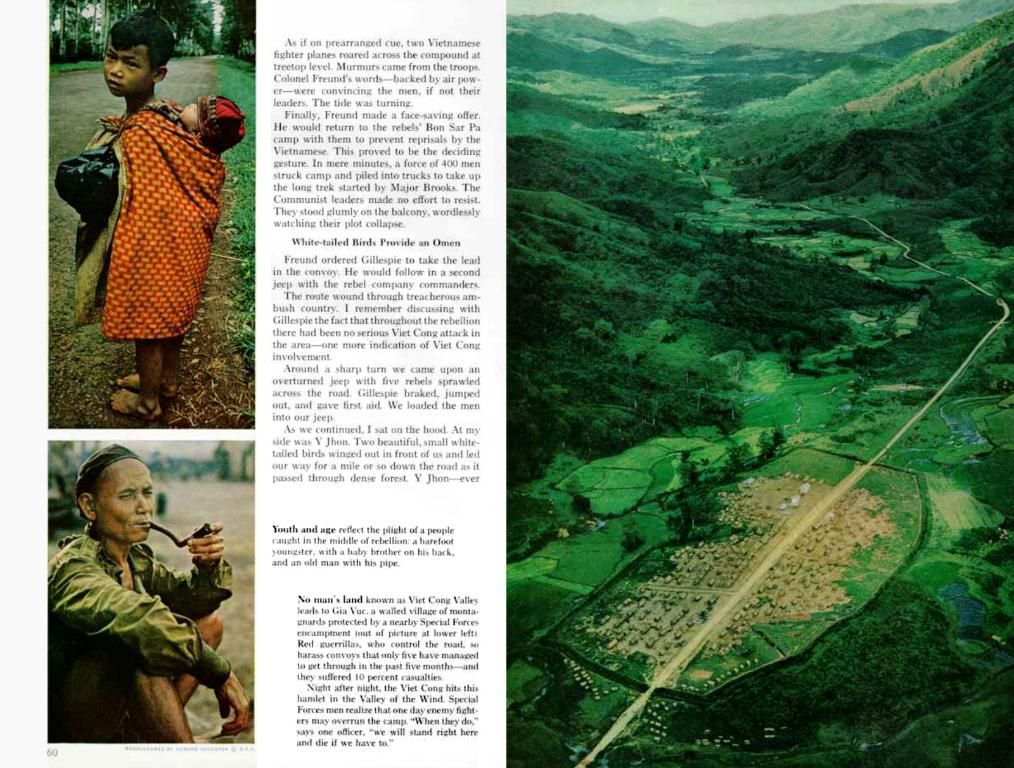

Amit

New Tax Regime Spruce Ups

12,00,000

- Individuals raking in up to ₹12 lakh annually can forget all about income tax under the new tax regime.

- For salaried taxpayers, this tax-free joy extends to ₹12.75 lakh, thanks to the standard deduction.

0

If you're curious about how marginal tax relief impacts your tax obligations, be sure to give our snazzy Income Tax Calculator a spin!

0

Marginal Relief under Section 87A

-

Worried about crossing the ₹12 lakh income threshold? Fret not! Marginal relief ensures that even if your income barely tops ₹12 lakh, you won't face debt-inducing tax burdens. Specifically:

- If your taxable income falls between ₹12 lakh and ₹12.75 lakh, the tax you have to cough up cannot exceed the incremental income over ₹12 lakh.

Rohit

This sweet benefit protects resident individuals from sudden tax spikes due to tiny income bumps.

12,10,000

Who's Eligible for Marginal Relief?

54,000

- Resident Individuals Only - Alas, marginal relief is for Indian residents, NRIs and businesses are left out.

- Income Must Be Between ₹12 Lakh and ₹12.75 Lakh - If your earnings fall within this range, you've made the cut.

- New Tax Regime Only - This party trick is exclusive to the new tax system, the old one doesn't get an invite.

10,000

To put it simply, marginal relief prevents small income increases from leading to enormous tax bills, giving taxpayers a fair shake.

44,000

Marginal Relief: Making a Mark in the Budget for FY24

The Marginal Relief feature in the FY24 Union Budget was a welcome move, providing relief to lower-income taxpayers whose income barely exceeded the ₹7.5 lakh tax-free limit.

However, with the Union Budget 2025, marginal relief ensures that taxpayers earning slightly above ₹12 lakh under the new tax regime do not face disproportionate tax burdens. Without this provision, even a minute income increase could lead to a crushing tax liability, making marginal relief a godsend for middle-income earners.

A Little Extra Math: Amit vs Rohit

Let's pit two individuals:* Amit, earning ₹12 lakh, paying zero tax under the new tax system.* Rohit, earning ₹12.10 lakh, a measly ₹10,000 more than Amit.

| Taxpayer | Annual Income (₹) | Tax Without Marginal Relief (₹) | Tax With Marginal Relief (₹) | Actual Tax Benefit (₹) || --- | --- | --- | --- | --- || Amit | 12,00,000 | 0 | 0 | - || Rohit | 12,10,000 | 54,000 | 10,000 | 44,000 |

Without marginal relief, Rohit would be taxed at 5% on income from ₹3 lakh to ₹6 lakh and then at 10%, 15%, 20%, or 25% on subsequent slabs, leading to a hefty tax liability. With marginal relief, though, Rohit pays only the difference between his income and ₹12 lakh (i.e., ₹10,000).

Perks of Marginal Relief for Taxpayers

- Fair Tax Dealing - Ensuring that tax payable does not exceed the additional income earned.

- Smooth Transition - Avoids sudden spikes in tax liability for those earning slightly above ₹12 lakh.

- Encouraging Higher Incomes - Eliminates the fear of disproportionate taxation on income increases.

- A Boost for Middle-Income Taxers - Particularly benefits salaried individuals and professionals near the exemption limit.

- Bonus Round for the New Tax Regime - Helps those opting for the new tax system make taxation a fairer game.

Wrapping Things Up

Marginal tax relief is shining bright in the new tax regime. It benefits those whose income barely surpasses the tax-free limit of Rs 7.5 lakh under the new tax regime. In the absence of this feature, a minor income increase beyond Rs 7.5 lakh would have been harshly punished by a much higher tax, taking away the increase and reducing income below Rs 7.5 lakh. Want to know which tax regime to choose from? We've got you covered in our article on old vs new tax regime.

Businesses can rejoice as the 2025 Union Budget focuses on amending the income tax system, with special attention given to Marginal Tax Relief, potentially impacting the financial landscape of various sectors.

In this new tax landscape, middle-income earners, such as salaried individuals and professionals, stand to reap the most benefits from Marginal Tax Relief. This provision helps ensure proportional taxation, encouraging higher incomes, and providing a smoother transition for those earning slightly above the exemption limit.