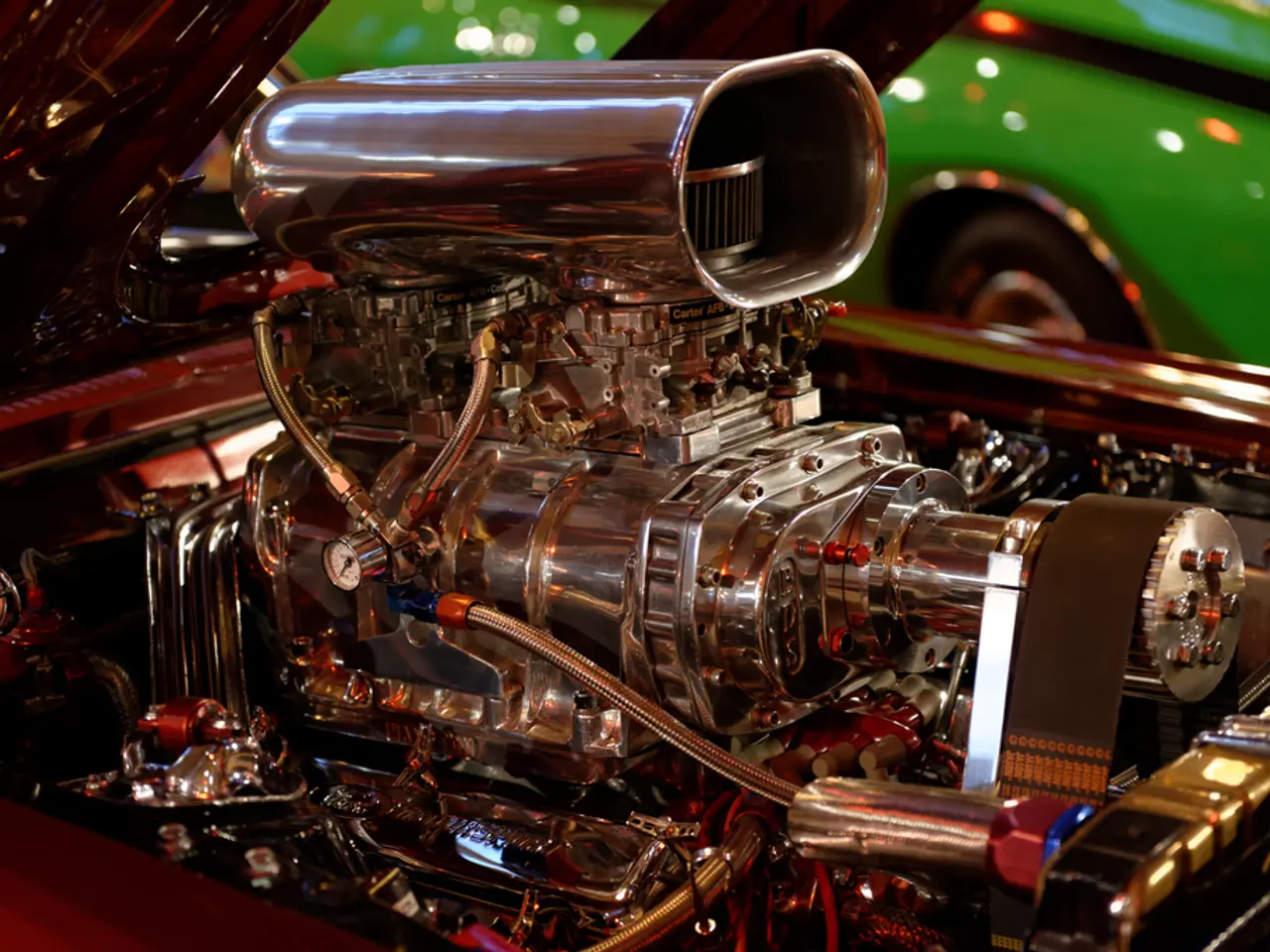

Southeast Asia's Internal Combustion Engine Market Declines in 2024, Thailand Remains Dominant

The Southeast Asian market for internal combustion engine equipment experienced a downturn in 2024, with both imports and exports declining. Despite this, Thailand remained a dominant player in the region's trade.

Imports of equipment for internal combustion engines in Southeast Asia decreased by X% to X units in 2024, marking the second consecutive year of decline. The market value also dropped by X% to $X, reflecting this decrease in volume. Meanwhile, exports of such equipment fell by X% to X units, extending a three-year downward trend. Thailand, however, maintained its lead in exports with X units.

The import price of these engines rose by X% to $X per unit in 2024, bucking the overall trend of decreasing trade. Thailand was the region's top importer, bringing in around X units. Despite the lack of specific data on individual countries, it's clear that consumption of internal combustion engine equipment in Southeast Asia saw a slight decrease in 2024, with a peak level of $X from 2016 to 2024. Similarly, production in the region reduced to $X in 2024, indicating a slight overall decrease.

In summary, 2024 saw a decline in both imports and exports of internal combustion engine equipment in Southeast Asia, with Thailand remaining a significant player in the region's trade. Despite a rise in import prices, the overall market showed signs of contraction, with both consumption and production decreasing slightly.

Read also:

- Hyundai's Planned Pickup Might Also Launch a Rough and Tumble Off-Road Sport Utility Vehicle

- Luxury car brand Audi set to contest in the elite premium vehicle market once more

- BMW's Brilliance Dadong Plant reaches a production milestone of 3.5 million vehicles, with the 5 Series model surpassing 2 million units.

- Renault, Nissan, and Mitsubishi alliance progressing with the launch of collaborative initiatives at the Ampere Douai Factory