Investing in Impact: BPI's Groundbreaking Sinag Bonds

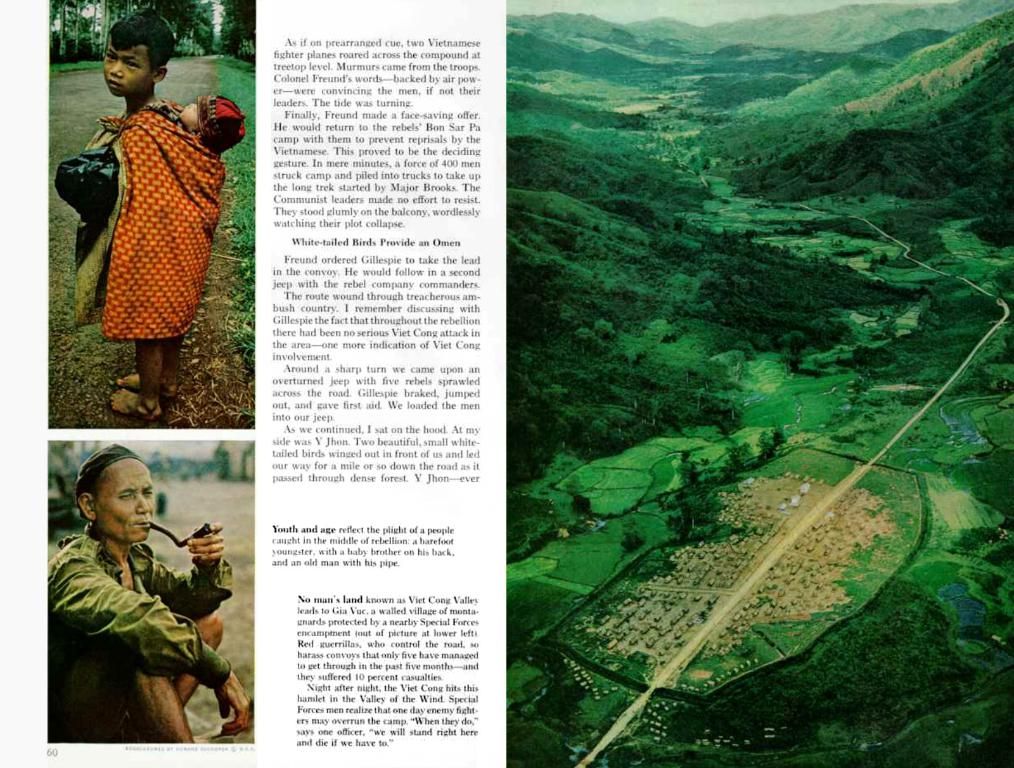

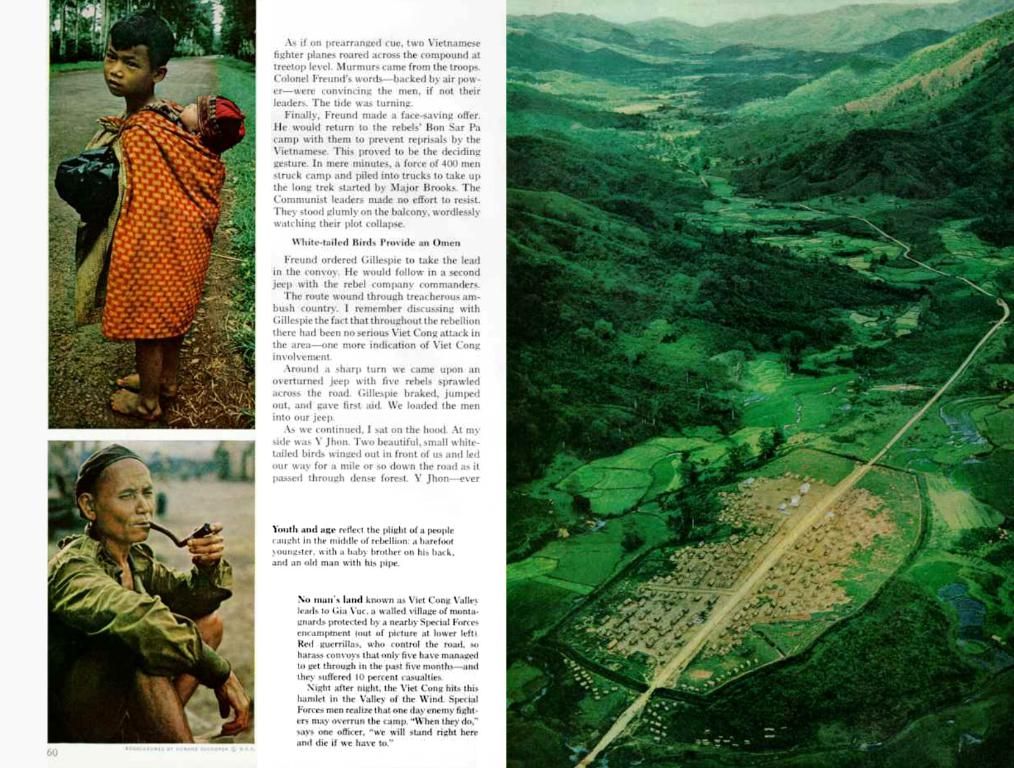

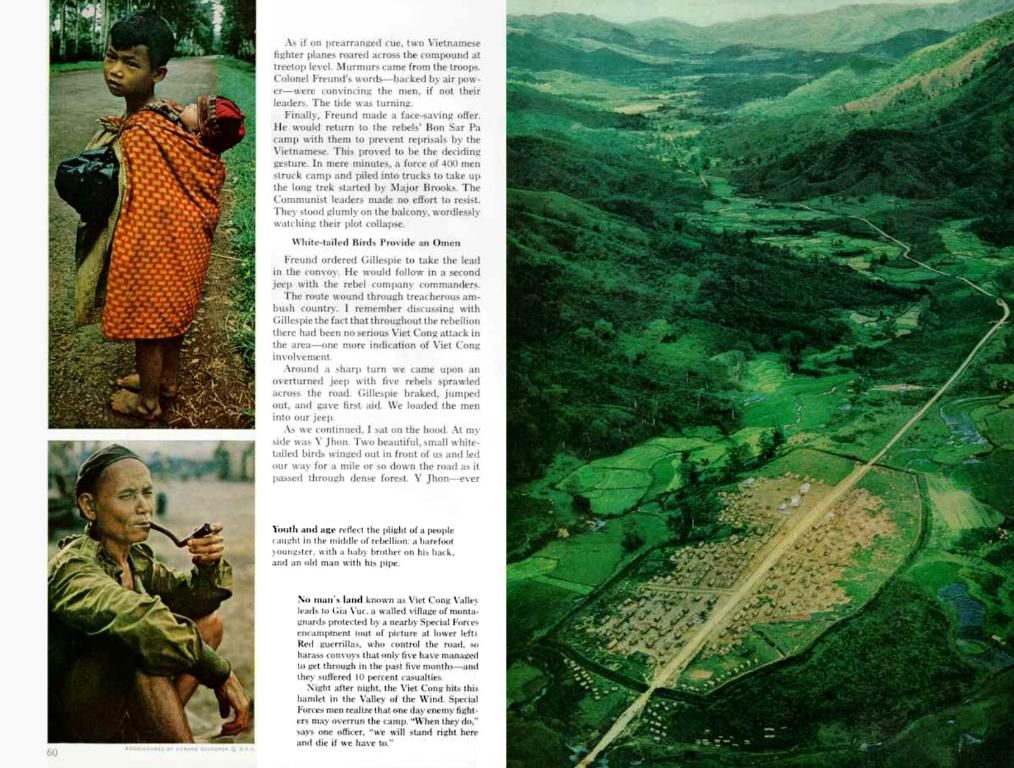

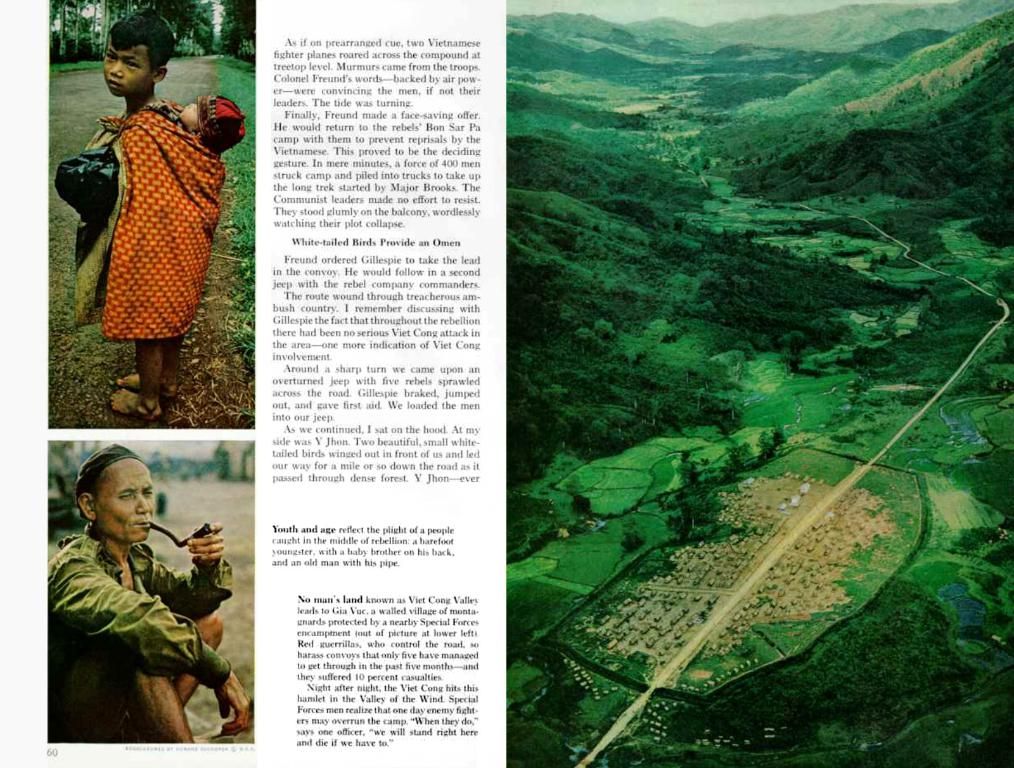

Sustainable Bond Investments with BPI Sinag: Stepping Towards a Brighter Future Each Step of the Way

The finance game isn't merely about minting bucks anymore; it's about making a mark. With the launch of the Sinag Bonds, Bank of the Philippine Islands (BPI) took the local financial scene by storm, demonstrating that investments can be both lucrative and meaningful.

What's the Gist?

The P40-billion Sinag Bonds, BPI's largest-ever peso bond issuance, is more than just an investment opportunity. This ambitious move serves as a catalyst for the Philippine capital market, attracting investors, beefing up market liquidity, and championing sustainability-driven investments-because forward-thinking finance is the way ahead.

Adverts All Around

Fun fact: BPI crafted the Sinag Bonds according to the Asean Sustainability Bond Standards, putting the Philippines on the global ESG (Environmental, Social, and Governance) radar. This isn't solely about cold, hard cash-it's about mobilizing resources for long-term economic resilience, proving that the Filipino capital markets can lead the ESG charge.

