Synopsys faces analyst divide ahead of critical December earnings report

Synopsys faces mixed views from analysts as it prepares to release its latest financial results. While Citi has started coverage with a strong buy rating, Wells Fargo has cut its price target sharply. The company’s upcoming report on December 10, 2025, will outline plans for 2026 amid ongoing cost-cutting and market challenges.

Wells Fargo recently lowered its price target for Synopsys from $550 to $445, citing concerns over inflated valuations. Despite this, the firm still forecasts fiscal 2026 revenue of $9.7 billion and earnings per share of $14. The company’s high gross margins—over 80%—and long-term contracts, which secure 70-80% of revenue visibility, remain key strengths.

Synopsys is navigating a period of contrasting analyst opinions and operational adjustments. With a major cost-cutting drive underway and a key earnings update approaching, the company’s next steps will be closely watched. The impact of AI-driven growth and the Ansys acquisition will also play a significant role in its future performance.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

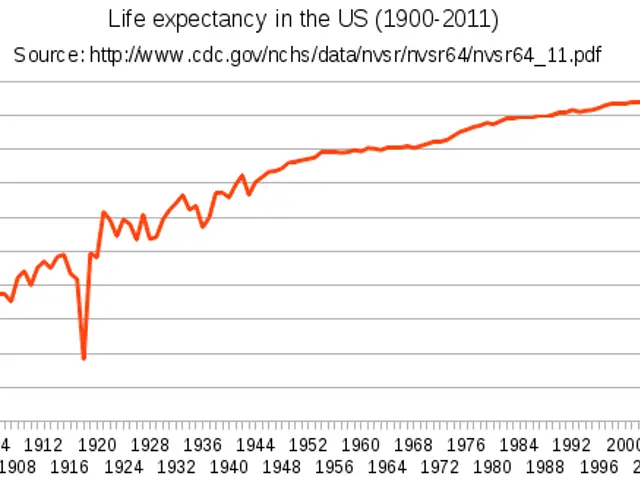

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting