Supreme Court Clears Path for Trump's New 10% Global Tariff Plan

The US Supreme Court has left open further tariff options for former President Donald Trump. The ruling confirms that existing trade laws still allow him to impose additional duties. Economists warn these measures could push up costs for American households even further.

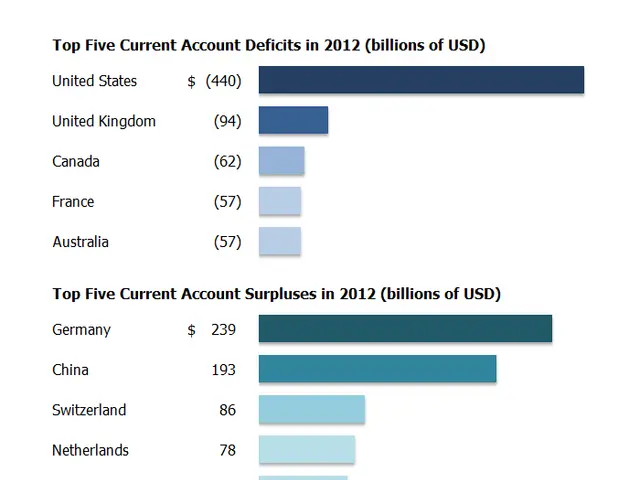

In 2018, Trump used Section 232 of the Trade Expansion Act to place 25% tariffs on steel and aluminium imports. Canada faced higher rates on steel, aluminium, and copper, while certain goods like aircraft parts and fertilizers were exempted. The move marked one of several tradingview restrictions introduced during his presidency.

A recent Tax Foundation study found that Trump's tariffs will cost the average US household an extra $1,000 in taxes by 2025. Despite this, the Supreme Court noted that other legal tools—such as those used for past steel and aluminium duties—remain available to him.

Now, Trump is planning a 10% global tariff on imports under Section 122 of the 1974 Trade Act. Stephanie Roth, chief economist at Wolfe Research, pointed out that he still has multiple tariff levers to pull. However, economists do not expect the latest court decision to drastically alter consumer prices in the short term.

The Supreme Court's stance keeps the door open for broader tariffs under Trump's trade policies. If implemented, the proposed 10% global duty could add to the financial burden already facing US consumers. The long-term effects will depend on how these measures are applied and whether exemptions are granted.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern