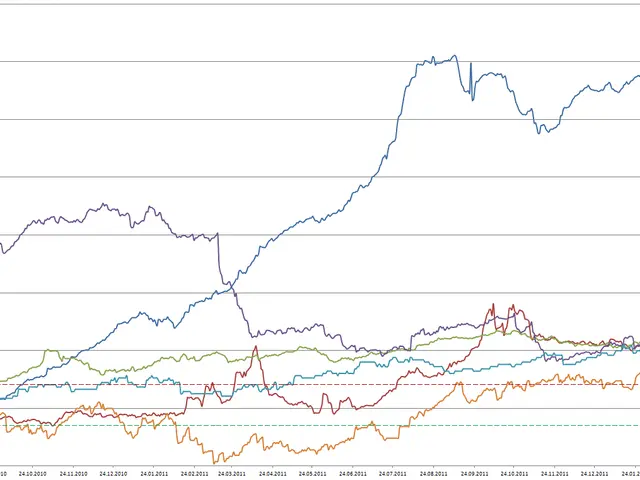

Stock Market Sees Wild Swings as Enova Soars and Sallie Mae Stumbles

Financial markets experienced sharp movements during the week ending 12 December 2025. Several companies posted significant gains and losses, driven by earnings forecasts, acquisitions, and trading updates. Investors reacted strongly to both positive and negative corporate news.

Enova International (ENVA) led the gains among large financial firms, surging 20% after announcing a $369 million deal to acquire Grasshopper Bancorp. The move marked the biggest weekly jump for a company with a market cap over $2 billion.

Neptune Insurance Holdings (NP) followed with a 12% rise, while American International Group (AIG) and HCI Group (HCI) climbed 10.2% and 10%, respectively. Slide Insurance Holdings (SLDE) also advanced, gaining 11%.

On the downside, Sallie Mae (SLM) dropped 12% after presenting weaker-than-expected earnings estimates at its 2025 investor day. Robinhood Markets (HOOD) fell 9.4% due to disappointing November trading volumes. Meanwhile, Cipher Mining (CIFR), eToro Group (ETOR), and IREN (IREN) declined by 11.6%, 11.8%, and 10%, respectively.

The week's trading highlighted how acquisitions and earnings reports can trigger major price swings in the stock market. Enova's deal boosted its share price, while Sallie Mae and Robinhood faced setbacks from weak financial outlooks. Markets remain sensitive to corporate performance updates.