Strategic Approach to Long-Term Financial Management: Interview with Charles Pohl

Deep Dive into Long-Term Investing: Avoid Short-Term Thinking Traps and Master Economic Cycles

Let's discuss the wisdom of Charles Pohl, investment guru and the mind behind The Professional's Guide to Long-Term Investing, as shared in a recent candid interview. He delves into the common pitfalls of short-term thinking, the evolution of investment strategies, and the role of economic cycles in building solid long-term portfolios.

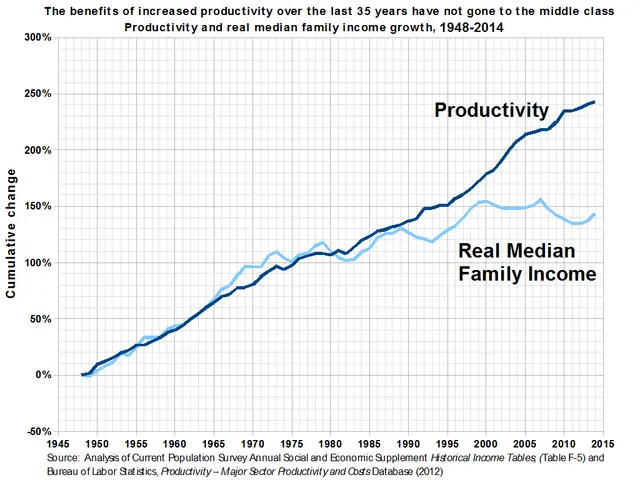

In the realm of investments, the struggle to keep eyes on the horizon can be a tad too real. Many investors succumb to short-term thinking, which Pohl warns against. One of the significant mistakes this mentality breeds is the assumption that a company's previous performance will carry over seamlessly into the future. Industries, such as energy and mining, are known for their cyclical fluctuations, making sales and cash flow unpredictable over time. Moreover, companies transform constantly—they restructure, cut costs, innovate new products, and services. All these changes take time to bear fruit in the financial sphere.

Short-term thinking might blind us to long-term investments made by management. Take the example of Amazon. While its current earnings may appear lackluster due to aggressive spending on logistics, cloud computing infrastructure, and AI research, these investments could potentially yield substantial long-term value.

Unpredictable market factors have an impact on short-term results. Factors like investor sentiment and irrational enthusiasm can sway the market. As Benjamin Graham put it, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This underscores the notion that a company's intrinsic value tends to surface over time, through earnings and cash flow generation.

Pohl's tenure at Dodge & Cox reflects a steadfast commitment to a long-term, research-driven approach to investing: fundamental analysis with a wide investment reach. The firm launched new strategies such as international and global bond funds, expanding the investment horizon and diversifying portfolios.

Dodge & Cox's ability to withstand short-term pressures can be attributed to its patient investor base, who understand the wisdom of valuation-sensitive, fundamental investing. Coupled with the firm's independence as an employee-owned organization, this ensures that investment decisions prioritize long-term value creation over short-term financial pressures.

In 2014, Pohl was recognized for his contributions to international investing with the Morningstar Award for International-Stock Fund Manager of the Year. This honor shone a spotlight on Dodge & Cox's patient, low-turnover, value-oriented strategy. Morningstar commended the firm's willingness to invest in overlooked companies by the market and its dedication to disciplined investing.

Over the years, Dodge & Cox's international stock fund has generated meaningful value for investors. Pohl emphasizes the significance of economic cycles in investment decision-making. Conducting industry-level and broader economic cycle analyses enables investors to identify investment opportunities when market sentiment is unduly pessimistic. Questions worth considering include a company's ability to maintain pricing power during downturns, fortitude of its balance sheet to endure economic stress, and whether current market valuations reflect excessive optimism or pessimism.

Distinguishing between cyclical and secular trends is crucial for long-term investors. Many investors often fail to make this distinction, creating opportunities for those who embrace patience and good judgment.

A solid educational foundation at the University of Chicago has equipped Pohl with a robust analytical ability. Understanding the intricacies of financial statements and the workings of management decisions is essential for long-term success. Though the investment landscape has evolved, the principles of competitive analysis have remained paramount. Pohl has channeled these analytical abilities not only in his investing roles but also in managerial positions within Dodge & Cox.

Technological advancements have transformed the investment sector, offering novel research, analysis, and decision-making tools. Pohl appreciates the benefits of technology but cautions that not all tools are equally valuable for long-term investors. Quantitative analysis can boost understanding of company fundamentals, but some high-frequency trading tools might not be as effective for investors with a multi-year time horizon. Human judgment, nonetheless, remains indispensable in making the best investment decisions. Despite the benefits of technology, artificial intelligence, and machine learning cannot replace the years of experience and instinct that seasoned investors possess.

In essence, Charles Pohl's insights, as presented in The Professional's Guide to Long-Term Investing, illuminate the importance of patience, discipline, and thorough research in investment decision-making. By focusing on long-term value rather than short-term fluctuations, investors can navigate economic cycles, capitalize on corporate transformations, and create portfolios capable of weathering market storms. Embrace these principles, refine your investment approach, and watch your wealth blossom over time.

Pick up a copy of The Professional's Guide to Long-Term Investing on Amazon and elevate your investment game.

By: Tom W.

Investing in long-term assets is crucial for avoiding short-term thinking traps, as evidenced by Charles Pohl, the investment guru behind The Professional's Guide to Long-Term Investing. One must understand the role of economic cycles and industry fluctuations in building solid portfolios, as shown in the example of Amazon, whose potential long-term value lies in its long-term investments.

In the realm of business and personal finance, Dodge & Cox's patient, value-oriented approach to investing has been recognized with esteemed awards, demonstrating the firm's commitment to long-term value creation over short-term financial pressures. Dodge & Cox's international stock fund has generated meaningful value for investors through their focus on conducting thorough industry and economic cycle analyses.

Mastering the principles of investment decision-making, such as patience, discipline, and thorough research, can help investors capitalize on corporate transformations and weather market storms. Embracing this philosophy, refining your investment approach, and taking the advice from The Professional's Guide to Long-Term Investing can lead to the growth of your wealth over time.

Pick up a copy of The Professional's Guide to Long-Term Investing on Amazon to elevate your investment game.