Dino's Take

"This isn't just a monetary milestone. It's proof that institutional, high-net-worth, and everyday investors believe banking can spark positive change," shares Dino Gasmen, BPI's Treasurer and Head of Global Markets.

Investments That Matter

Here's the lowdown: The Sinag Bonds boast a 1.5-year tenor and an annual interest rate of 5.85%, promising competitive returns. None the less, it's about more than just money. The funds aid real-life initiatives, funding ventures that range from renewable energy and clean water projects to eco-friendly buildings and affordable housing.

SEC's Backing

The Securities and Exchange Commission (SEC) backs these bonds under the Asean Sustainability Bond label, guaranteeing that each peso invested contributes to a greener, fairer future. Investors aren't merely earning returns-they're driving tangible change.

The Power Duo

BPI Capital Corporation and Standard Chartered Bank-two finance powerhouses-made this happen. As joint lead arrangers and selling agents, they designed, promoted, and secured robust investor participation, pumping up confidence in the Philippine bond market.

The Bigger Picture

This isn't just an ESG fad-it's the start of a wave of ethical investments. The Sinag Bonds pave the way for future responsible investments, encouraging businesses to link profits with purpose.

BPI's lead in sustainability-focused finance isn't just motivational-it's shaping the future. With support from investors, regulators, and financial leaders, the Philippines is setting itself up for inclusive economic growth and environmental resilience.

The takeaway? Smart investing means choosing financial products that build a better world. Sinag Bonds prove you can do both.

- The Sinag Bonds by Bank of the Philippine Islands (BPI) are not solely investment opportunities; they serve as a catalyst for the Philippine capital market, promoting sustainability-driven investments.

- BPI crafted the Sinag Bonds according to the Asean Sustainability Bond Standards, attracting investors and positioning the Philippines on the global ESG (Environmental, Social, and Governance) radar.

- Dino Gasmen, BPI's Treasurer and Head of Global Markets, shares that the Sinag Bonds aren't just a monetary milestone but proof that investors believe banking can spark positive change, linking profits with purpose.

- The funds from the Sinag Bonds support real-life initiatives in renewable energy, clean water projects, eco-friendly buildings, and affordable housing, driving tangible change towards a greener and fairer future.