Symrise AG’s Stock Divides Analysts as Price Targets Clash Over Growth Potential

Symrise AG, a global leader in fragrances and flavours, is drawing attention from analysts and investors. Recent reports highlight both optimism and caution around the company’s stock performance. Several banks have adjusted their price targets, reflecting mixed views on its future growth.

Analysts remain divided on Symrise AG’s outlook. UBS and Deutsche Bank Research see upside potential, setting targets of €115 and €83 respectively. UBS maintains a 'buy' rating, while Deutsche Bank’s lower target suggests more restrained confidence.

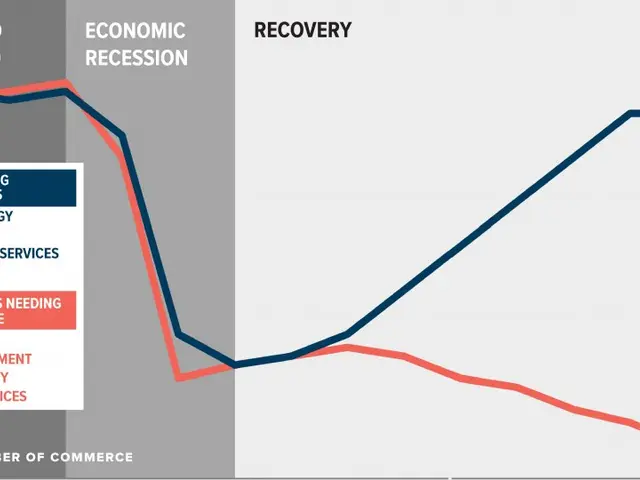

DZ Bank recommends buying the stock, estimating its fair value at €107—slightly down from earlier projections. Warburg Research and Baader Bank are also bullish, with targets of €113 and €116. Their optimism stems from the company’s strong organic growth across regions. Barclays, however, stays neutral, assigning a fair value of €84. Berenberg Bank takes a more cautious stance, keeping a 'hold' rating. The bank cites a tough consumer environment and fierce competition as key concerns. The company is focusing on high-growth areas like natural flavour modulators and protein flavour masking. Demand for plant-based proteins and sports nutrition is driving expansion in these segments. Future Market Insights predicts significant growth in the natural flavour modulators market by 2036. Technical analysis points to €72 as a crucial support level for Symrise AG’s stock. If held, this could reinforce the positive trend seen since early this year.

Symrise AG’s stock faces contrasting assessments, mirroring wider uncertainty in the consumer goods sector. While some banks highlight growth opportunities in emerging markets, others remain wary of industry challenges. The company’s strategic focus on high-demand areas may shape its performance in the coming months.