Struggles persistent in Cambodia's LNG project due to concerns over energy security and financial expenses

In the heart of Southeast Asia, Cambodia is embarking on a significant energy transition with the Royal Group's 900-megawatt electricity generation project in the Botum Sakor district. This ambitious endeavour, if completed, will not only mark Cambodia's largest operational power plant but also its first to run on gas, making it the country's first foray into liquefied natural gas (LNG) power generation.

The project, however, comes with its challenges. Integrating LNG into the Cambodian power mix could potentially make electricity prices more expensive, hindering the government's efforts to reduce these rates. Achieving the 70% renewables target by 2030, as outlined in Cambodia's energy objectives, will require the country to limit its utilisation of baseload LNG-fired power plants.

The Economic Research Institute for ASEAN and East Asia (ERIA) advocates for LNG to play a major role in Cambodia's energy future, as outlined in a 2023 report. However, the high costs associated with LNG-fired power plants are a concern. At current prices, operating one 900MW, LNG-fired power plant could cost as much as KHR 2.95 trillion (US$730 million) for the fuel alone.

This price volatility is a significant concern, as buying LNG from the spot market can lead to price fluctuations, while multi-year contracts have rigid "take-or-pay" terms. LNG fuel prices would likely need to fall below US$4.8/MMBtu to compete with coal and renewables, but global prices have rarely fallen this low.

This uncertainty makes it difficult for Cambodia to commit to long-term LNG contracts. Cambodia will import LNG primarily from the United States, as LNG from the US is expected to fill supply gaps according to EU and US trade discussions, but the specific port or supplier for Cambodia has not been explicitly identified in the available sources.

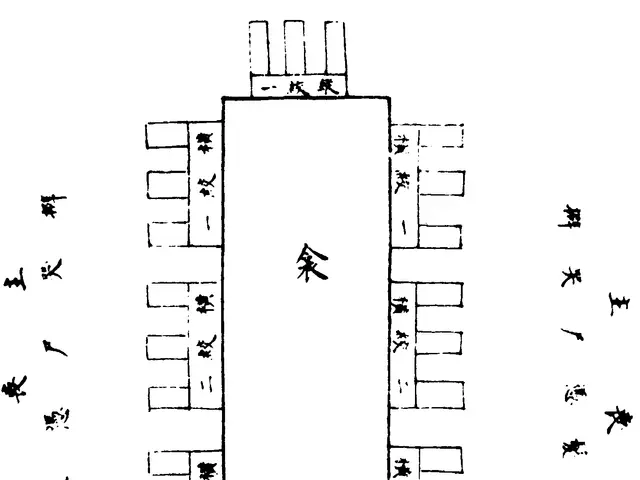

The project requires infrastructure for importing liquefied natural gas (LNG) and reheating it for combustion. This is a significant investment, but one that could allow stakeholders to pursue LNG contracts and infrastructure plans that are best-suited to deliver Cambodia's energy objectives.

The article was originally published on Dialogue Earth under a Creative Commons licence. This endeavour is related to topics such as Carbon & Climate, Energy, and Policy & Finance. Other Asian countries, such as Vietnam and the Philippines, are grappling with the impact of uncompetitive LNG imports upon their electricity rates, making this issue a regional concern.

Despite these challenges, Cambodia remains committed to its energy objectives. The country's current power mix is dominated by fossil fuels, with solar making up only 5% of the power mix. To achieve its goal of generating 70% of the country's power from renewable sources by 2030, Cambodia will need to navigate this transition carefully, balancing the need for affordable power with the pursuit of cleaner energy.