Sports valuation entity Arctos maintains no sports team valuation bubble exists.

Zach Baran, managing director at Arctos Partners, and Arctos executive Sushaan Modi, have authored a white paper titled How Sports Franchise Valuations Actually Work. The paper aims to dispel common myths and misunderstandings surrounding the price of sports teams.

According to the white paper, sports team valuations are driven by identifiable metrics, not just scarcity value. Fundamentals like cash flow and brand value are the pillars of a valuation. The rise in sports team prices, as argued by Arctos Partners, is explainable by these fundamentals and is not irrational.

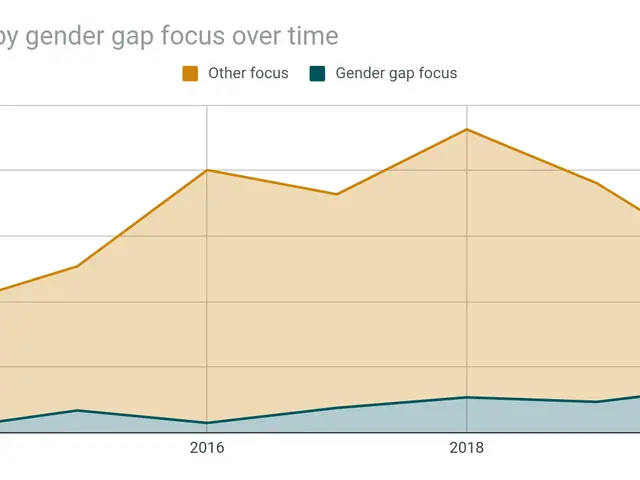

The paper provides insights into the historical trends of sports team valuations. For instance, the peak-to-trough decline was 9.8% in the mid-1990s, and it took 15 months for values to recover, almost entirely driven by MLB teams after a strike canceled the 1994 World Series. The longest down period was 60 months that ended in June 1979, and the RASFI (an index created by Arctos and Michigan Ross) was off 22.9% at its worst. However, contrary to the belief that "Sports valuations always go up", Arctos states that there have been six periods where franchise valuations declined since 1961, only two of which were in the last 45 years.

The white paper also discusses the evolution of institutional ownership in sports teams. Institutional ownership rules changes have come online in part as a response to growth in fundamentals that created the demand in the first place. Arctos Partners, which owns stakes in more than 20 sports franchises, has utilised institutional investors such as pension funds, endowments, and sovereign wealth funds as capital sources for their investments. As of the first quarter of 2025, available institutional capital for PE investments was less than $11 billion.

From 2019 through the first quarter of 2025, sports teams slightly lagged the stock market, with the S&P 500 compounding 14.4% annually and RASFI, the index created by Arctos and Michigan Ross, up 13.8% during the same period. However, over a 10-year and 20-year horizon, RASFI outperforms the stock market, with returns of 15.3% and 12.8% respectively.

The white paper by Arctos Partners was recently used by Sportico for their NFL franchise valuations projects. The paper explains that valuations are not solely driven by top-line growth but also by multiple expansions, boosted by better profits. This phenomenon is referred to as the negative cost of carry reversal by Arctos Partners. Half of the returns are attributed to top-line growth, and the other half to multiple expansions.

Arctos Partners, which was launched in 2019, has published this white paper to provide a clearer understanding of sports franchise valuations. The firm downplays its own role and that of private equity (PE) in franchise gains, stating that team values in the Big 5 North American sports leagues have increased $270 billion since 2019.

Despite the overall growth in sports team valuations, the first half of 2022 saw a 5.6% decline, by Arctos' count, in a slump that lasted six months. The white paper serves as a valuable resource for anyone interested in understanding the complex world of sports franchise valuations.