Switzerland's cash future hangs on a historic March 8 vote

Switzerland is preparing for a key vote on the future of cash. On March 8, citizens will decide on the Cash Initiative, a proposal aimed at protecting physical money. The debate comes as digital payments grow, but banknotes remain widely used across the country.

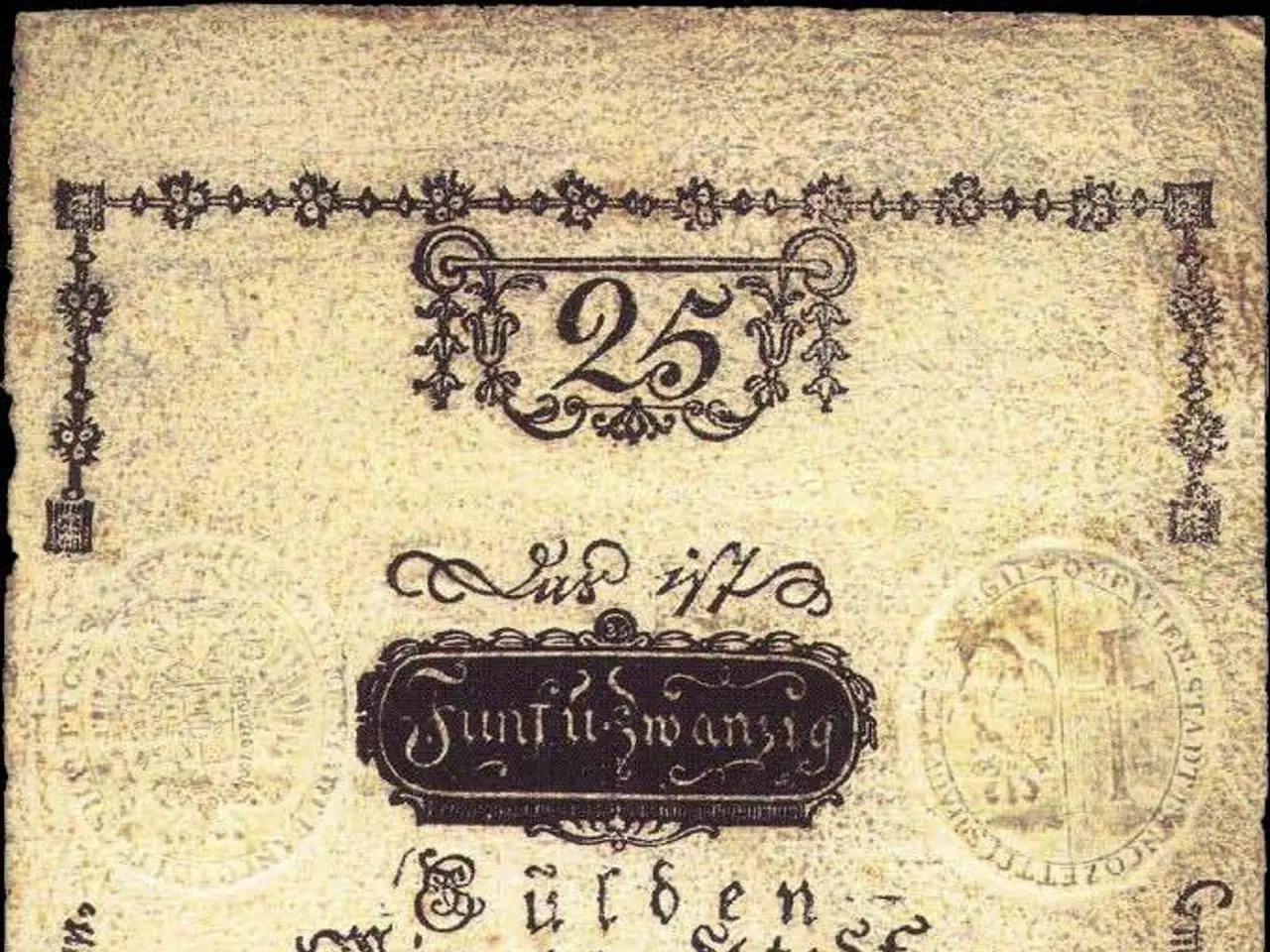

The Swiss National Bank (SNB) recently unveiled twelve fresh banknote designs, signalling the enduring popularity of cash. Yet, concerns persist that cash could eventually disappear from daily transactions.

The Cash Initiative was launched out of concern that cash might be phased out. Supporters argue that limiting its use could leave some people struggling to pay. They point to the rise of debit cards and mobile apps like Twint, which have already reduced cash transactions.

In response, a counter-proposal has been put forward for the same vote. This alternative would anchor the Swiss franc as the national currency in the constitution. It also ensures the SNB must guarantee enough cash for payments, using wording from existing laws. Unlike the original initiative, it avoids unnecessary details—such as listing 'coins or banknotes'—and instead uses the broader term 'cash'. Most major parties, including the SVP, SP, FDP, Centre, and Greens, back this version.

The counter-proposal skips a redundant clause about replacing currency, as such changes already require a public vote. Its focus is on maintaining cash access without restricting digital payment options.

The March 8 vote will determine whether cash remains a protected part of Switzerland's financial system. If the counter-proposal passes, the Swiss franc's role and cash availability will be written into the constitution. The outcome will shape how people pay for goods and services in the years ahead.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern