Swiss investors embrace ETF savings plans for long-term wealth growth

ETF savings plans, also known as ETF tsp, are gaining popularity in Switzerland as a simple way to invest regularly in exchange-traded funds. These plans allow investors to contribute fixed amounts at set intervals, building wealth over time. With nearly half of Swiss investors expected to put money into ETFs within the next two years, the trend shows no signs of slowing down.

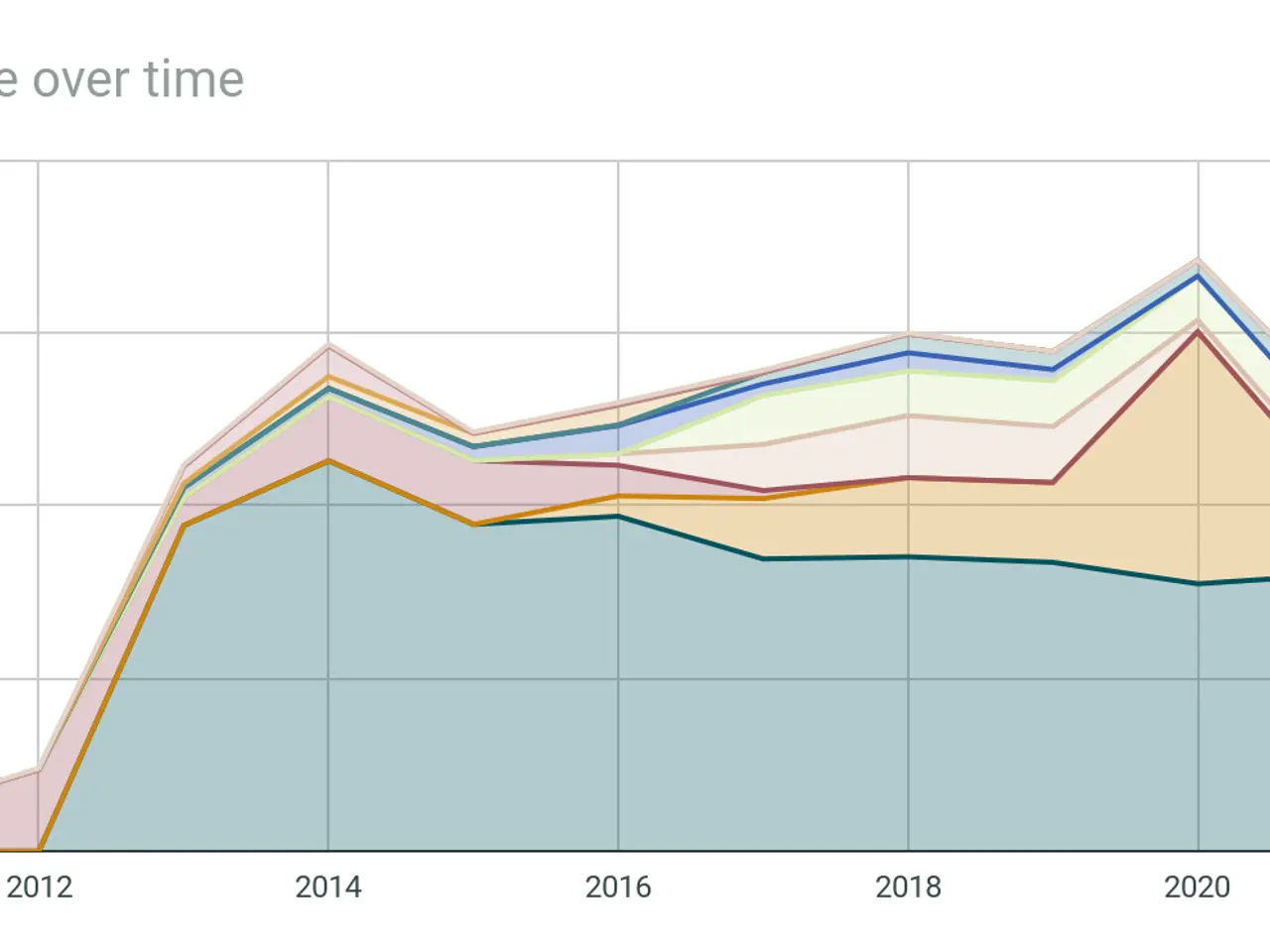

An ETF tsp works by automatically investing a fixed sum into one or more ETFs on a regular basis. These funds passively track market benchmarks, such as the MSCI World, offering broad diversification at low cost. In Switzerland, ETFs now make up 16% of all retail funds but hold 26% of total fund assets, with most new investments flowing into them over the past five years.

Several Swiss providers offer official ETF tsp, often with transparent fees below 0.5% per year. Companies like neon, PostFinance, Saxo Bank, Swissquote, Yuh, VIAC, Finpension, Zuger Kantonalbank, UBS, and Zweiplus (Cash) provide these services. Among them, Saxo Bank, Swissquote, and Yuh stand out for their large ETF selections, zero transaction fees on tsp, and low total expense ratios (TERs) on funds like Vanguard FTSE All-World (0.10% p.a.).

The benefits of ETF tsp include ease of use, consistency, diversification, and long-term growth potential. Automation helps investors stay disciplined, while low costs and flexibility make them accessible. However, risks remain, such as market volatility, no guaranteed returns, and potential tax implications. Investors must also consider fees, limited control, and the psychological challenge of staying patient during downturns.

Switzerland currently offers around 1,500 different ETFs, with roughly 8% new options added annually. This variety allows investors to tailor plans to their financial goals, though careful selection remains important.

ETF tsp provide a structured way to invest in a diversified portfolio with minimal effort. As more Swiss investors turn to ETFs, the market continues to expand with new options and competitive fee structures. For those focused on long-term wealth building, these plans offer a disciplined approach to growing assets over time.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting