Stablecoins Fuel Crypto Rally, Pushing $236.6 Billion in Supply

Stablecoin Reservoirs Reach $236 Billion - Could This Push Bitcoin Prices to $100,000?

In the crypto world, it's about more than just bitcoins these days. With a staggering $2.135 billion increase in a week, the total stablecoin supply has smashed previous records, reaching an eye-watering $236.6 billion. And guess what? This surge in stablecoins could be the catalyst for the next big crypto rally.

The rise in stablecoin supply is like a flood of ready cash, just waiting to dive into risk assets like Bitcoin and altcoins. Historically, this influx of liquidity has often paved the way for market rallies as investors snap up cryptocurrencies, pushing prices skyward.

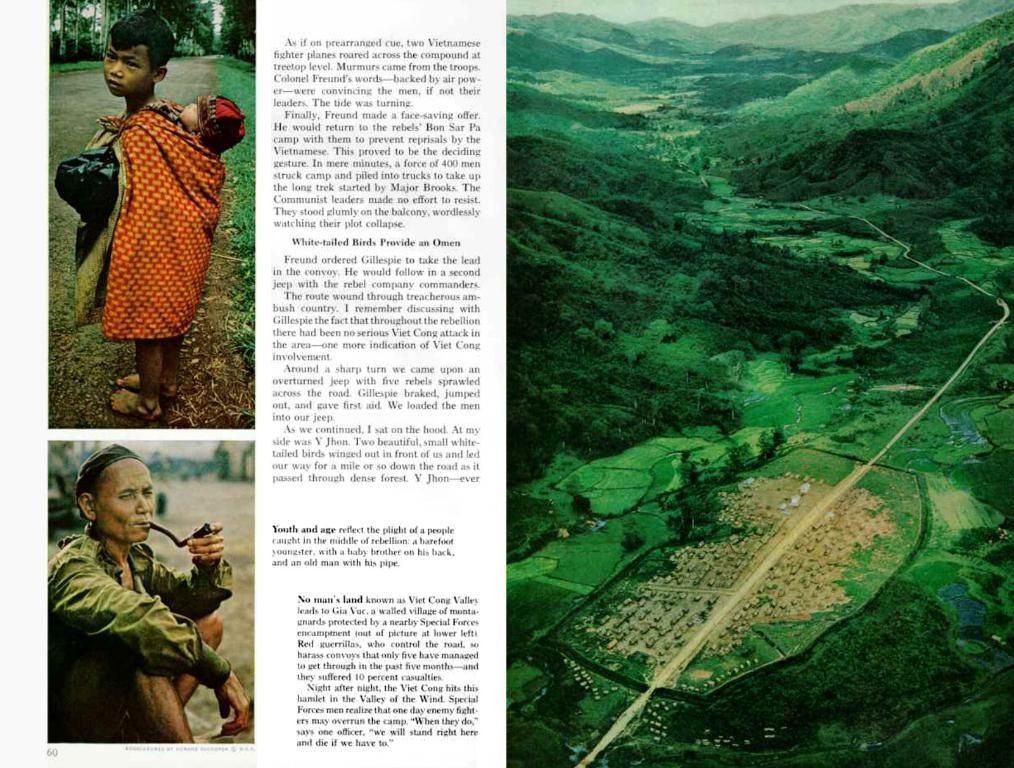

Take Bitcoin, for instance. After a powerful 10% surge to $93K, the king of crypto is currently showing bullish signs, aiming for the $100K psychological milestone. The strong connection between stablecoin supply and bitcoin's price growth is hard to ignore. It's like they're dancing a salsa, with one putting on a show while the other follows closely behind.

The altcoins market isn't far behind, either. With the total altcoin market cap leaping by 16% in a week, it's clear that altcoins are playing catch-up to Bitcoin's lead. At present, the altcoin market Excluding Ethereum and Bitcoin, totals $821 billion. This close alignment between Bitcoin's performance and the altcoin market highlights their mutual dependence upon BTC's directional bias.

While some may argue that the altcoins might trail behind Bitcoin, they usually catch up once Bitcoin stabilizes or consolidates. So, if Bitcoin continues to charge ahead, a stronger altcoin season could be brewing in the shadows.

As the stablecoin supply climbs and the crypto market gears up for action, overall sentiment is overwhelmingly positive. Investors are keen to get their hands on digital assets, and the pace of capital rotation is picking up speed. With Bitcoin leading the charge and a record amount of stablecoins in play, the crypto landscape looks decidedly bullish.

Crypto Cycle Insights

Here's the lowdown on the correlation between stablecoin supply and crypto market rallies:

- Fresh Liquidity: The minting of stablecoins brings fresh capital into the crypto market, fueling demand for bitcoin and altcoins and pushing prices higher. These liquidity surges have often coincided with key Bitcoin bull runs, such as the 2017 surge to $20,000 and the 2020-2021 rally reaching nearly $69,000.

- Investor Readiness: Even during periods of market caution, growing stablecoin supply indicates that investors are poised to deploy capital once conditions improve, foreshadowing potential future rallies.

- Hedge Behavior: During bearish markets, stablecoin supply may contract due to redemptions, signaling liquidity withdrawal and increased selling pressure on cryptocurrencies.

In summary, the ebb and flow of stablecoin supply can act as a leading indicator of crypto market rallies. Increases in stablecoin supply drive fresh liquidity into the market, often leading to significant price increases. Conversely, stablecoin contraction often coincides with market downturns.

Stay tuned as we dance our way through this crypto rally, keeping an eye on the waves of stablecoin supply and the movements of our favorite digital assets! 💃 🕺

- The crypto landscape is no longer solely about bitcoin, as altcoins and Decentralized Finance (Defi) are also gaining traction.

- The surge in stablecoin supply recently, reaching $236.6 billion, is being closely watched, as it could trigger the next big crypto rally.

- The increase in stablecoin supply resembles a flood of ready cash, waiting to invest in risk assets like Bitcoin, Ethereum (ETH), and other altcoins.

- The king of crypto, Bitcoin (BTC), has surged 10% to reach $93K, showing bullish signs as it aims for the $100K psychological milestone.

- The altcoins market, with a total market cap of $821 billion, is following the lead of Bitcoin, highlighting their mutual dependence upon BTC's directional bias.

- Kelvin, a crypto investor, sees potential in the stronger altcoin season that may brew if Bitcoin continues to surge.

- Finance professionals at Li Finance are keeping a close eye on the relationship between stablecoin supply and crypto market rallies, considering it a key factor in their businesses and investing decisions.

- As the crypto market continues to rally, the overall sentiment among investors is increasingly positive, with a growing reliance on technology, like stablecoins and Bitcoin, in the world of business and finance.