Stock markets in Europe end with a mixture of gains and losses, reflecting a cautious trading day

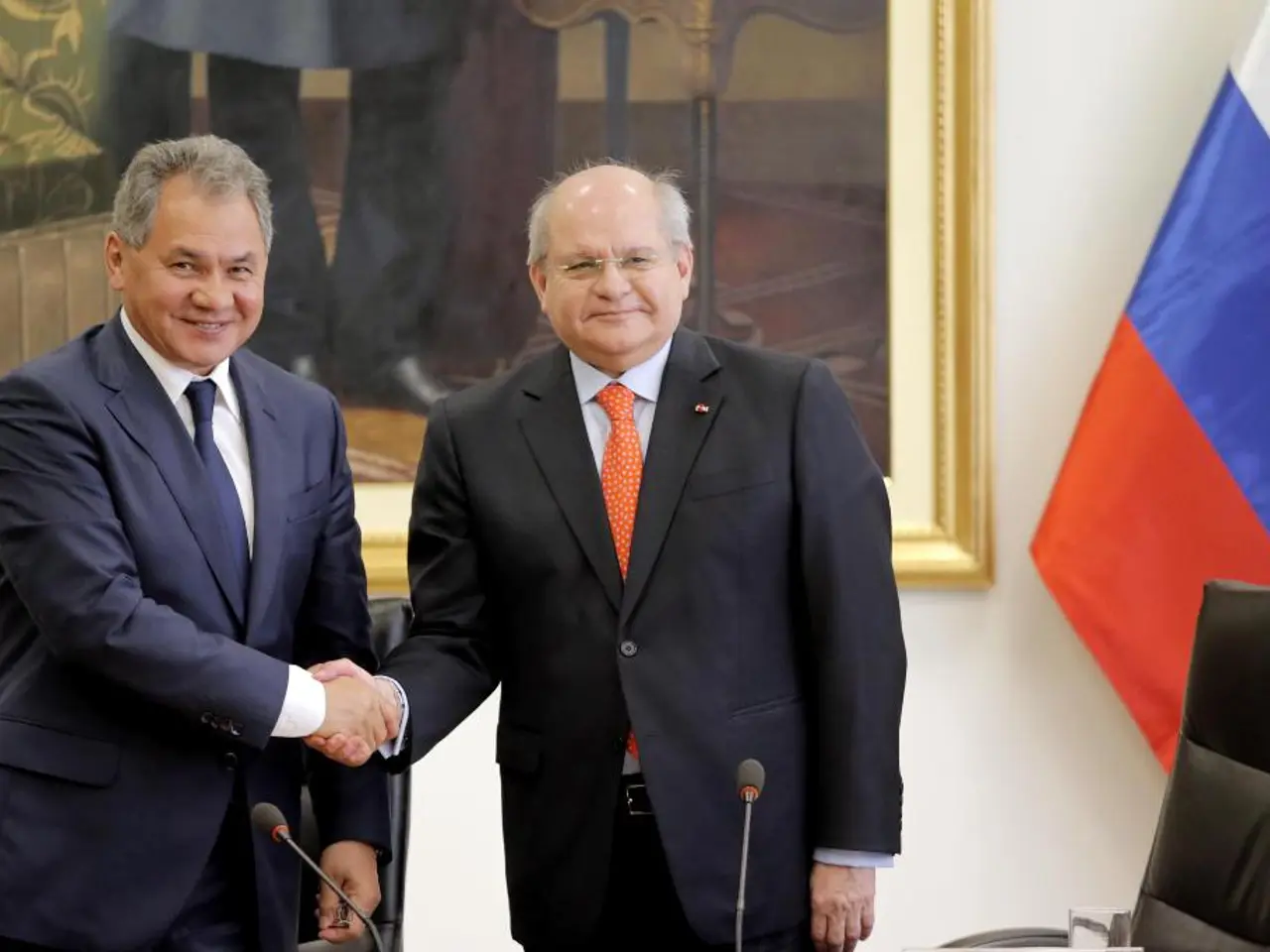

The Trump-Putin summit, held in Alaska, took place earlier today. The meeting was seen as a diplomatic success for Putin, but it did not result in any concrete agreements to end the Ukraine war or ease economic tensions.

The summit allowed Putin to gain diplomatic recognition without offering significant concessions or ceasefire commitments on Ukraine, reinforcing the status quo rather than promoting quick resolution. Trump's proposals for potential economic deals with Russia did not materialize during the summit, as unresolved conflict issues prevented linking diplomacy with economic incentives.

Analysts have warned that Russia’s economic and fiscal situation remains precarious due to sanctions and the war, causing falling oil revenues and depletion of reserves. These factors continue to undermine regional and global economic stability. Europe, closely watching the summit outcomes, remained wary due to the absence of Ukrainian President Zelenskyy and unclear peace prospects, which heightened geopolitical risk and generally pressured European stock markets as investors factored in prolonged conflict uncertainty.

The meeting did not bring an immediate thaw in Western sanctions or improve business conditions, thereby limiting positive triggers for European stock markets and contributing to cautious global economic growth outlooks.

In the UK market, Anglo American Plc gained about 2.3%, Glencore and BP gained about 1.8%, but no new information was provided regarding the UK market in the current paragraph. The pan European Stoxx 600 edged down 0.06%, and the U.K.'s FTSE 100 drifted down 0.42%.

Standard Chartered plunged more than 7% following a call from US Republican Elise Stefanik for Florida AG Pam Bondi to investigate the bank for "illicit payments to known terrorists."

In France, the CAC 40 climbed 0.67%, while Infineon Technologies found support after acquiring Marvell Technology Inc.'s Automotive Ethernet business. In the French market, Teleperformance rallied more than 4%.

However, Publicis Groupe, Thales, Hermes International, Schneider Electric, and Safran closed weak, and Adidas, Puma, and other companies (E.ON, SAP, Puma, and Vonovia) closed lower by 0.8 to 1.7%. Among other European markets, Belgium, Denmark, Netherlands, and Poland ended weak.

Finland's market closed higher, and no new information was provided about Germany's DAX, the international markets mentioned (Czech Republic, Greece, Iceland, Ireland, Norway, Portugal, Russia, Spain, Sweden, Turkiye), or Switzerland's SMI in the current paragraph.

In sum, the Trump-Putin summit reinforced existing geopolitical tensions without resolving critical issues, which maintained downward pressure on global economic growth prospects and added volatility to European stock markets due to the ongoing Ukraine conflict and Russia’s financial strains.

The absence of concrete agreements in the Trump-Putin summit could potentially hinder the improvement of business conditions, particularly in Europe, due to the ongoing Ukraine conflict and Russia’s financial strains. The financial strains in Russia, exacerbated by sanctions and the war, have a domino effect, causing regional and global economic instability. This unstable situation may pose risks for the finance industry, as it could lead to decreased economic growth and increased volatility in the business world.